2 0

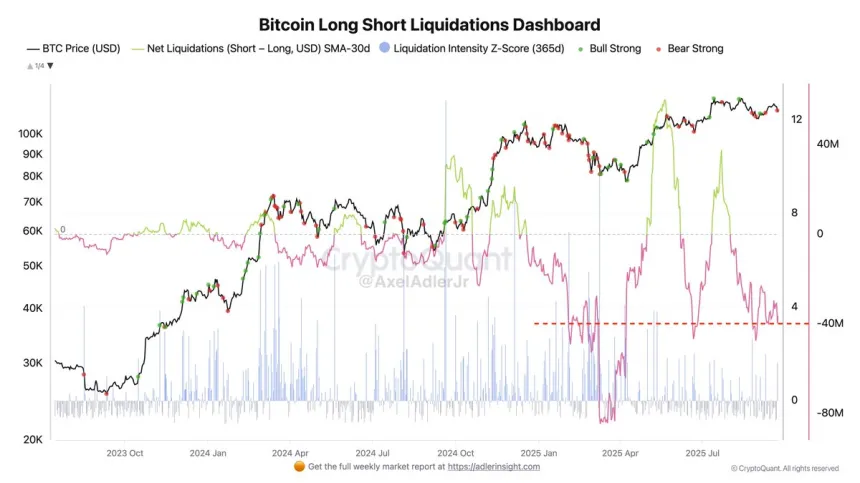

Bitcoin Net Liquidations Stay Negative Near $40M: Analyst Warns Downside Remains

Bitcoin Market Overview:

- Bitcoin is stabilizing above $110,000 after a volatile period with significant liquidations across the crypto market.

- The recent correction wiped out last week's gains, highlighting market volatility. Currently, BTC is near a key liquidity zone where bulls and bears are contending for control.

Market Sentiment and Analysis:

- Market sentiment is cautious as traders consider potential further declines. Analysts suggest Bitcoin could test lower support levels if bearish momentum increases.

- Analyst Axel Adler indicates medium risk of further bearish pressure due to ongoing long liquidations, which remain negative around −$40 million.

- The Liquidation Intensity Z-Score is neutral to moderate, suggesting the absence of a large-scale selloff despite steady liquidation pressure.

Technical Insights:

- Bitcoin is trading near $113,025, below its 50-day and 100-day moving averages, which act as resistance around $114,600–$115,000.

- The 200-day moving average at approximately $115,077 reinforces this resistance barrier.

- Temporary support is noted at $112,900; failure here may lead to further decline towards $110K and potentially $108K.

Conclusion:

- Current price action shows lower highs since rejection near $118K, indicating decreasing bullish strength.

- As long as $110K holds, Bitcoin remains in a consolidation phase rather than a trend reversal.

- Traders are observing if Bitcoin can regain the $115K level to signal renewed positive momentum.