2 0

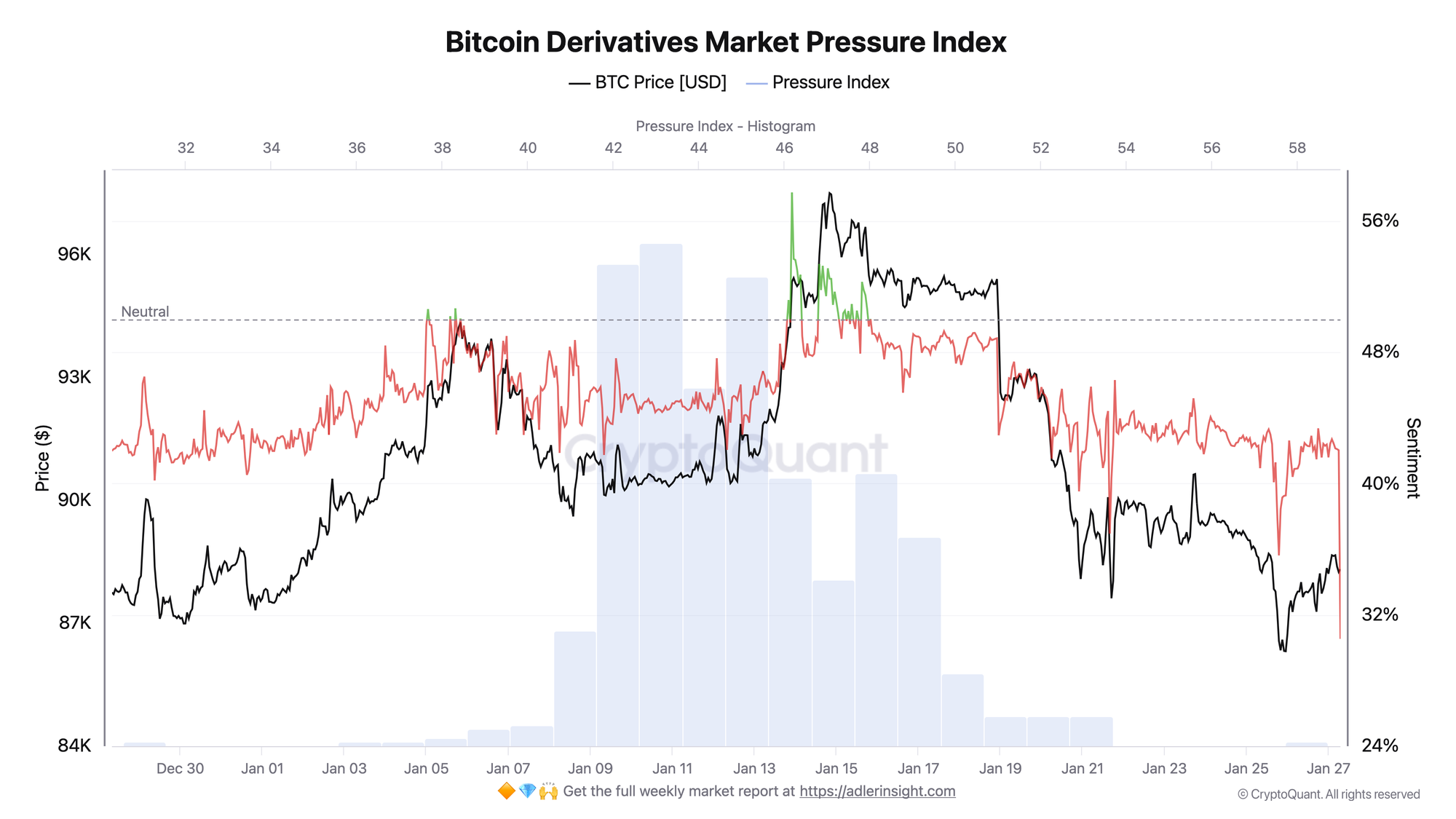

BEARISH 📉 : Bitcoin struggles below $88K amid extreme derivatives pressure

Bitcoin remains under pressure, struggling to regain traction below the $88,000 level. Despite a volatile selloff, the price has stabilized, but market confidence is fragile.

- The Market Pressure Index dropped to 30.54, a new 30-day low, showing increased derivatives-related pressure without a significant price reaction.

- Bitcoin is trading in the lower 17% of the Donchian channel, hovering above the $86.4K support level.

- If buyers absorb supply, support could hold; if not, volatility may increase if this level fails.

Extreme Derivatives Pressure Meets Price Stability

- The Derivatives Market Pressure Index saw a rapid drop of 12 points within an hour, with Bitcoin's price remaining stable from $88.2K to $88.3K.

- This indicates a rare divergence between derivatives pressure and price movement, suggesting either strong demand or potential for further downside.

Bitcoin Downtrend Pressure Persists Below Key Averages

- Trading around $87,800, Bitcoin struggles to reclaim higher resistance zones after transitioning from an uptrend to a corrective phase.

- Price is below the downward-sloping 50-day moving average, with the 100-day and 200-day averages reinforcing bearish momentum.

- Sellers remain active, rejecting attempts to rise toward $92K–$96K.

- Holding the $86K–$88K zone is critical for bulls to prevent deeper declines.

- A daily close above $90K would indicate trend stabilization, while failure to defend current levels risks further decline toward the low-$80K range.