6 0

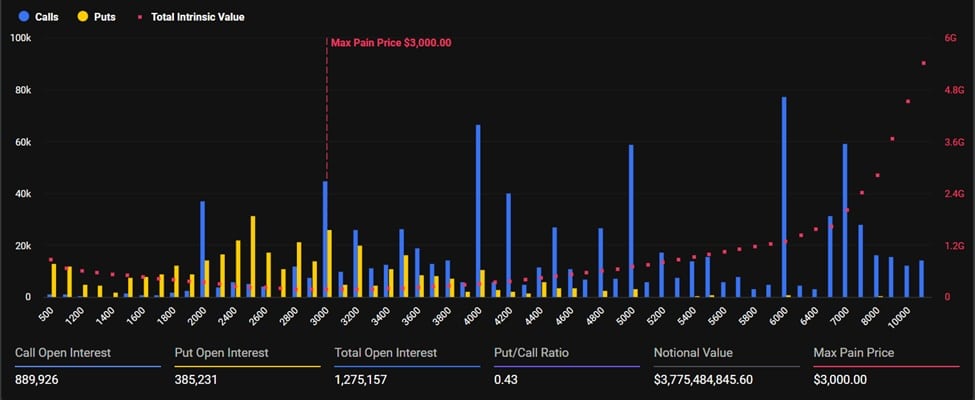

Bitcoin Price Volatility Surges Ahead of $28 Billion Options Expiry

Bitcoin Price Volatility and Options Expiry

- On December 26, Bitcoin's price increased by 1.63%, reaching over $89,100 before stabilizing around $88,500.

- The surge precedes a significant $28 billion options expiry set for Friday.

- Analyst Ardi attributes the initial price increase to short-covering, followed by genuine demand from high-volume buyers.

- Daily trading volume for BTC rose by 36% to $30 billion, indicating bullish sentiment.

- Despite positive movement, Bitcoin needs to surpass $90,500 for a short-term upside and $94,000 for sustained bullish momentum.

- The upcoming options expiry could cause volatility due to traders repositioning.

Bitcoin Price Outlook

- In 2025, especially Q4, Bitcoin has underperformed expectations with negative returns anticipated.

- Analyst Daan Crypto Trades notes a compression phase that might lead to a decisive price move soon.

- January is seen as crucial for determining the next trend, with $94,000 identified as critical resistance.

- A breakout above $94,000 could aim for $100,000; falling below $80,000 would shift the outlook negatively.