11 0

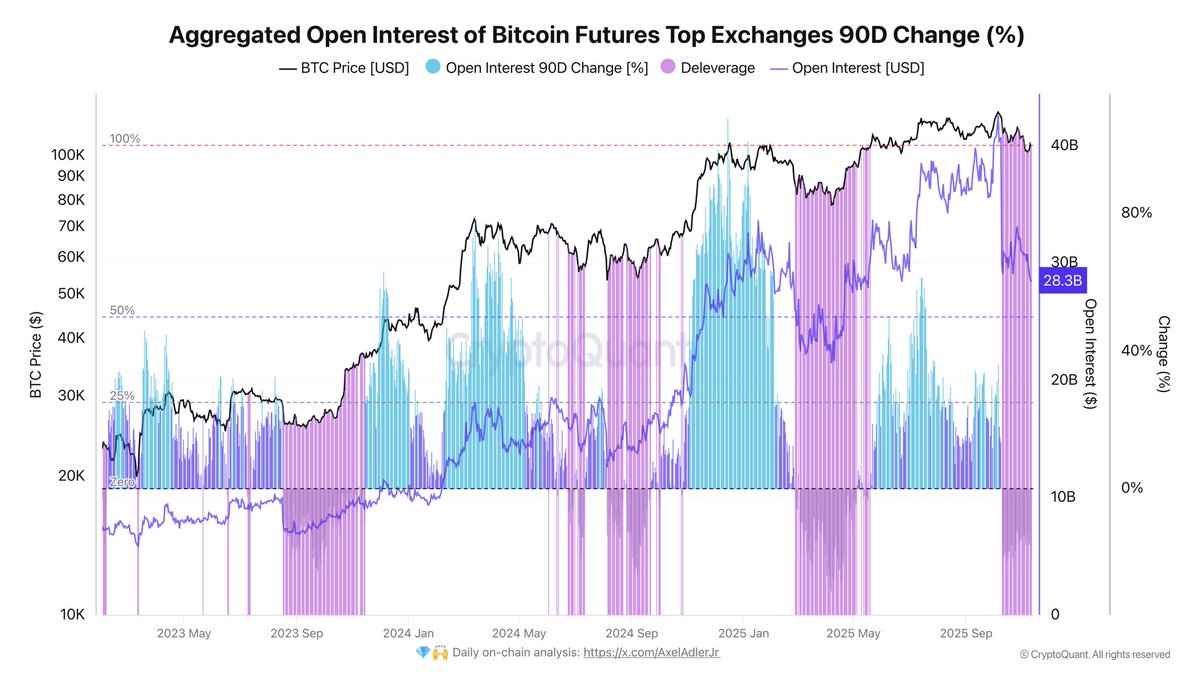

Bitcoin Open Interest Drops 21% Amid Market Deleveraging Phase

Bitcoin Consolidation and Market Deleveraging

- Bitcoin consolidates below $105,000, holding above the key $100,000 support level despite market uncertainty.

- Market is in a deleveraging phase post-October 10 liquidation, reducing excessive leverage.

- Open interest in futures contracts decreased by 21% over the last 90 days.

- Leverage usage cooling echoes phases from September 2024 and April 2025, historically leading to market recovery.

Potential Turning Point for Bitcoin

- Current deleveraging aligns with past periods that preceded recoveries.

- Open interest reductions serve as healthy resets, potentially attracting long-term investors.

- If BTC holds above $100K, it may indicate the end of the correction phase.

BTC Tests Support Amid Consolidation

- Bitcoin remains between $100,000 and $105,000, defending the 100-day moving average.

- The 200-week moving average trends upward, maintaining long-term bullish structure.

- Decreased trading volume suggests declining forced selling pressure.

- A weekly close above $106,000 could signal renewed bullish momentum; falling below $100,000 might lead to further corrections towards $92,000.