4 0

Bitcoin Short Traders Bet $1.4B Amid US Shutdown Speculation

The US is potentially facing its first government shutdown in seven years due to a deadlock over a $1.7 trillion spending bill. This could impact federal funding and economic stability, with non-essential services at risk.

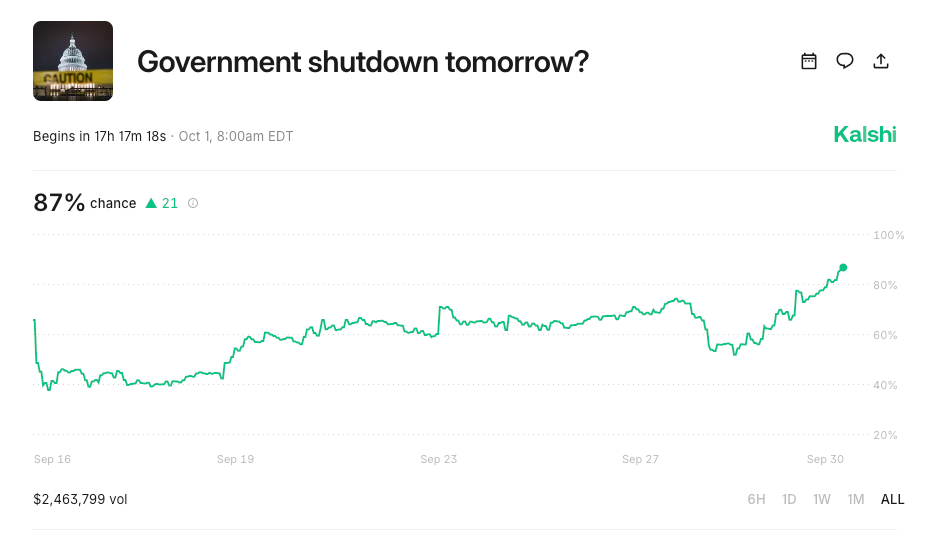

- Prediction markets indicate an 87% chance of a shutdown, with wagers nearing $2.5 million.

- Gold prices rose by 0.6%, while the S&P 500 increased by 0.1%. The Dow Jones saw a slight decline of 0.022%.

- Bitcoin is consolidating around $114,000 amid market caution.

Bitcoin Market Reaction

- Bitcoin initially retraced under $113,500 but rebounded to $114,200.

- Short traders deployed $1.4 billion, showing bearish sentiment due to the potential shutdown.

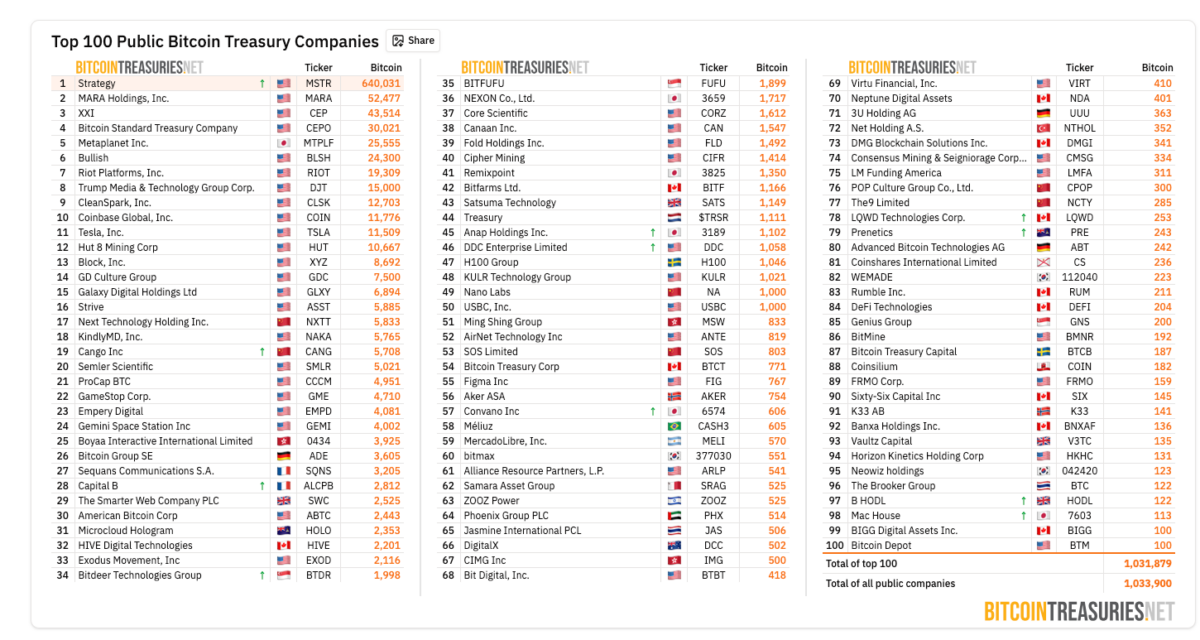

- Top US firms hold significant Bitcoin reserves, entangling cryptocurrencies with US markets.

Bitcoin Price Forecast

- Bitcoin trades within a rising wedge formation, indicating potential sharp movements.

- A close above $115,000 could trigger a short covering rally toward $120,000.

- Failure to break $115,000 might confirm bearish dominance, risking a drop to $95,000.