47 0

Bitcoin Volatility Surges as Options Market Influences Price Moves

Bitcoin's recent price volatility has increased, with options markets influencing movements. This change affects trader and investor responses to Bitcoin fluctuations.

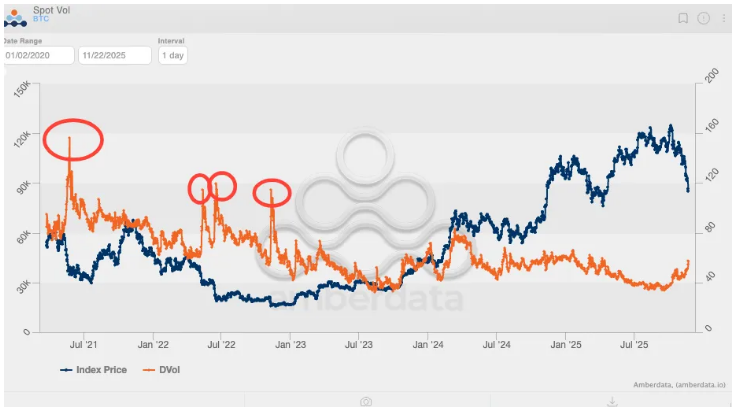

Volatility Rise

- Implied volatility was under 80% after US Bitcoin ETF approval but is now nearing 60%.

- Options can amplify market moves, similar to January 2021 when options drove Bitcoin to a high of $69,000.

Price Decline and Position Liquidations

- Bitcoin dropped below $85,000, triggering liquidations and selling pressure.

- Losses stem from highly leveraged positions closing and long-term holders taking profits.

- Bitfinex analysts view this as tactical rebalancing, not affecting long-term fundamentals.

- Binance CEO notes similar volatility across asset types.

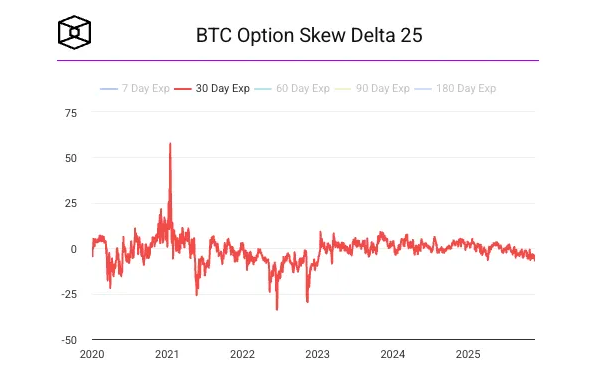

Impact of Derivatives

- Options positioning sharpens price action due to quick hedging requirements.

- This factor contributed to the 2021 Bitcoin surge and may influence current trends as implied volatility rises.

- Traders note early signs of option-driven behavior, though not at extreme past levels.

Potential Fed Rate Cut

- The CME FedWatch tool indicates a 71% chance of a 25-basis point rate cut in December, up from 30–40% earlier.

- New York Fed President's comments suggest a move toward neutral policy, influencing market expectations.

- A rate cut could boost risk assets; if not, volatility may remain high.

Traders are closely watching December for indicators that could stabilize or further fuel market activity. Some will wait, while others may trade amid volatility.