19 1

Bitcoin Trades Near $90K as Short-Term Holder Capitulation Deepens

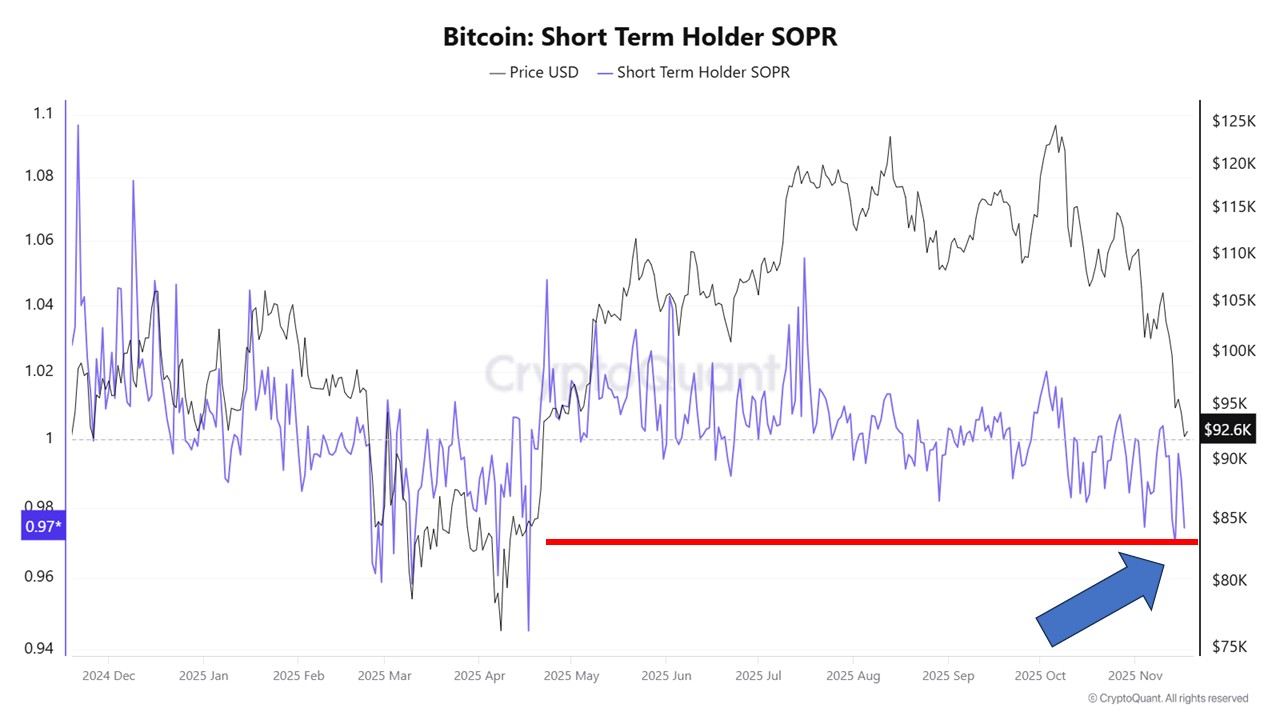

The crypto market is in a tense phase, with Bitcoin trading at critical levels. New data from CryptoQuant indicates Bitcoin is experiencing a severe short-term capitulation. Short-term holders (STHs) are realizing losses similar to past major market turning points.

- STH-SOPR metric dropped to 0.97, indicating STHs are selling at a loss, driven by fear.

- This metric staying below 1.0 suggests emotional selling and aligns with late-stage corrections and potential market reversals.

Short-Term Holders Under Extreme Stress

- XWIN Research on CryptoQuant reports the STH-MVRV ratio is far below 1.0, showing recent buyers hold Bitcoin at a loss.

- 65,200 BTC were sent to exchanges at a loss, highlighting panic-driven selling.

- This behavior often precedes cyclical recoveries as weaker hands deplete their holdings.

Testing Weekly Support

- Bitcoin trades above $91,000 after a decline from $110,000–$105,000 range, approaching critical support near $88,000–$90,000.

- The 50-week moving average acts as a potential pivot point for market direction.

- Volume increase shows panic exits but also hints at nearing a capitulation threshold.

- Despite downside pressure, Bitcoin remains above the 100-week and 200-week moving averages, maintaining a broader upward trend.

The current market situation indicates stress and potential for recovery, but volatility may persist as weak hands exit the market.