8 0

Long-Term Bitcoin Holders Selling Amidst Price Pressure, Fidelity Analyst Reports

Key Points on Bitcoin Market Dynamics:

- Visible buying from spot bitcoin ETPs and corporates has not led to a significant price increase, raising questions about market supply sources.

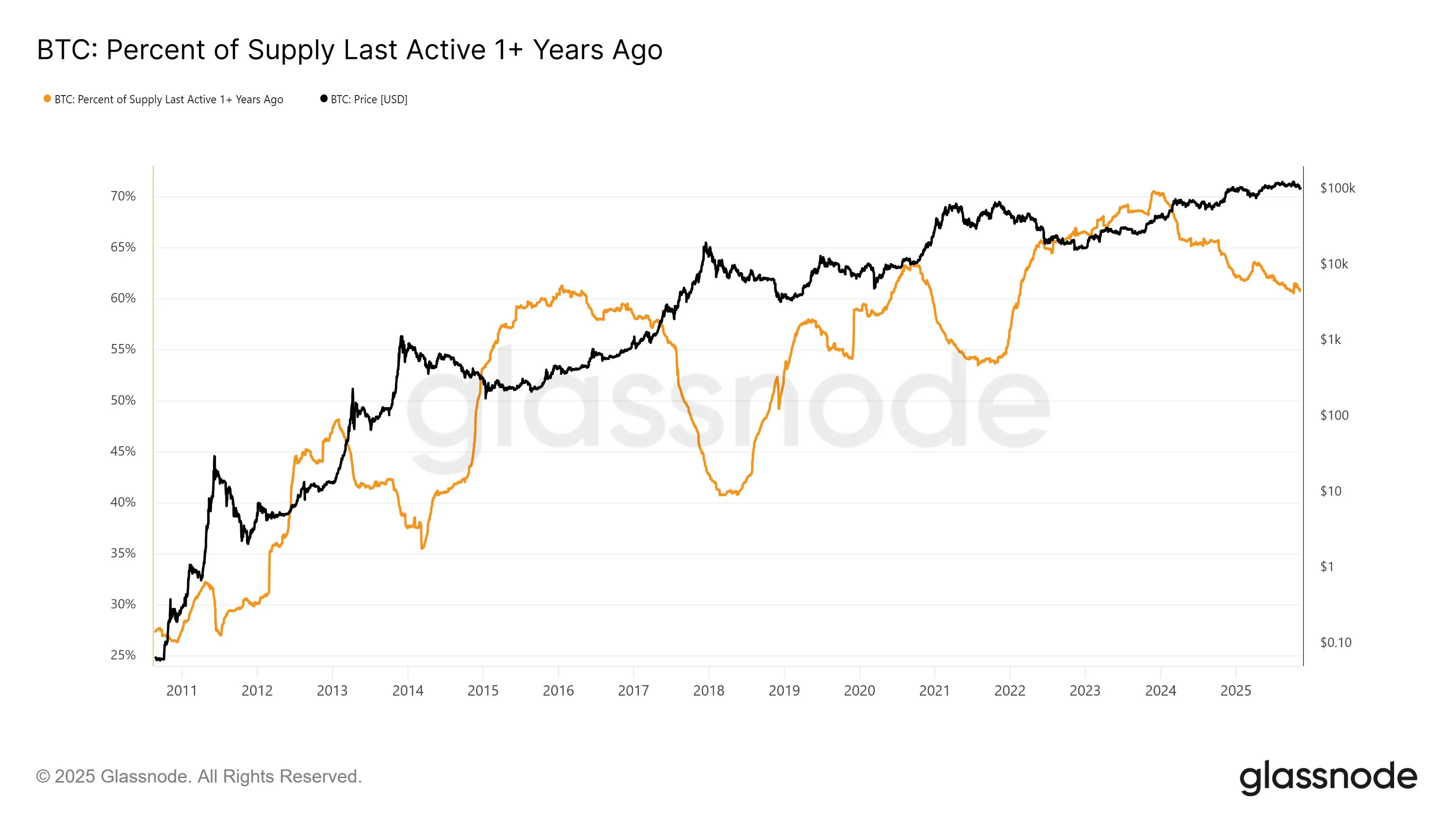

- Chris Kuiper from Fidelity Digital Assets suggests long-term holders (HODLers) are selling, as indicated by Glassnode’s metric showing stagnant bitcoin supply that hasn't moved for over a year.

- The current cycle shows a gentle decline in long-term holder supply, contrasting with sharp declines seen in previous bull markets.

- Bitcoin's recent performance has lagged behind gold and the S&P, leading some investors to reevaluate their positions heading into the year-end.

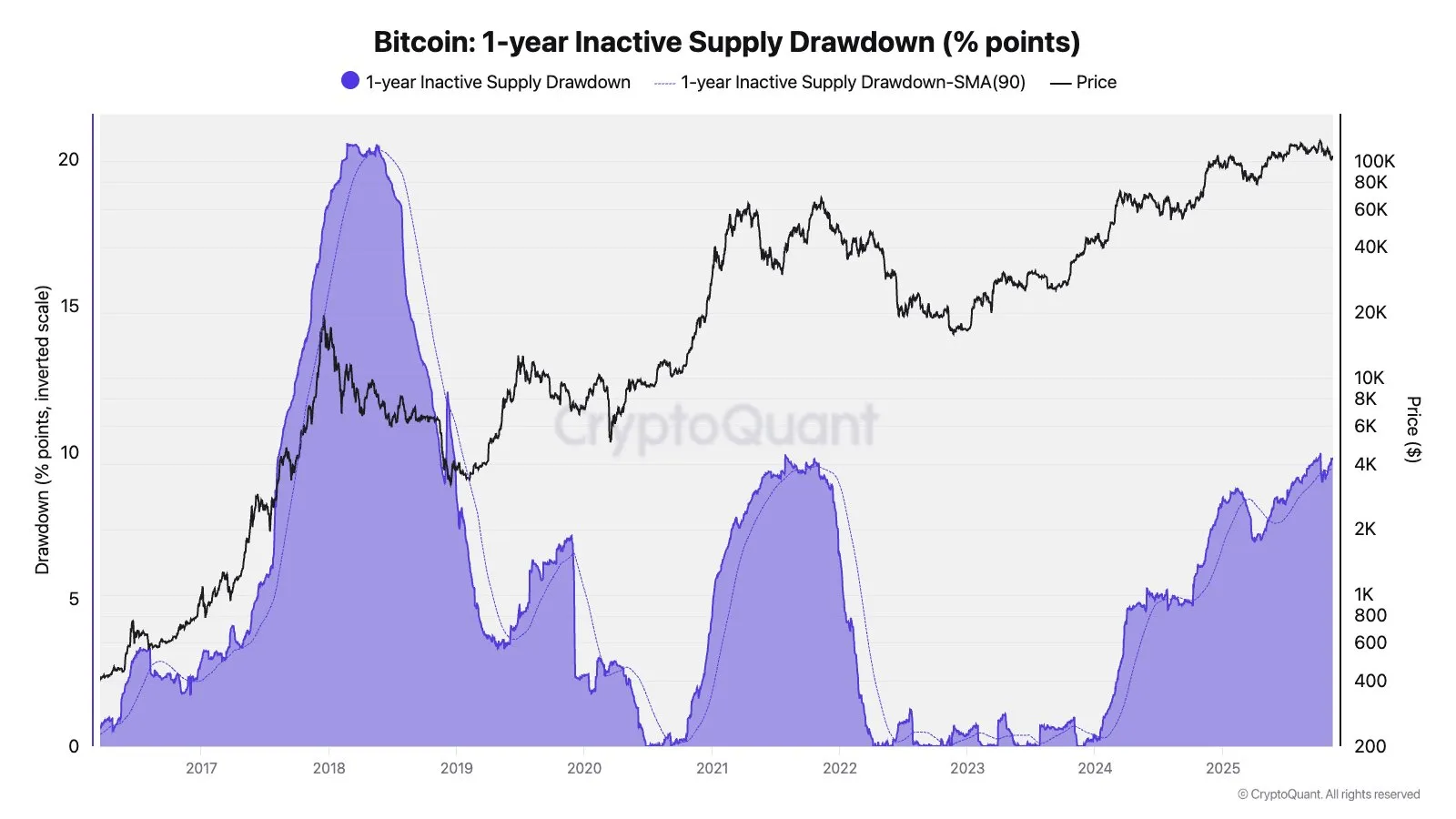

- CryptoQuant analyst Julio Moreno highlights a similar trend: a consistent drawdown in 1-year inactive supply, yet less dramatic than in past cycles.

- The current reduction in inactive supply is comparable to the 2021 cycle but unfolds over a longer period, reflecting a steadier release rather than abrupt profit-taking.

- Kuiper plans to monitor these metrics further to assess potential seller exhaustion while noting the divergence between positive fundamentals and lackluster price movement.

As of the latest update, BTC traded at $102,609.