11 0

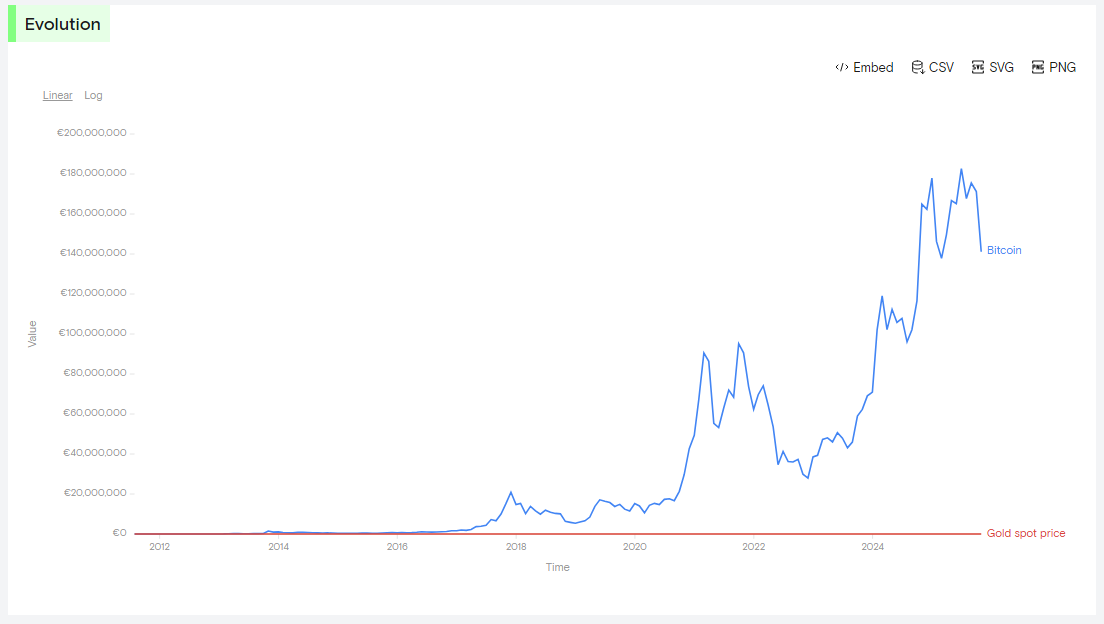

Bitcoin-to-Gold Ratio Drops 37% as Gold Surges Over 70%

A veteran market analyst has identified a technical pattern indicating a potential shift for Bitcoin following its underperformance against gold.

Bitcoin Versus Gold Ratio Decline

- The Bitcoin-to-gold ratio dropped from 32 on Oct. 5 to 20, marking a decrease of over 37%.

- This decline suggests that one Bitcoin could buy 32 ounces of gold in early October but now buys about 20.

- Daily data shows a possible momentum change with the BTC/GOLD pair hitting a low of 20 and an RSI of 21.30 on Nov. 21. Subsequent lows showed higher RSI values, indicating easing selling pressure.

Michaël van de Poppe highlighted this as a "strong" bullish divergence on the daily chart, suggesting reduced selling despite price lows.

Technical Signals Indicate Reduced Selling Pressure

- The weekly RSI for the BTC/GOLD pair is around 31.85, a level last seen during the November 2022 sell-off linked to the FTX collapse.

- Similar RSI levels were observed at market bottoms in 2015 and 2018.

- The combination of daily divergence and low weekly RSI suggests a potential downtrend reversal.

Gold surged by over 70% in 2025, while Bitcoin fell by 7%, trading at $87,750, down 4.8% year-to-date. The breakdown in the Bitcoin-to-gold ratio raises questions about Bitcoin's "digital gold" narrative amid gold's gains.

- Short-term investors prefer gold for capital protection.

- Long-term holders remain optimistic about Bitcoin's upside potential when risk appetite returns.

The near-term outlook depends on whether the BTC/GOLD ratio and price action move above key levels. Until then, signals remain tentative.