9 0

Bitcoin Stalls Around $112K as Whales Lead Selling Wave

Bitcoin remains stable between $110,000 and $120,000, while gold and U.S. equities approach record highs.

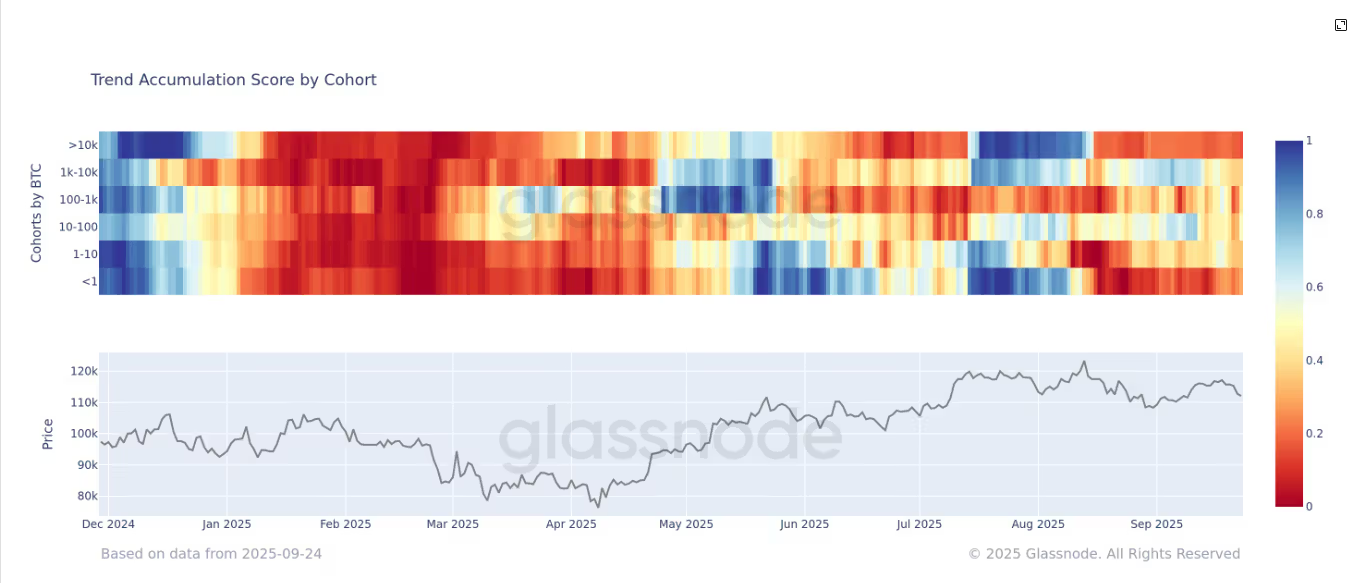

- Glassnode's Accumulation Trend Score indicates selling pressure across all wallet groups, excluding exchanges and miners.

- Wallets holding less than 1 BTC to whales with over 10,000 BTC are in a distribution phase. Large whales show aggressive selling behavior.

- Long-term holder supply, or the percentage of circulating supply unmoved for at least 1 year, decreased from 70% to 60% since November 2023.

- Holders with coins for over two years reduced their share from 57% to 52%.

- The three-year-plus cohort dropped to just above 43%, declining since November 2024, indicating profit realization by those who bought during the previous cycle top and 2022 bear market.

- Five-year-plus holders remain stable, suggesting long-term investors are not selling.

This trend reflects ongoing selling pressure as investors capitalize on unrealized profits from the current cycle.