6 0

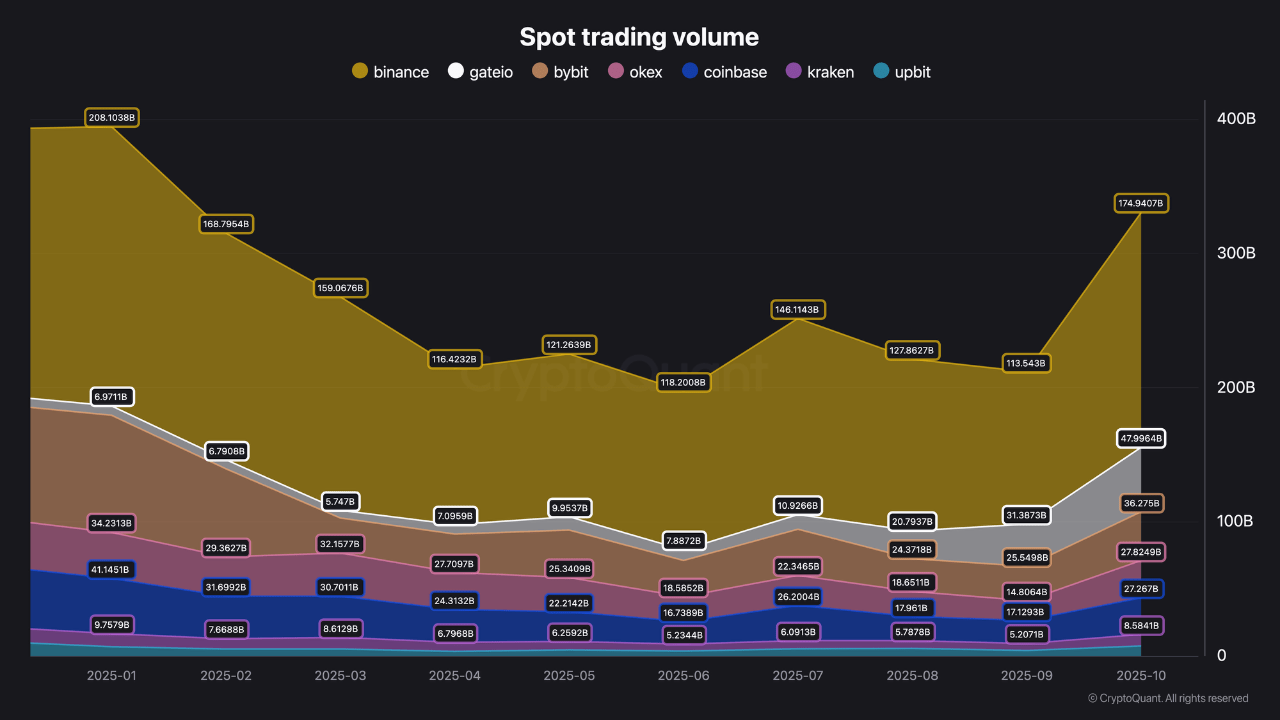

Bitcoin Spot Volume Surpasses $300B in October, Traders Favor Direct Exposure

Bitcoin Volatility and Market Trends

- The US Federal Reserve cut interest rates by 25 basis points and plans to end quantitative tightening by December 1st. This shift in monetary policy aims to support liquidity, impacting Bitcoin's volatility.

- Initial spikes in Bitcoin were followed by a retracement as markets assessed the implications of increased liquidity.

Spot Trading Surge

- October saw a significant increase in Bitcoin spot trading volume, reaching over $300 billion across major exchanges. Binance accounted for $174 billion, marking October as the second-highest month for spot volume this year.

- This surge indicates stronger market structure and growing confidence in direct Bitcoin exposure over leveraged speculation.

- The historic liquidation event on October 10th prompted traders to favor spot exposure, reducing leverage risks.

Spot Market Impact

- A market led by spot flows rather than derivatives tends to be more stable and sustainable.

- Elevated spot participation signals genuine demand, aligning with structural accumulation phases and potential bull cycles.

Bitcoin Price Movement

- Bitcoin is trading near $110,800 after failing to break through the $117,500 resistance level.

- Price tests key support between $110,000 and $111,000; failure to hold could lead to declines toward $105,000 or $102,500.

- Bulls need to reclaim the $113,500–$114,500 area to regain momentum and aim for $120,000–$123,000.