13 0

Bitcoin Surpasses $125K Amid Market Uncertainty and US Dollar Shift

The crypto market is experiencing volatility, with Bitcoin reaching a new all-time high alongside a rise in gold prices amidst US economic uncertainty.

- The US government shutdown has shifted investor interest from the USD to safe-haven assets like gold and Bitcoin.

- Gold hit a record of $3,897 per ounce on October 2, while Bitcoin reached $125,559 on October 5, achieving a market cap near $2.5 trillion.

- Bitcoin dominates the crypto market with a 58.5% share of a $4.26 trillion market capitalization.

- Short-term investors have driven Bitcoin's recent surge, with US-based spot BTC ETFs seeing $3.24 billion in net inflows last week.

- The total inflows for Bitcoin investment products have surpassed $60 billion.

- Expectations of "Uptober" may be contributing to increased market activity as investors anticipate a bullish trend.

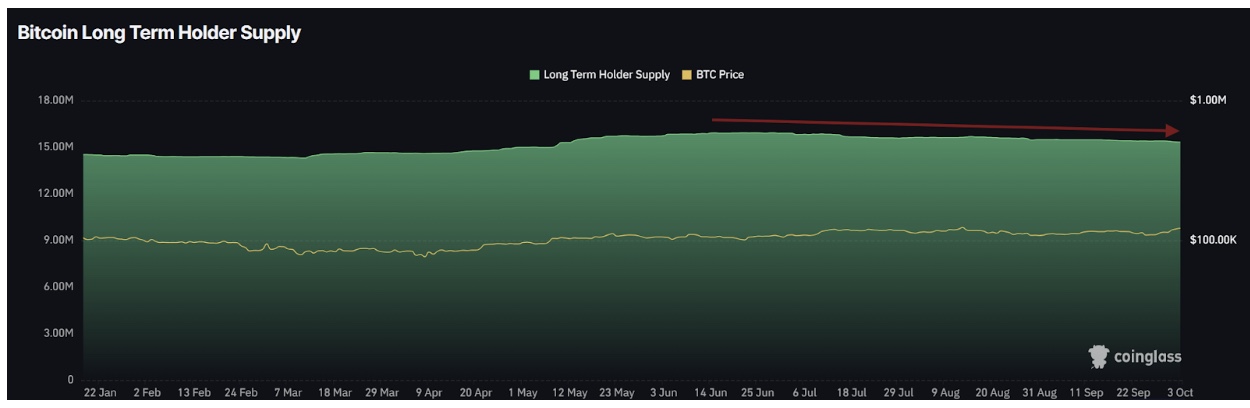

- Long-term Bitcoin holders have been reducing their positions since mid-June, with holdings decreasing from 15.92 million BTC to 15.32 million BTC by October 3.

- This decrease in long-term holder supply suggests waning confidence in Bitcoin's future value, with some anticipating a price correction.

- The Bitcoin Net Unrealized Profit/Loss (NUPL) indicator rose from 0.51 to 0.56 last week, hinting at potential profit-taking if it reaches the 70 mark.