10 0

Bitcoin Exchange Reserves Drop to Historic Lows Amid Market Volatility

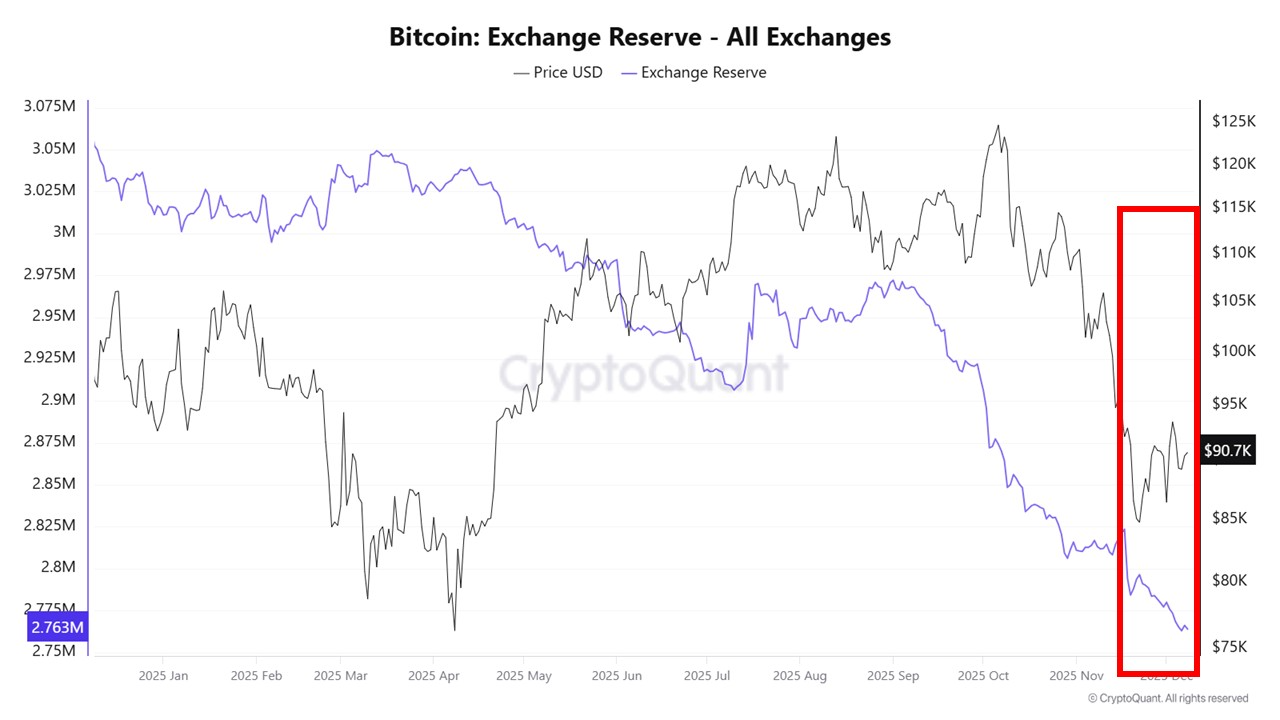

Bitcoin's On-Chain Dynamics Amid $90K Price Holding

- Bitcoin remains above $90,000 as the market anticipates the FOMC meeting, a potential pivot for risk assets.

- Despite price corrections, Bitcoin's exchange reserves have declined to 2.76 million BTC, nearing historic lows.

- This trend suggests investors are moving BTC into long-term custody instead of selling during price drops.

Shrinking Exchange Reserves Indicate Market Strength

- Fewer coins on exchanges suggest reduced immediate sale availability, tightening liquid supply.

- Long-term holders and institutions are driving this trend by moving BTC to self-custody.

- The ongoing divergence between price action and on-chain behavior indicates underlying market strength.

- Potential for a future "supply shock" increases as exchange reserves reach historic lows.

BTC Tests Critical Support Levels

- Bitcoin trades around $90,437, staying above the 200-day moving average, considered a dynamic support level.

- A bounce from the $87K–$88K range shows buyer defense, but structural fragility persists below key averages.

- Breaking the $95K–$97K resistance is crucial for recovery; failure may lead to further consolidation.