3 0

Bitcoin Strategy Shows 5.9x Debt Coverage, Institutions Shift to ETFs

- Strategy's Bitcoin Rating indicates its $BTC stack covers convertible debt by approximately 5.9 times at the average cost and retains a 2x coverage even if Bitcoin drops to $25K.

- Institutions are shifting from Strategy stock to spot Bitcoin ETFs, causing Strategy to be excluded from the S&P 500 and trade below its BTC holdings' value.

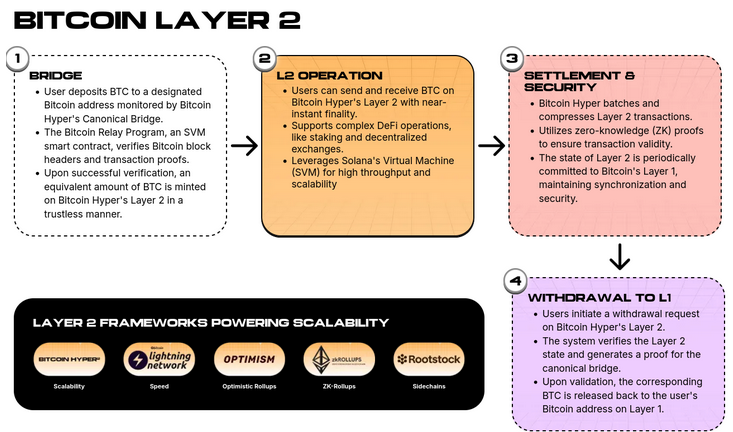

- Bitcoin Hyper is developing a Bitcoin Layer 2 with Solana Virtual Machine (SVM) for low-fee, near-instant smart contracts and DeFi solutions anchored to Bitcoin.

- PEPENODE introduces a mine-to-earn model using virtual nodes to earn $PEPENODE and other meme coins, with node upgrades and token burns linked to in-game activity.

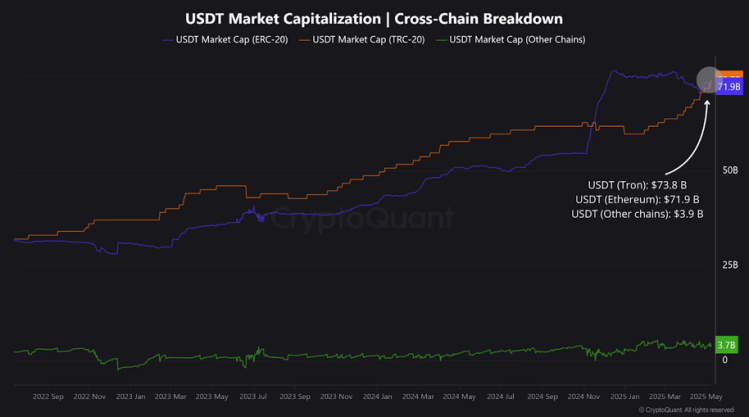

- Tron ($TRX) dominates stablecoin transfers, surpassing Ethereum in circulating $USDT, benefiting from high TPS and low fees.

Corporate treasuries showing strong Bitcoin reserve coverage suggests potential for high-beta plays. Bitcoin Hyper and PEPENODE are positioned as significant opportunities in this context.