8 0

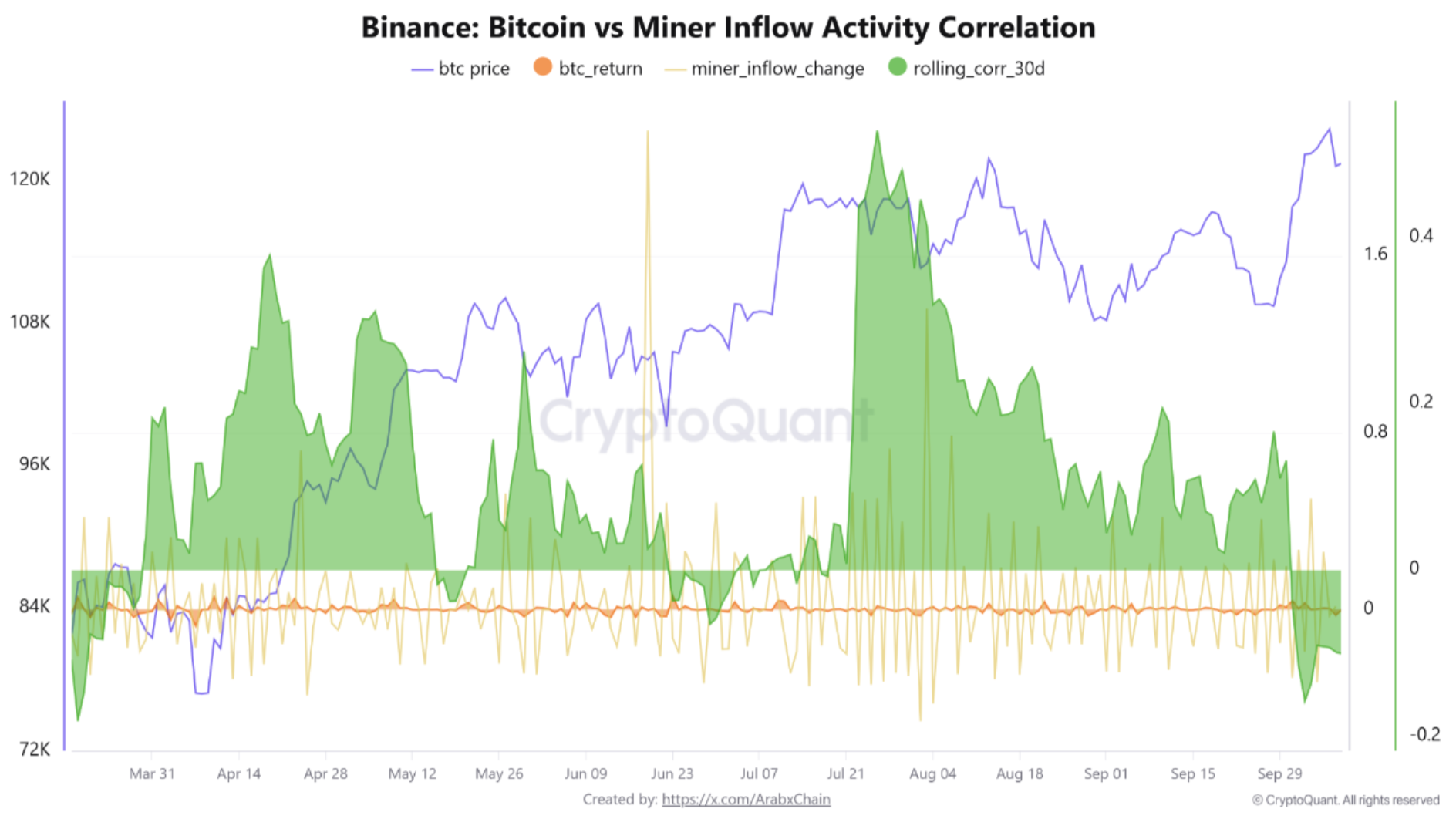

Bitcoin Price and Miner Correlation Hits -0.157, Indicating Market Shift

Bitcoin (BTC) is trading in the low $120,000 range after a slight decline. A significant shift has been observed in the correlation between Bitcoin's price and miner flows to exchanges.

Key Points

- The 30-Day Rolling Correlation indicator for BTC and miner flows dropped to -0.157, its lowest level since March 2025.

- This negative correlation suggests that recent BTC price increases are not driven by miner flows.

- Unlike previous cycles, current positive price action is attributed to increased demand from investors and institutions.

- The decrease in miner-to-exchange flows indicates miners are holding BTC rather than selling, reducing circulating supply.

- If correlation turns positive again, it may indicate returning selling pressure and potential price correction.

Price Levels and Predictions

- BTC must defend the $120,600 level to prevent further declines.

- At the time of reporting, BTC trades at $121,375, down 0.8% over 24 hours.

- Crypto entrepreneur Arthur Hayes predicts BTC could reach $250,000 by the end of 2025.