0 0

BULLISH 📈 : Bitcoin ETF holders maintain positions despite 44% BTC decline

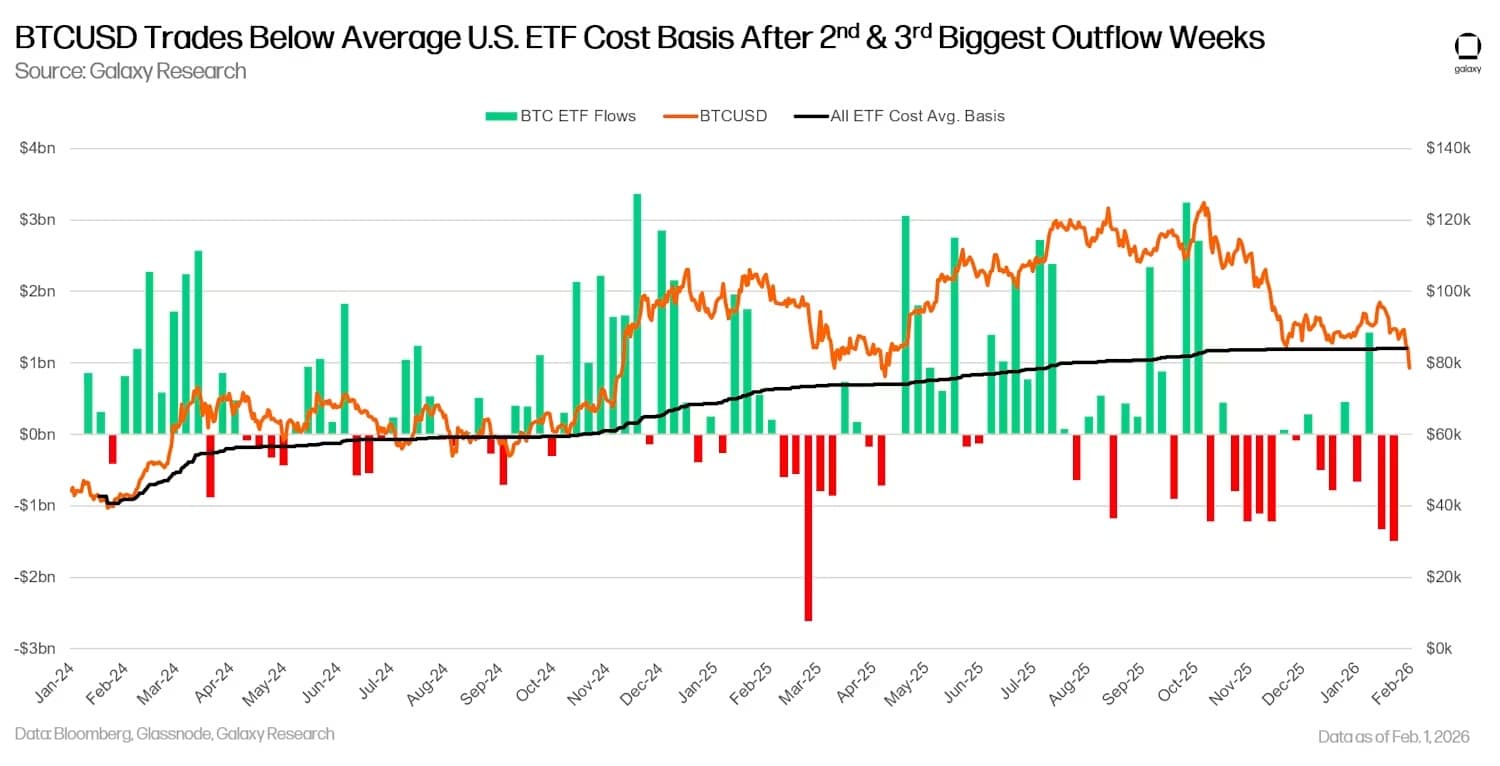

Spot Bitcoin ETFs in the US experienced significant outflows in January 2026, with a 6.6% decrease in BTC held since October 2025. Despite this, the price of BTC has dropped by 44%, indicating strong holding behavior among institutional investors.

Key Points

- US spot Bitcoin ETFs held approximately 1,362,293 BTC as of October 10, 2025.

- Despite a 44% BTC price drop, ETF holdings have only declined by 6.6%.

- Institutional holders are maintaining long-term positions despite market downturns.

- Eric Balchunas compared Bitcoin ETF outflows to historical gold ETF outflows, which saw much larger asset exits during downturns.

- Galaxy Research data shows the average cost basis for spot Bitcoin ETF holders is $84,099. With BTC prices below $70,000, ETFs are currently at a loss.

- Bitcoin ETFs have recorded over $7 billion in outflows since October 2025 but had previously attracted around $63 billion in inflows.

Market Sentiment

- Extreme fear is prevalent in the crypto market; however, ETF data indicates institutional resilience.

- Analysts suggest that the limited selling from ETFs, despite price crashes, demonstrates investor confidence.