Bitcoin Tests Resistance at $114,000 as Bulls Target $117,500

Bitcoin is trading at a pivotal level after a rally pushed its price above $114,000. This move may indicate a market turning point as investors test if Bitcoin can sustain this threshold for potential further gains.

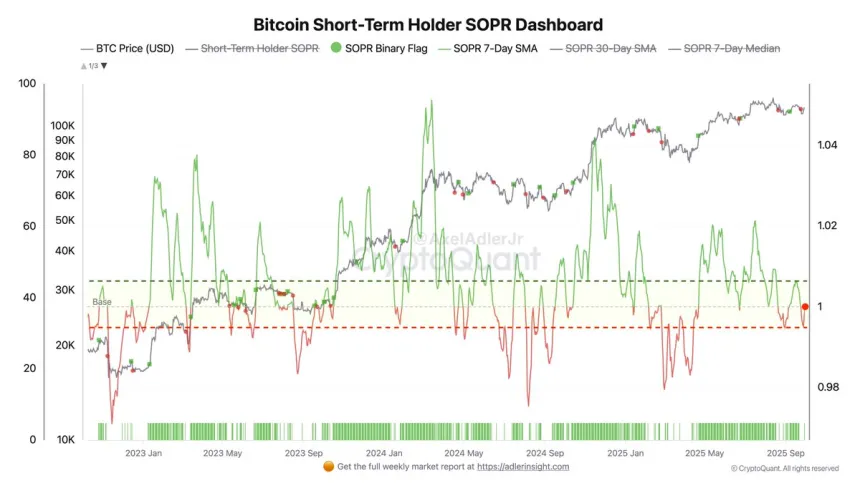

- The Short-Term Holder Spent Output Profit Ratio (STH SOPR) has reset to 1, indicating that short-term holders are selling at their cost basis, showing market neutrality.

- This equilibrium usually precedes significant market movements.

- A sustained increase could validate bullish efforts, while failure to maintain above $114,000 may lead to renewed downward pressure.

SOPR Signals Market Equilibrium

Analyst Axel Adler emphasizes the STH SOPR's role in assessing Bitcoin’s market state. When this metric nears 1, it indicates a balance between buyers and sellers. A rise above 1 shifts breakeven holders into profits, leading to increased selling pressure.

This creates a self-limiting environment where rallies face profit-taking pressures. For a trend acceleration, a consistent SOPR rise above 1.002 is needed, signaling reduced selling pressure and increased buying momentum. Until then, Bitcoin risks range-bound action with vulnerable rallies.

Bitcoin Tests Resistance as Bulls Eye $117,500

Bitcoin trades around $113,400, having touched $114,800 earlier. The $117,500 level remains critical, capping rallies since mid-August. A decisive close above this level is necessary to confirm upside momentum.

- The 50-day moving average acts as near-term resistance; the 100-day average serves as support.

- The 200-day moving average provides a strong base for the longer-term trend.

- Clearing the $117,500 barrier is crucial; otherwise, rallies risk fading into selling pressure.