9 0

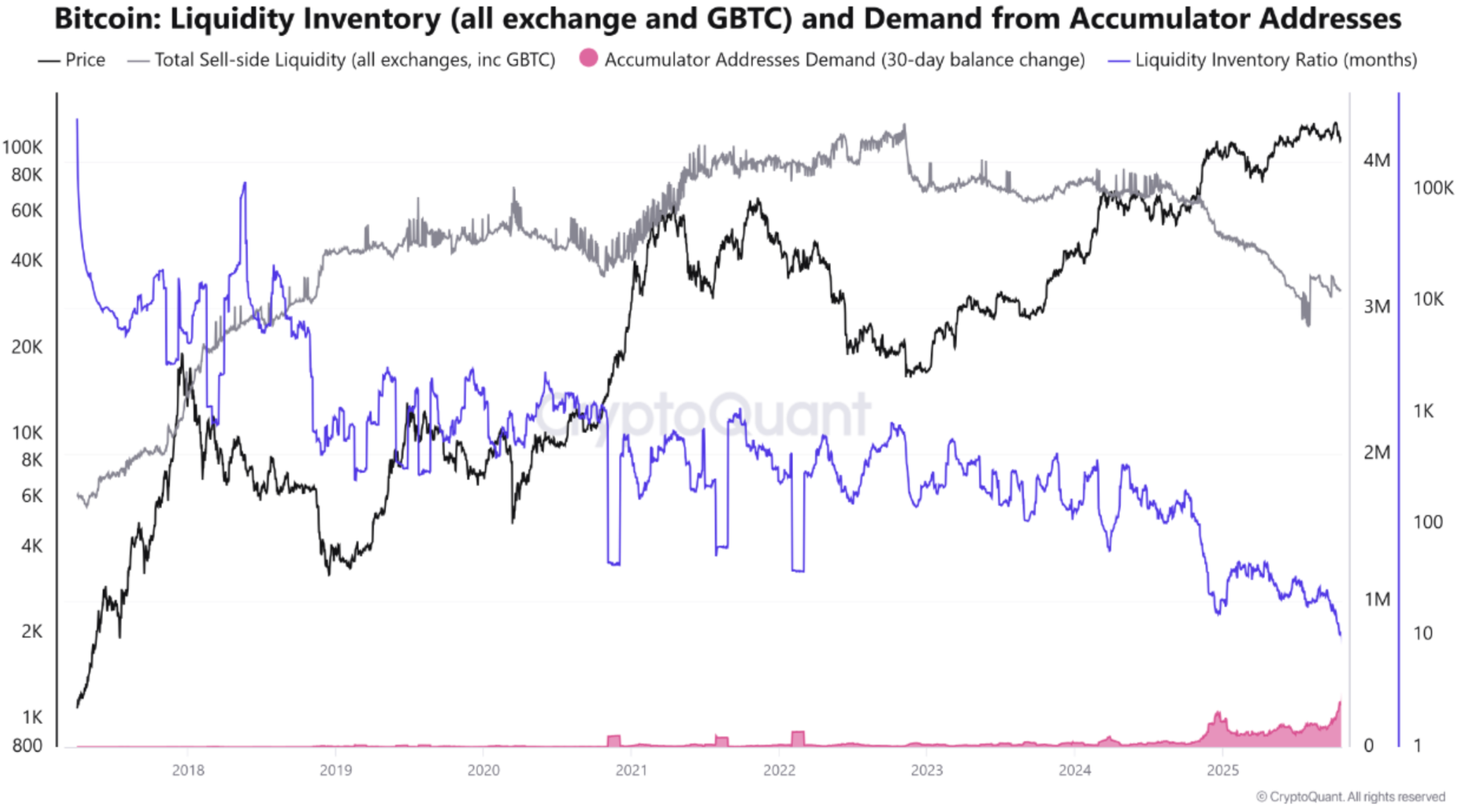

Bitcoin Liquidity Reaches Seven-Year Low Amid Rising Accumulation Demand

Bitcoin liquidity is at a seven-year low, with available supply dropping to around 3.12 million BTC, the lowest since 2018. The cryptocurrency continues to trade below the 99-day Moving Average, approximately $112,086.

Key Points

- Current Bitcoin trading price is in the low $110,000 range, indicating limited circulating supply alongside increased institutional demand.

- Long-term holders have accumulated 373,700 BTC over the past month, reflecting robust market interest despite volatility.

- The Liquidity Inventory Ratio (LIR) is at 8.3 months, revealing reduced liquidity covering less than nine months of demand.

- A lower LIR suggests thinner order books, making the market more susceptible to volatility.

- The medium-term outlook remains positive due to declining liquidity and increasing demand from institutional and long-term investors.

- Some analysts suggest Bitcoin's price could exceed $115,000 if current trends persist, supported by US investment funds and ETFs.

Market Sentiment

- There are mixed opinions on whether Bitcoin has reached its cycle high.

- Recent data shows that Bitcoin's NVT Golden Cross hasn't hit levels seen in previous cycle tops.

- Analysts estimate a 55% probability that Bitcoin hasn't peaked for this market cycle, with the current price at $111,295, up 2.1% in 24 hours.