12 3

Bitcoin Exchange Supply Ratio Falls After Fed Rate Cut, Targets $120,000

The US Federal Reserve reduced interest rates by 25 basis points, boosting the economy and favoring risk-on assets like Bitcoin (BTC).

Fed's Impact on Bitcoin

- Interest rate cut increased investor interest in BTC.

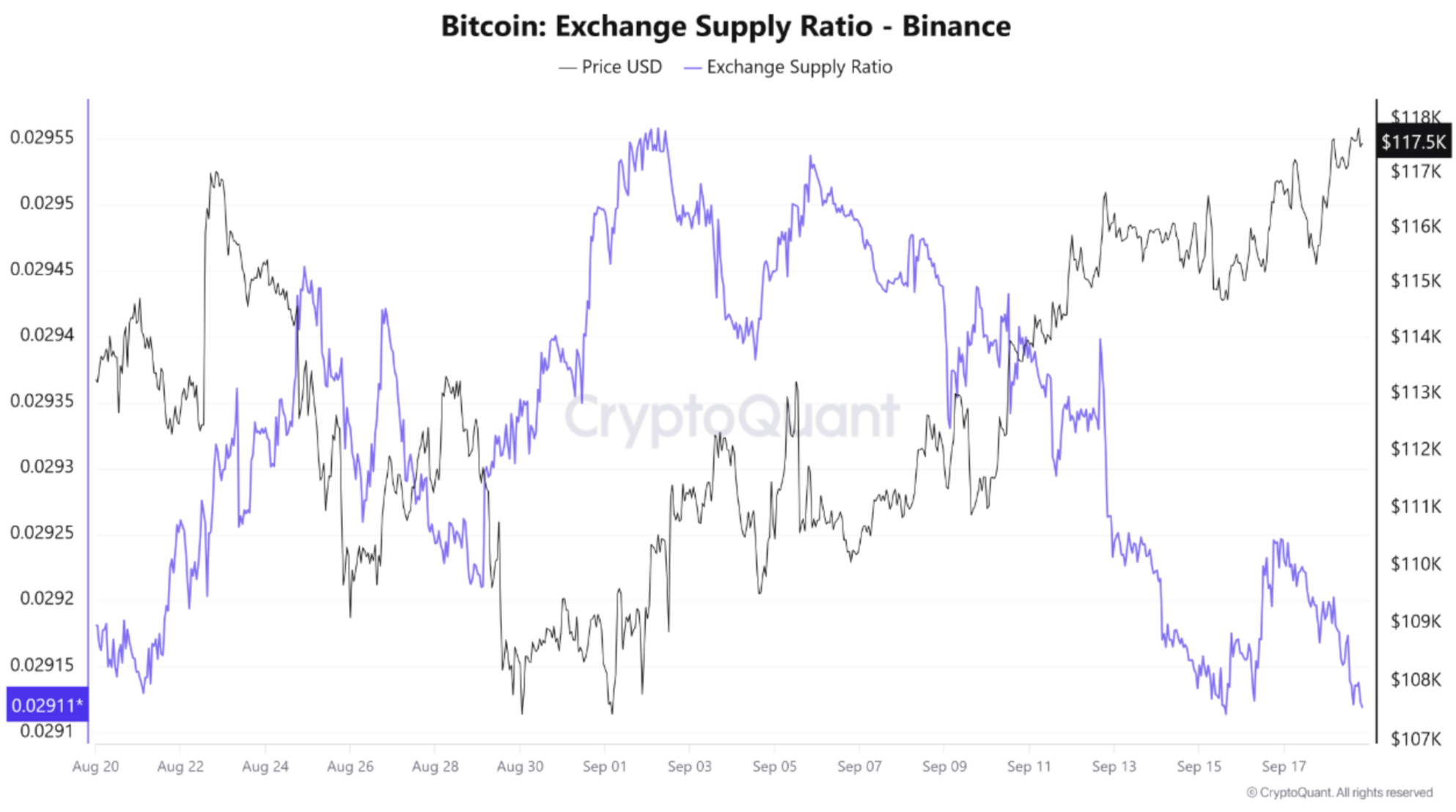

- Exchange supply ratio declined to 0.0291, indicating long-term holding preferences.

- Bitcoin price remains stable above $115,000, suggesting buying pressure.

- If BTC outflows continue, it may target the $120,000 resistance level.

- Stable traditional markets post-Fed decision could support a bullish trend.

Potential Supply Crunch

- Declining exchange supply ratio hints at a potential bullish 'supply crunch'.

- Bitcoin Scarcity Index recorded its first spike since June 2025.

- Rapid BTC outflows from Binance reduce circulating supply.

- Lack of whale participation raises concerns despite positive trends.

Currently, BTC is trading at $116,374, down 1.3% in the last 24 hours.