8 0

Bitcoin Miner Outflows Increase Short-Term Sell Pressure on BTC

Bitcoin has reclaimed the $88,000 level, offering temporary stability. However, it struggles to break above $90,000, indicating market hesitation.

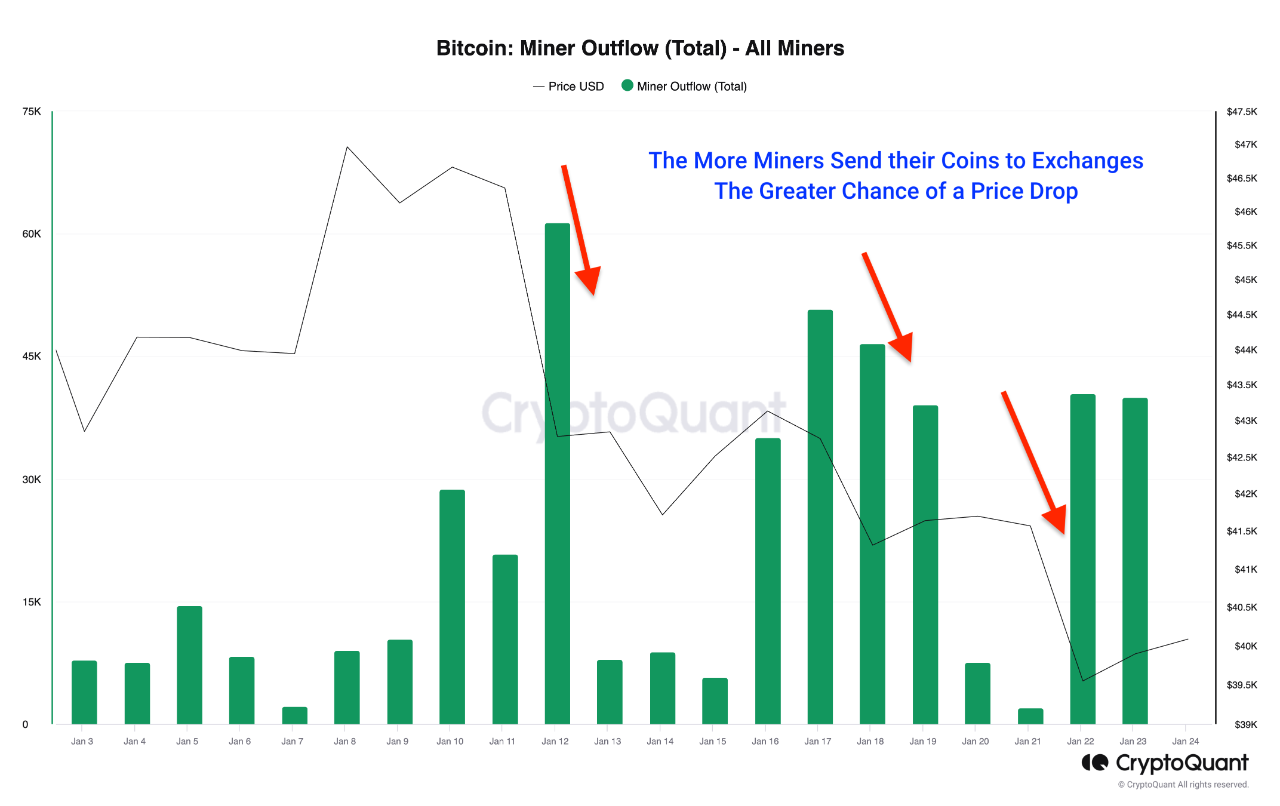

Miner Outflows and Market Impact

- CryptoZeno from CryptoQuant highlights miner behavior as a short-term risk factor.

- Rising Bitcoin miner outflows suggest increasing sell-side pressure.

- Sharp increases in miner outflows often lead to local price pullbacks.

- Miners are informed participants; increased activity can introduce additional supply during weak demand phases.

Concentrated miner transfers to exchanges can raise sell-side pressure, increasing the probability of corrective moves.

Market Conditions and Technical Analysis

- Bitcoin trades in a consolidation range after failing to reclaim $90,000.

- The $85,000–$87,000 zone provides support after November's sell-off.

- BTC remains below declining moving averages, suggesting resistance to upward momentum.

- Volume decline indicates stabilization but not new demand entry.

A daily close above $90,000 could indicate momentum shift, while losing $85,000 support may lead to further declines. The current chart reflects balance and market indecision.