15 0

Bitcoin Treasury Companies Suffer $17 Billion Loss Amid Altcoin Shift

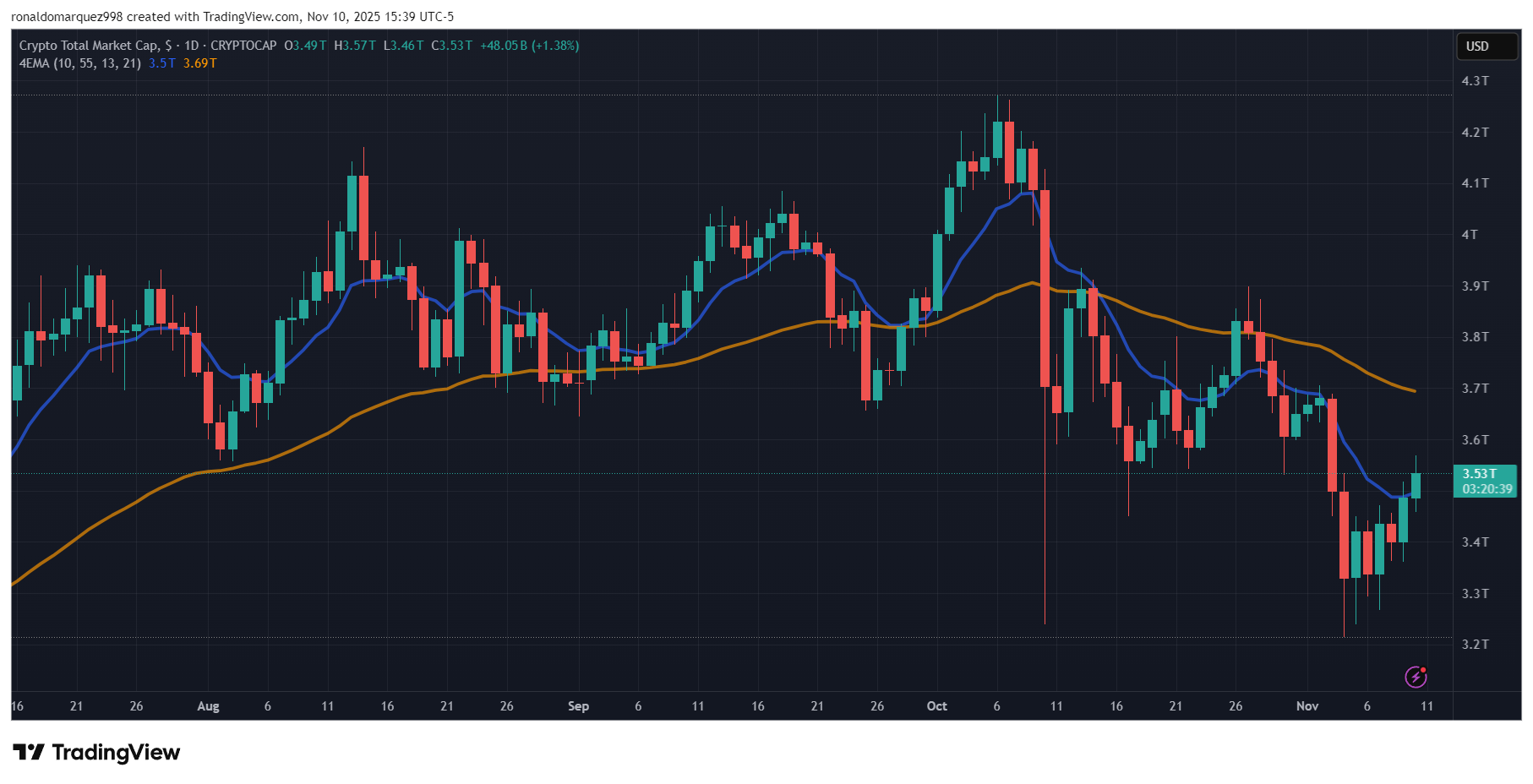

Over the past year, Bitcoin (BTC) and Ethereum (ETH) have been central to Digital Asset Treasuries (DATs), supported by favorable global regulations. However, a shift towards altcoins is emerging.

Shift in Focus for DAT Firms

- As of September, there are over 200 DAT companies focusing on BTC with a market cap of approximately $150 billion, tripling from last year.

- With BTC value declining, firms like Greenlane, OceanPal, and Tharimmune are exploring tokens such as Berachain (BERA), Near protocol (NEAR), and Canton Coin (CC).

- Peter Chung from Presto Research suggests potential for a resurgence despite diminishing hype around DATs.

Retail Investor Losses and Market Challenges

- Earlier this year, digital asset treasury companies traded at a premium due to investor confidence in acquiring more tokens.

- Recent struggles of BTC led to a decline, with at least 15 treasury companies trading below token net asset value.

- Retail investors lost around $17 billion on trades, as per 10x Research estimates.

- Companies like ETHZilla and Forward Industries are resorting to share repurchases to support prices.

Risks and Expert Warnings

- Analysts warn that investing in less liquid cryptocurrencies increases risk.

- Cristiano Ventricelli from Moody’s Ratings highlights heightened equity pressure during adverse market conditions.

- Michael O’Rourke from JonesTrading cautions that many DAT companies might trade at discounts to their digital assets.