17 0

Bitcoin Price Nears Historical Low, Potential Rebound Predicted

The Bitcoin market has recently experienced a downturn, revisiting the $100,000 support level. However, on-chain analysis suggests potential positive movement ahead.

Bitcoin Price Below Average Cost

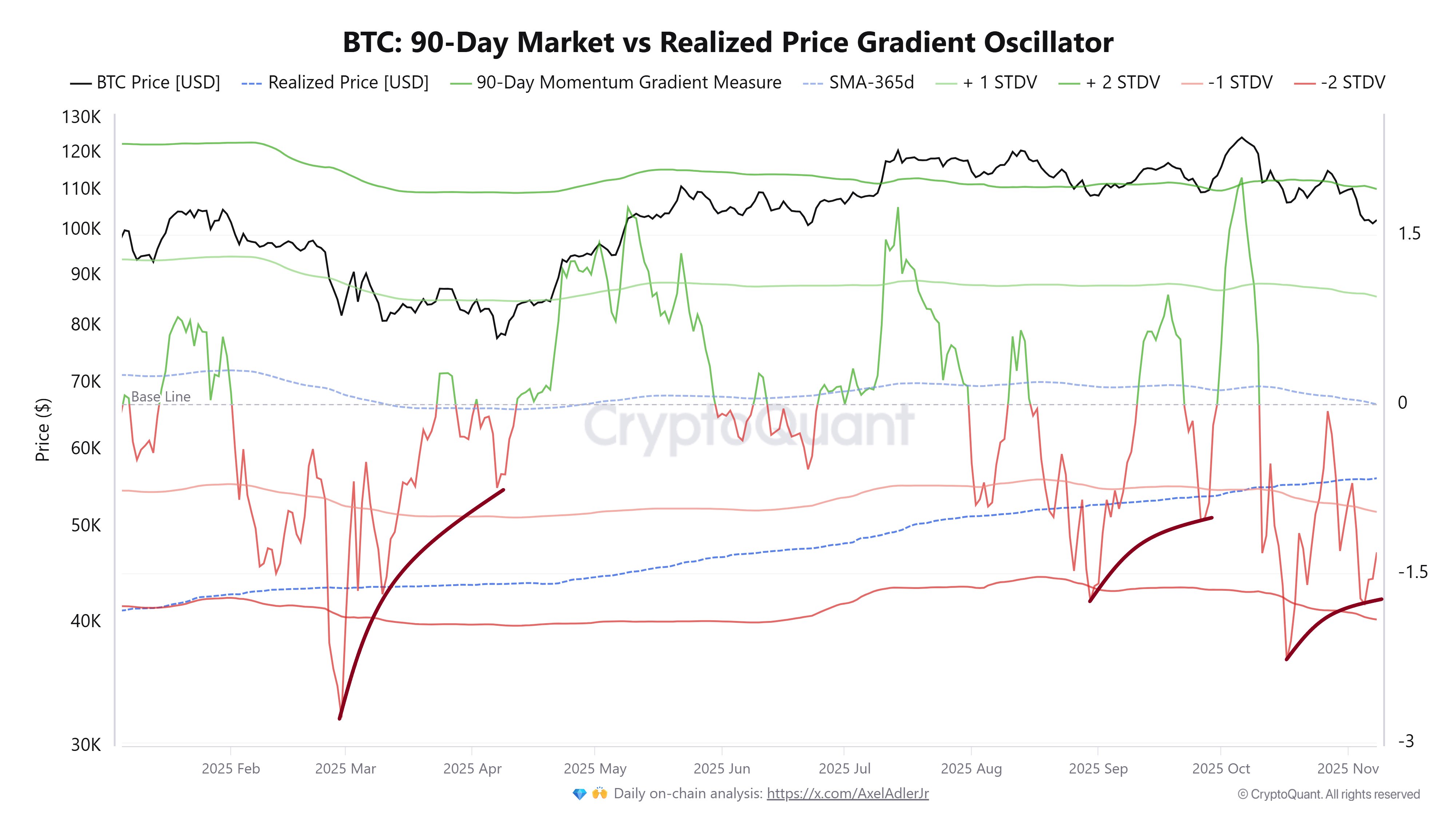

- Market analyst Burak Kesmeci highlighted the Bitcoin: 90-Day Market Price vs Realized Price Gradient Oscillator as key to predicting bullish reversal.

- This metric evaluates Bitcoin's market price deviation from its realized price over 90 days.

- A positive reading indicates rising market price above average cost, suggesting bullish momentum.

- A negative reading shows decline below realized price, indicating bearish momentum and possible 'cooling' phase.

- Kesmeci noted the metric is at -1.27 STDV, showing Bitcoin price significantly below historical cost basis, pointing to an 'extreme cooldown.'

- Currently, investors are paying less than recent buyers for Bitcoin. Increased purchases at current prices could absorb existing bearish pressure.

- Historically, a metric below -1 STDV often precedes downtrend endings and beginning of upward expansions.

- Previous instances: April saw Bitcoin rise from $82,000 to $100,000; July witnessed growth from $108,000 to $124,000.

Bitcoin Price Overview

Bitcoin is currently valued at approximately $102,023, marking a slight decrease of about 0.94% from the previous day.