2 0

Bitcoin Miners Shift to Accumulation as BTC Price Reaches $114,000

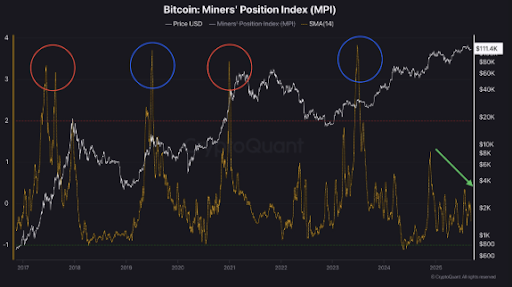

Bitcoin miners are adapting strategies as the price of BTC rebounds above $114,000. This shift in approach indicates a move from selling to accumulating Bitcoin, which diverges from historical patterns.

Key Points:

- CryptoQuant's analysis highlights a significant change in miner strategies, favoring long-term accumulation over aggressive sell-offs.

- The Miners’ Position Index (MPI) shows a deviation from typical pre-halving and late bull market selling patterns.

- Factors such as Spot ETF approvals and recognition of Bitcoin as a strategic reserve contribute to this trend.

- Mining difficulty has reached unprecedented levels, suggesting confidence in Bitcoin’s long-term potential and reducing supply shock risks.

- Despite higher transaction fees, Bitcoin’s price remains stable, supporting the theory of strategic accumulation by miners.

Additional Insights:

- Bitcoin’s mining difficulty reached an all-time high, surpassing 136 trillion, highlighting network resilience amid price volatility.

- Analyst Matthew Hyland notes extreme monthly Bollinger Bands for Bitcoin, indicating a potential surge in market volatility.

- Bitcoin's price dropped 4% over the past month from its ATH, yet saw a 2.73% increase last week to $114,000, signaling growing momentum despite cautious market sentiment.