5 0

BULLISH 📈 : Bitcoin whales accumulate 104,340 BTC amid market volatility

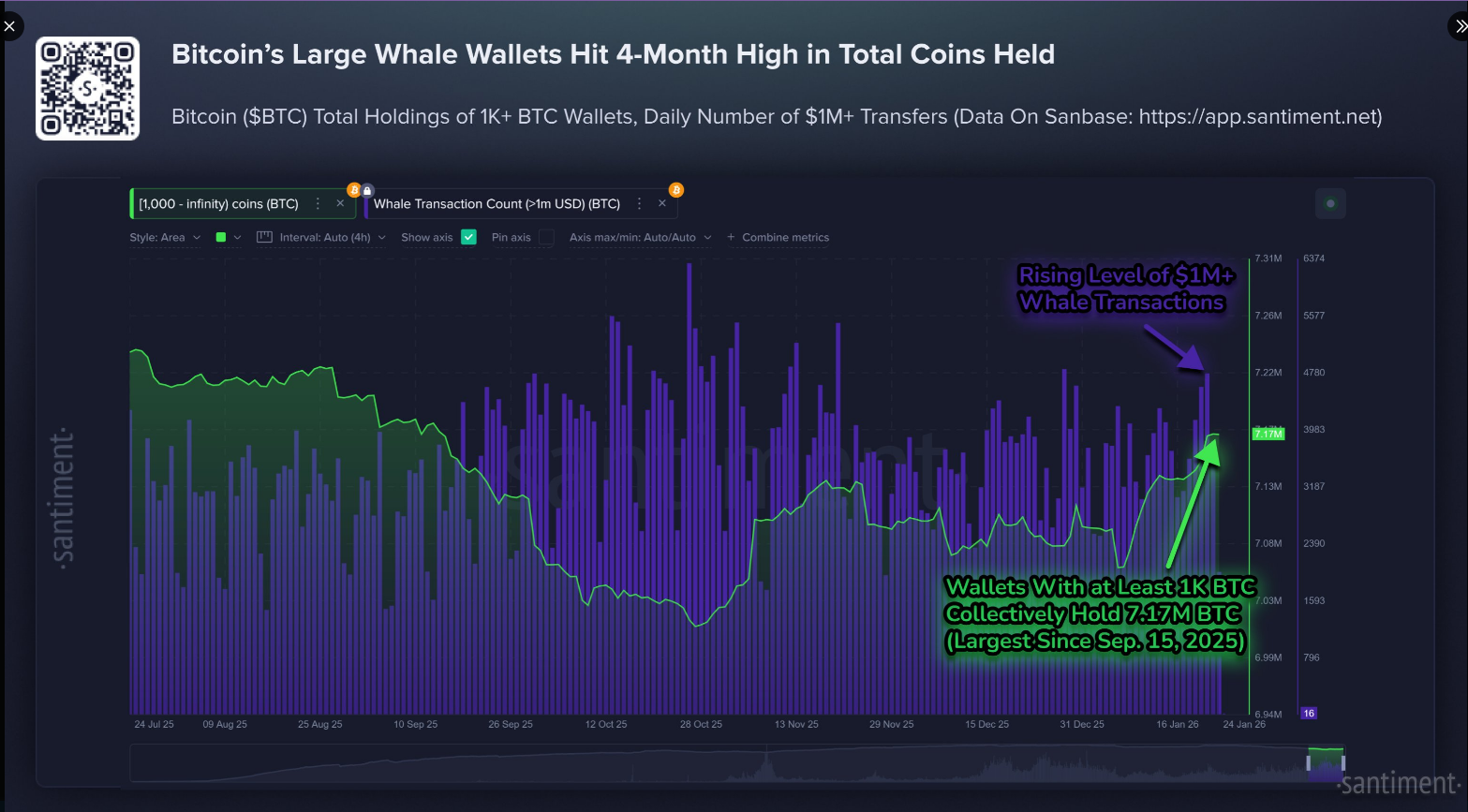

Recent blockchain data reveals that large Bitcoin holders, or "whales," have increased their holdings despite price fluctuations. Key insights include:

- Wallets with at least 1,000 BTC added 104,340 BTC recently.

- Total supply in these wallets reached 7.17 million BTC, the highest since September 2025.

- Mid-sized holders also increased their holdings by approximately $3.21 billion worth of Bitcoin between January 10 and January 19.

- Retail investors offloaded about 132 BTC, valued at around $11.66 million.

Market Activity

- Large transfers worth $1 million or more have risen to a two-month high, indicating active network participation by big players.

- The activity is linked to institutions and wealthy individuals moving coins among custody, exchanges, and private wallets.

Price Movement

- Bitcoin’s price ranged from $86,500 to $87,500, trading around $87,730.

- It decreased by 0.5% over 24 hours and 5.4% over the previous week.

- Increased trading volumes suggest some investor interest at current levels.

Macro Risks

- Geopolitical concerns include US military movements near tense regions and possible conflict with Iran.

- Trade disputes with Canada could elevate market uncertainty and affect risk appetite.

- There is a >70% chance of a US government shutdown, according to Polymarket.

While on-chain accumulation hints at potential support for future rallies, external factors like geopolitical tensions and trade issues contribute to market volatility.

Image sourced from Unsplash, chart from TradingView.