2 0

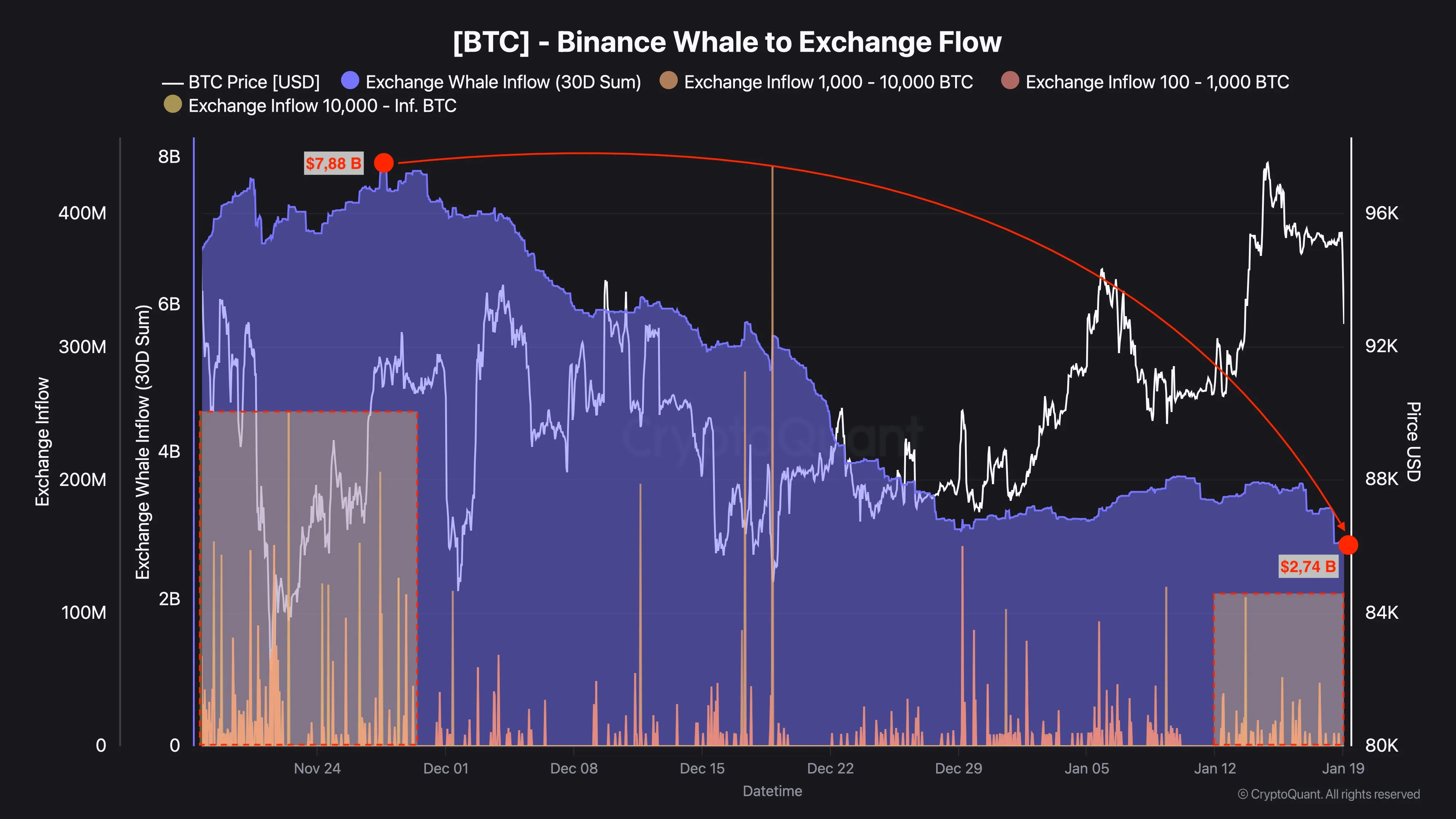

Bitcoin Whale Sell Pressure Drops Sharply as Binance Inflows Decline

Bitcoin Whale Activity Decline

- Significant decrease in Bitcoin inflows from whale-sized transfers to Binance since late November.

- CryptoQuant reports a decline in large BTC holder transactions, indicating reduced sell-side pressure.

- Whale behavior shifted post-market drawdown in late 2025, with increased caution and patience observed.

- Previously, whale inflows surged as Bitcoin corrected from an all-time high near $126,000, reaching an average monthly total of nearly $8 billion.

- Current inflows have decreased to approximately $2.74 billion, reflecting a change in whale behavior towards holding rather than selling.

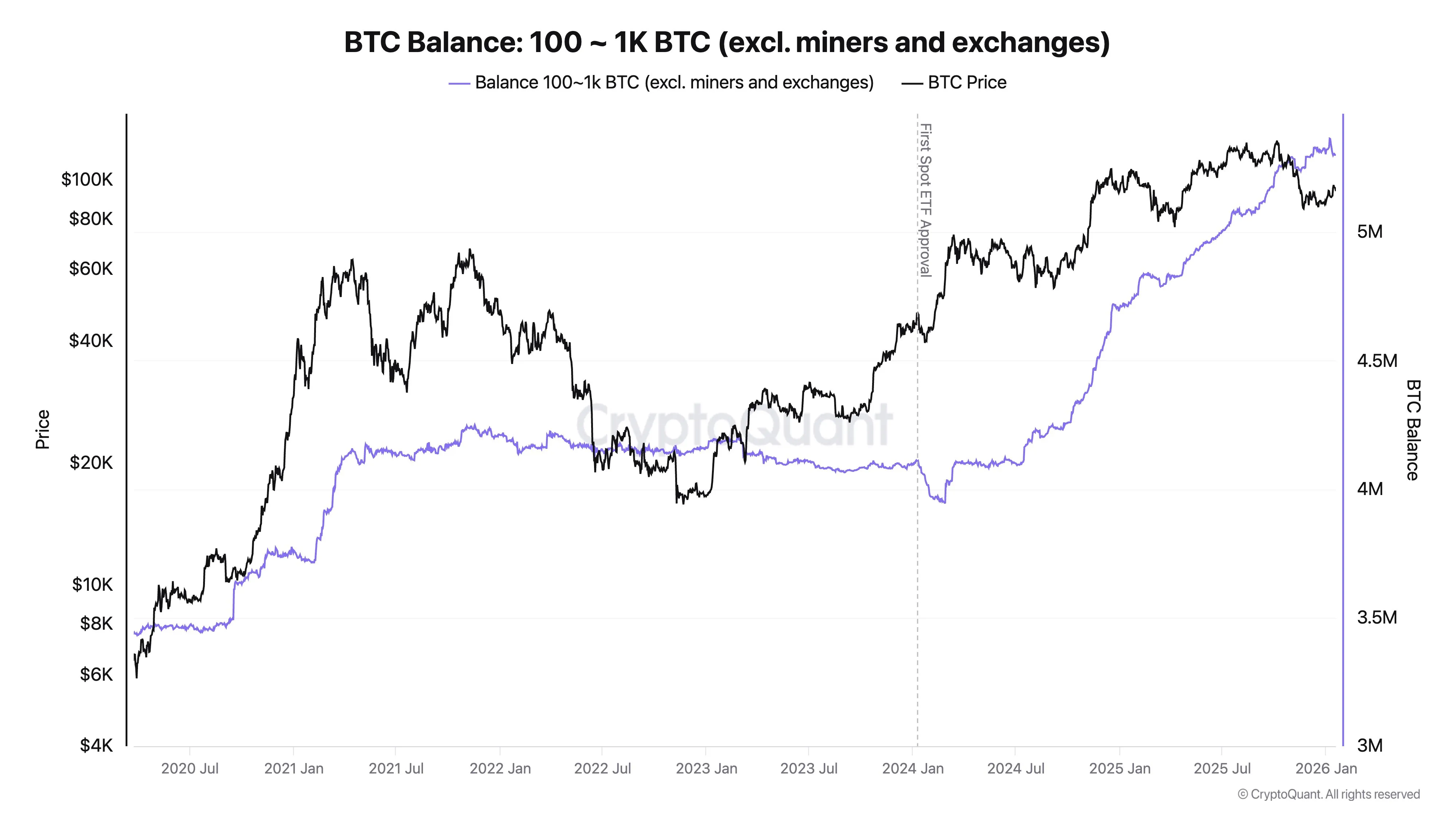

Institutional Demand for Bitcoin

- Institutional demand remains strong, according to CryptoQuant CEO Ki Young Ju.

- US custody wallets typically hold between 100–1,000 BTC each, excluding exchanges and miners.

- 577K BTC, valued at $53B, was added over the past year, indicating ongoing institutional accumulation.

At present, Bitcoin trades at $90,885.