10 0

Bitcoin Reclaims Key On-Chain Level, Eyes $115K Breakthrough

Bitcoin is showing signs of strength as it attempts to reclaim the $115,000 level. After weeks of mixed sentiment and heavy selling, a recent weekly close above $114,500 indicates a possible bullish shift.

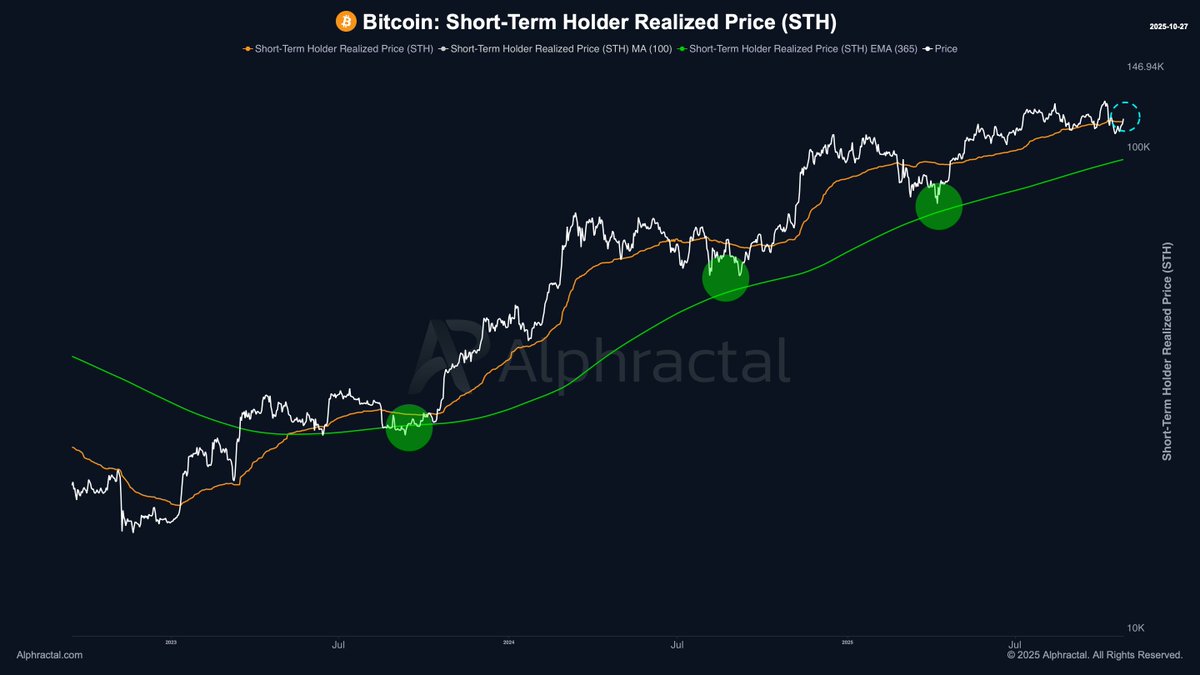

- The Short-Term Holder (STH) Realized Price, a key on-chain threshold at $113,000, has been reclaimed, suggesting renewed buyer confidence.

- Analyst Darkfost highlights that sustaining this level could lead to bullish continuation and potentially a retest of the $120,000 region.

Bitcoin Holds Above Key On-Chain Level

- Darkfost notes that surpassing the STH Realized Price historically marks a turning point; failing multiple times in 2024 before gaining momentum.

- A sustained position above this price could lead to a strong bullish impulse and possibly a new all-time high.

- Caution is advised: falling below the yearly STH Realized Price of $94,000 could signal a deeper market shift.

If Bitcoin holds above its short-term realized threshold, the trend remains positive with potential for further rallies if buying pressure increases above $115K.

BTC Bulls Defend Key Support While Momentum Cools

- Bitcoin is trading around $114,360, having reclaimed the 200-period moving average on the 4-hour timeframe.

- $113,000–$114,000 now serves as immediate support, aligning with the STH Realized Price.

- Failure to maintain above the 200-MA could prompt a retest of $111,000, where the 100-MA provides secondary support.

- Volume remains subdued as investors await the Federal Reserve’s interest rate decision.

Overall, Bitcoin's structure remains constructive above $113K, with potential for upward movement if it breaks above $117,500.