8 0

Bitcoin Investors Face Deep Unrealized Losses Amidst 11% Weekly Decline

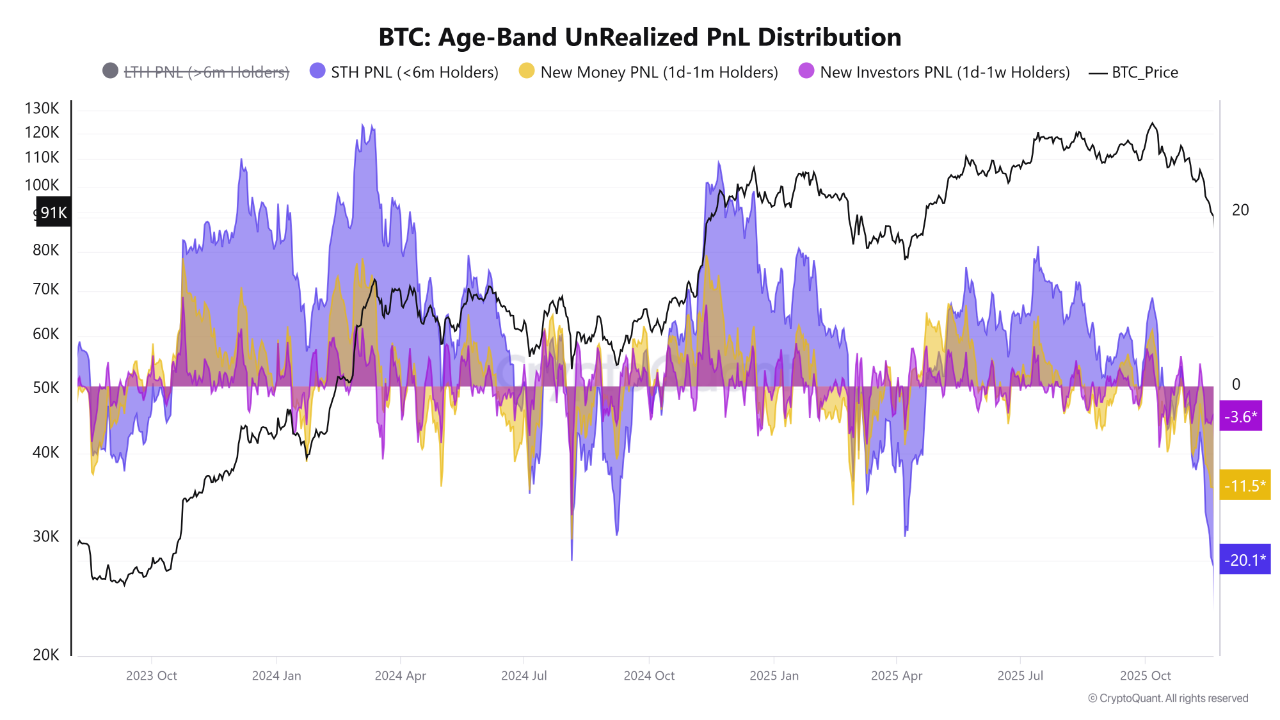

The price of Bitcoin is struggling, having dropped below its 2025 starting point. Current on-chain data indicates investors are dealing with substantial unrealized losses.

Key Investor Insights

- Bitcoin investors holding coins for less than a week to six months are facing significant unrealized losses.

- The Age-Band Unrealized PnL Distribution metric reveals these losses across different holder groups based on the age of their coins.

- High unrealized losses may lead to investors using any price recovery as an exit opportunity, reinforcing the 'Support Becoming Resistance' trend.

- Short-term holder behavior is crucial; avoiding capitulation at 20-30% losses could prevent a deeper bear market.

- Conversely, widespread selling by short-term holders could exacerbate Bitcoin's price decline.

Current Bitcoin Price

- Bitcoin is valued at approximately $84,530, down 4% in the last 24 hours and over 11% in the past week.

The market remains bearish, but investor decisions in the coming days will significantly influence the direction of Bitcoin's price movement.