8 0

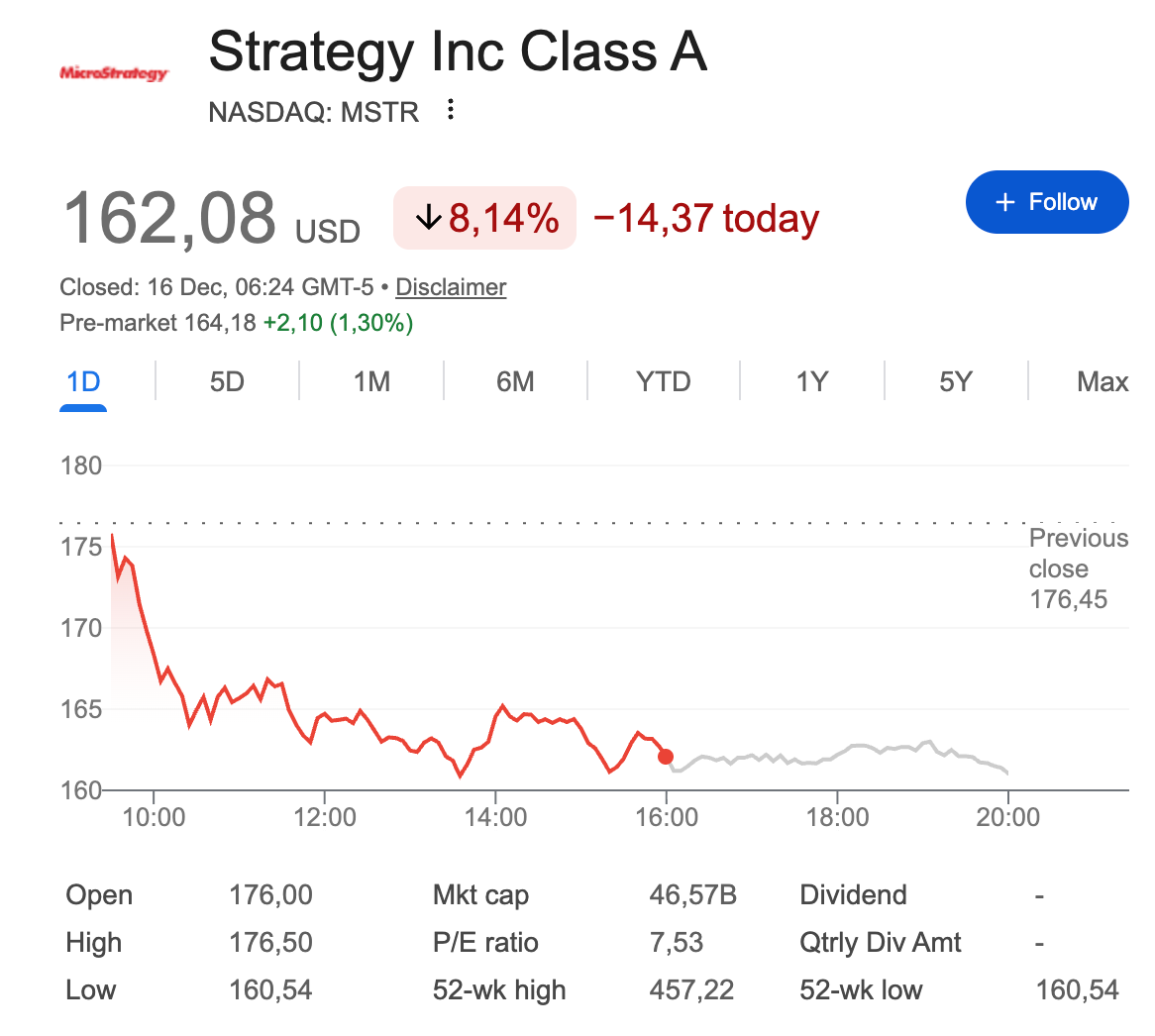

– Strategy buys 10,645 BTC for $980.3 million – Total holdings reach 671,268 BTC at average cost of $74,972 – MSTR shares drop 8.4% amid Bitcoin price decline

Key Points on Strategy's Bitcoin Moves and Market Impact:

- Strategy (MSTR) shares decreased sharply as BTC trades around $87,000.

- The decline comes despite Strategy's new billion-dollar investment in BTC. The company purchased 10,645 BTC for approximately $980.3 million, increasing its holdings to 671,268 BTC.

- The average purchase price was about $92,098 per BTC, making this one of their largest acquisitions since July.

- MSTR is now the largest holder of Bitcoin, with an average acquisition cost of roughly $74,972 per coin.

- Despite aggressive purchasing, MSTR's stock fell by 8.4% due to its exposure to BTC’s price volatility.

- MSTR's stock performance is heavily linked to BTC's movements, amplifying both gains and losses.

- BTC's value has dropped more than 30% since October, affecting sentiment towards crypto-exposed stocks.

- While Strategy continues to buy BTC, market risk appetite remains weak, putting additional pressure on MSTR.