13 1

Bitcoin Price Trend Constructive Above Short-Term Holder Realized Price

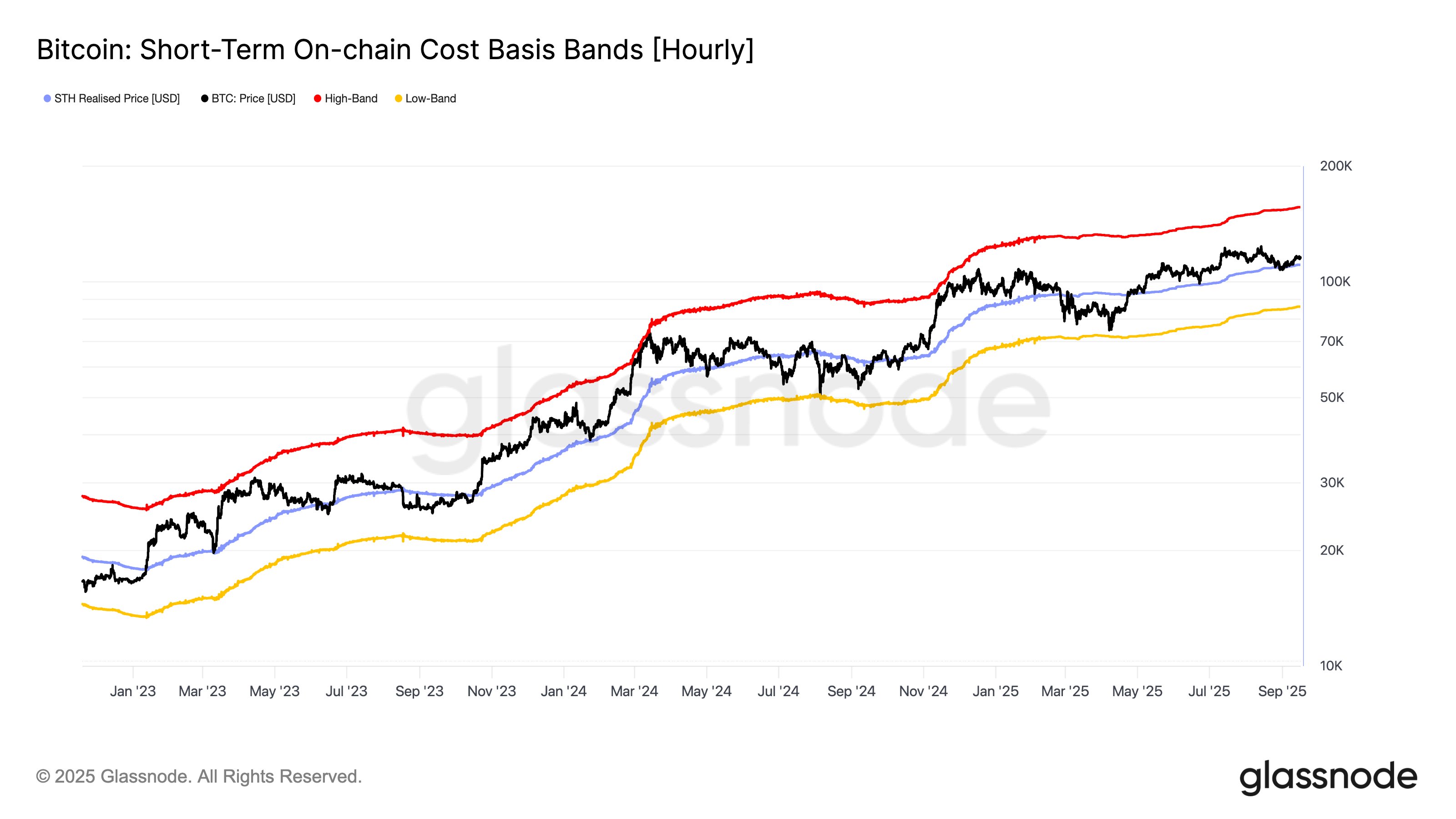

On-chain analytics firm Glassnode highlights that Bitcoin's price trend remains positive as long as it stays above the short-term holder (STH) cost basis.

Key Points

- The Realized Price is an indicator tracking the average investor's cost basis on the Bitcoin network.

- When this metric exceeds BTC’s spot price, investors are in net unrealized profit; below it, they face a net loss.

- Short-term holders (STHs), those who purchased BTC within the last 155 days, are of particular interest.

- Bitcoin recently retested the STH Realized Price and found support, leading to some price recovery.

- The STH Realized Price often acts as a support barrier during bull markets due to investor psychology.

- STHs, with shorter holding times, may panic sell or buy, depending on market conditions.

- As long as Bitcoin maintains above the STH Realized Price, the trend is considered constructive. Falling below this level can lead to market contractions.

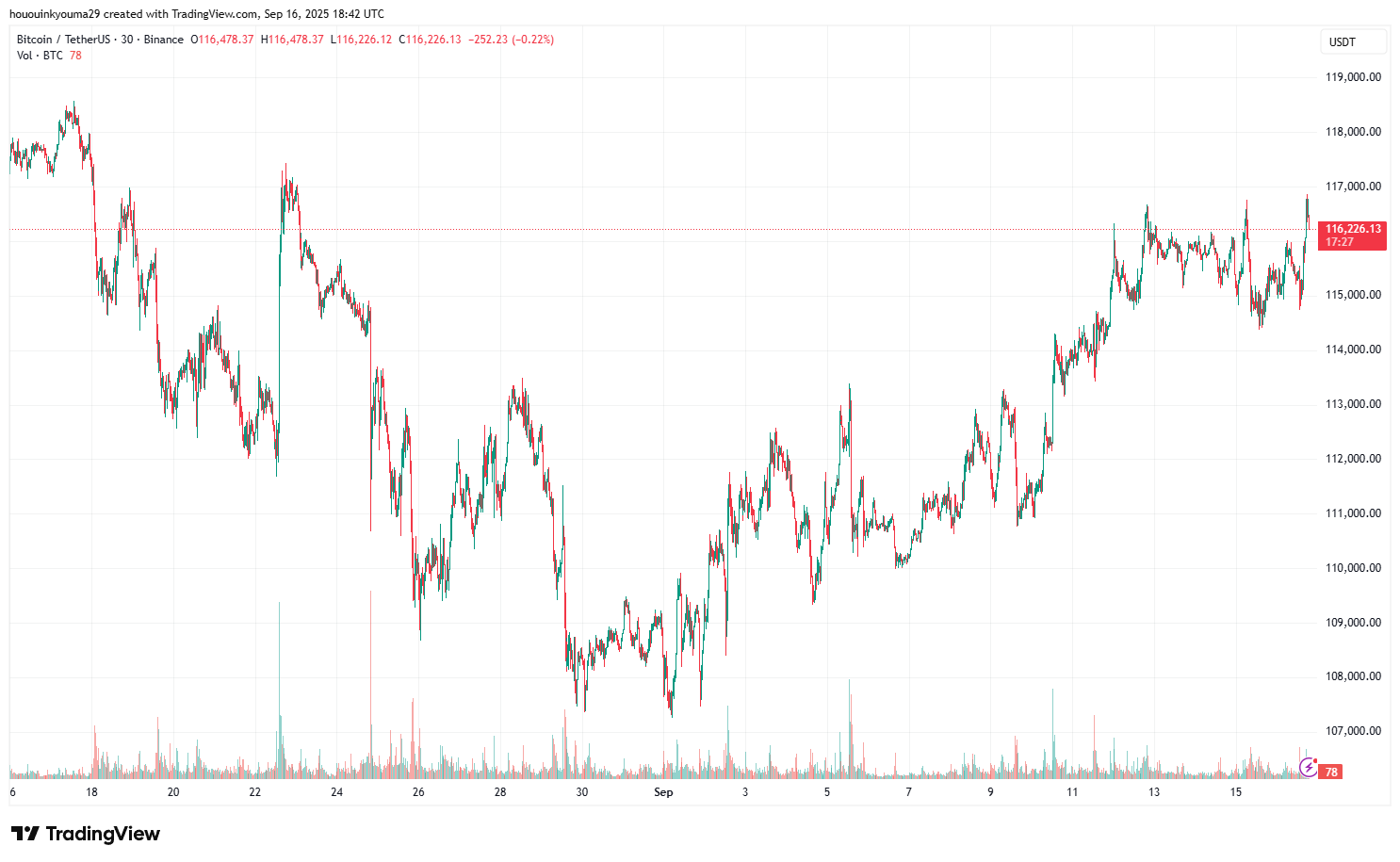

Current BTC Price

Bitcoin is currently trading around $116,200, marking a nearly 5% increase over the past week.