10 0

Bitcoin Price Nears $89,000 Amid US-Driven Market Pressure

Bitcoin Market Overview

- Bitcoin maintains prices near $89,000 despite a recent pullback.

- Analysts view the current dip as part of a normal cycle correction, not a prolonged downturn.

Insights from Eric Balchunas

- Bitcoin's recent decline follows a +122% rise over the past year, aligning with typical market corrections.

- Despite potential flat or lower performance in 2025, Bitcoin's average annual gain remains around 50%.

- Balchunas dismisses comparisons to the tulip bubble, citing Bitcoin's resilience through multiple crises over 17 years.

- He emphasizes Bitcoin's lasting value akin to non-productive assets like gold and rare art.

Eric Balchunas (@EricBalchunas): "Yes, bitcoin and tulips are both non-productive assets. But so is gold, so is a Picasso painting, rare stamps—would you compare those to tulips?"

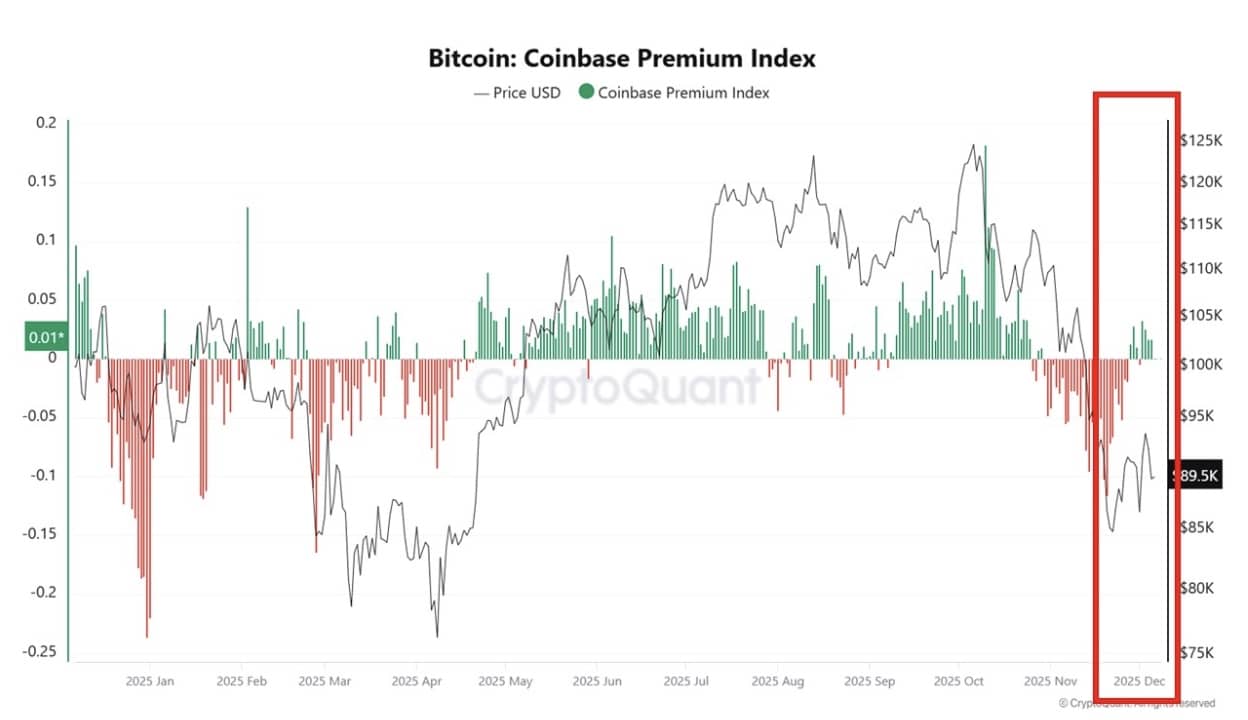

US Market Influence in December

- The Coinbase Premium Index indicates US-driven selling impacted Bitcoin prices at December's start.

- The premium turned negative due to portfolio rebalancing and tax-loss strategies by US institutions but rebounded quickly.

- CryptoQuant suggests that this shift may signal the end of selling pressure, with US demand potentially returning.

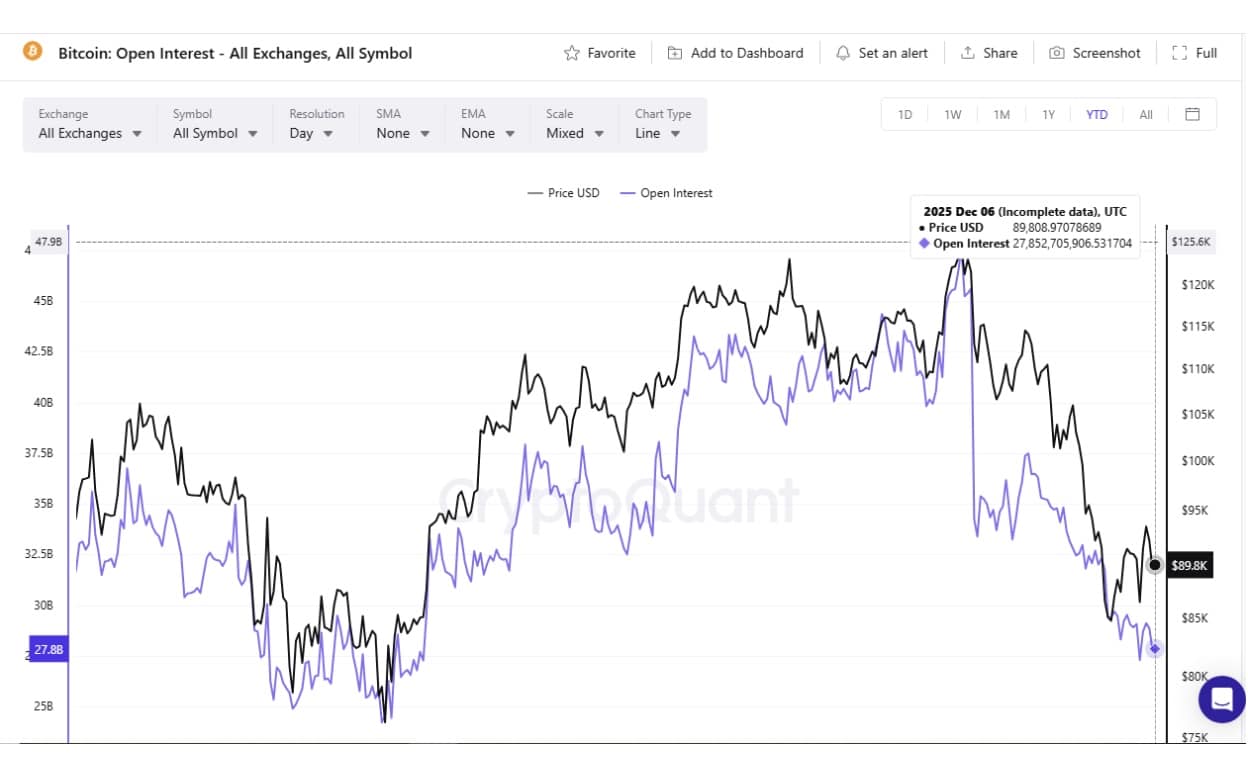

Futures Market Activity

- A significant drop in Open Interest (OI) across exchanges suggests a futures market reset.

- This reduction in OI indicates a clearing of excess leverage, reducing artificial momentum from short-term derivatives.

- Such dynamics point to a market reset rather than the start of a bearish trend.