5 0

Bitcoin’s Recent Sell-Off Sparks Debate on Market Bottom

Recent Bitcoin sell-off has sparked discussions of a potential local bottom. Chris Kuiper, VP of Research at Fidelity Digital Assets, highlights several indicators:

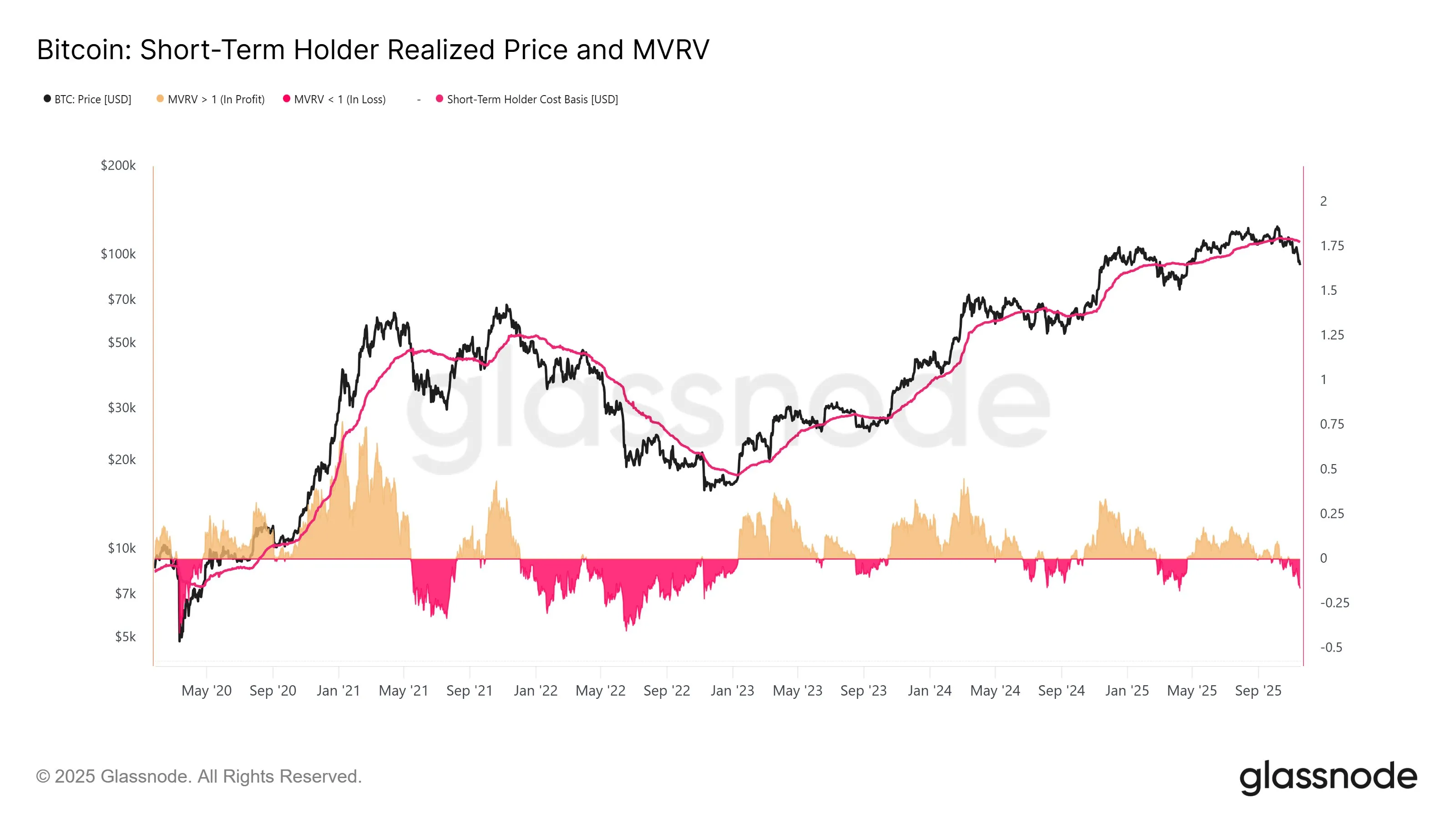

- Short-term Holder (STH) MVRV Chart: Tracks Bitcoin against realized price for STHs. Historical trends suggest local lows when MVRV dips below 1.

- Current drawdown resembles past mid-cycle pullbacks, with STHs back in loss territory, indicating a typical 20-30% bull market drawdown.

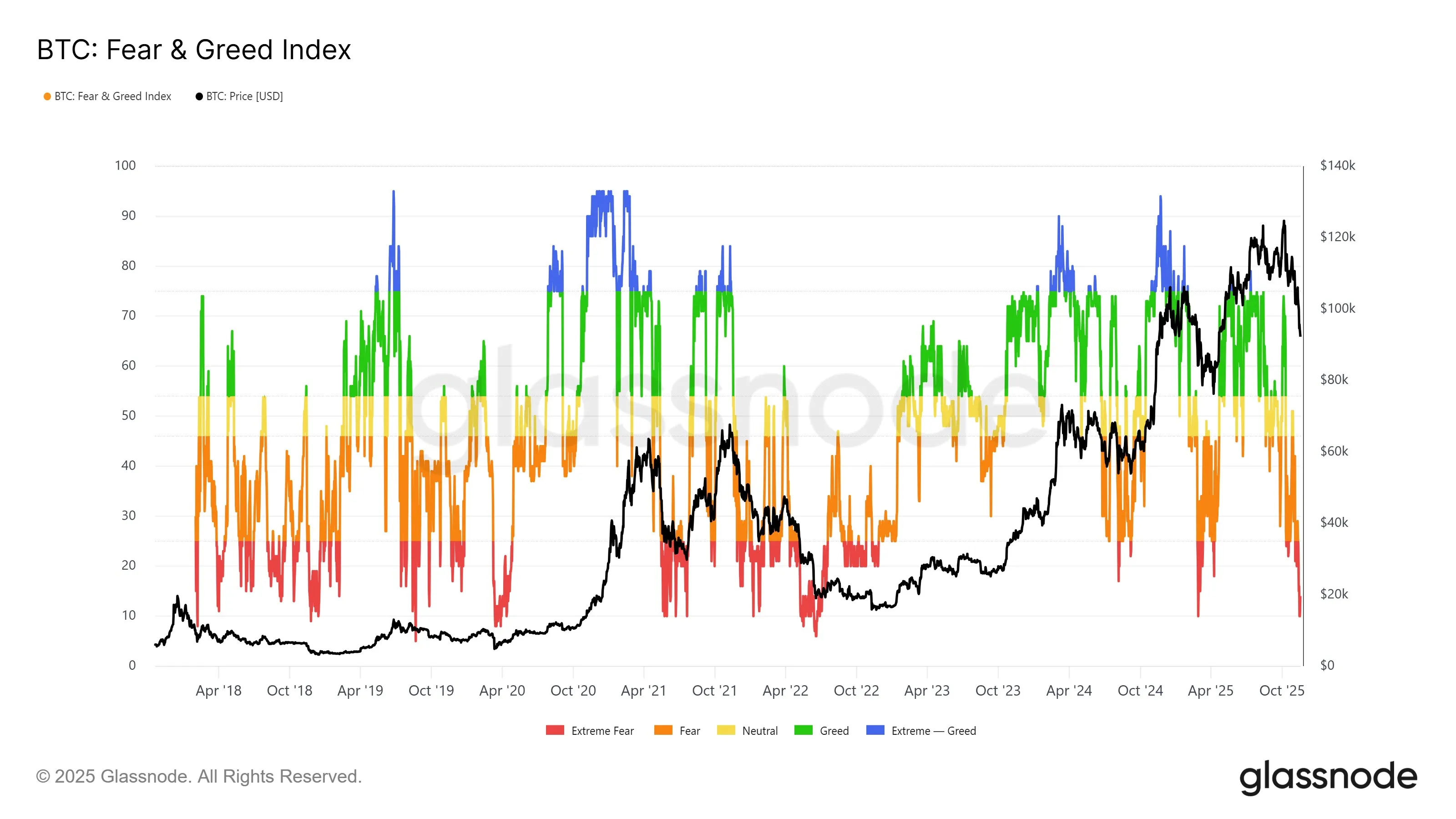

- Fear & Greed Index: Swung from “greed” to “fear,” suggesting sentiment reset after euphoria. Currently sits at 11.

Kuiper notes these data points indicate a regular and healthy drawdown, lacking negative fundamental changes.

Other analysts express caution:

- Max Shannon, Bitwise: Warns of possible downside due to equity market correlation and other factors, but sees improving risk-return profiles.

- Richard Haas, Crypto Investor: Notes deviation from previous corrections, highlighting concerns over moving averages.

Kuiper maintains the current situation aligns with a typical bull-market shakeout, though it's uncertain if this marks a durable bottom or a pause before further decline.

At press time, BTC traded at $92,019.