12 0

Bitcoin Whales Drive Demand to All-Time High, Signaling Possible Rally

Bitcoin is currently trading between $90,000 and $88,000, indicating a consolidation phase that often precedes significant market moves.

Accumulation Demand Metric Hits Record High

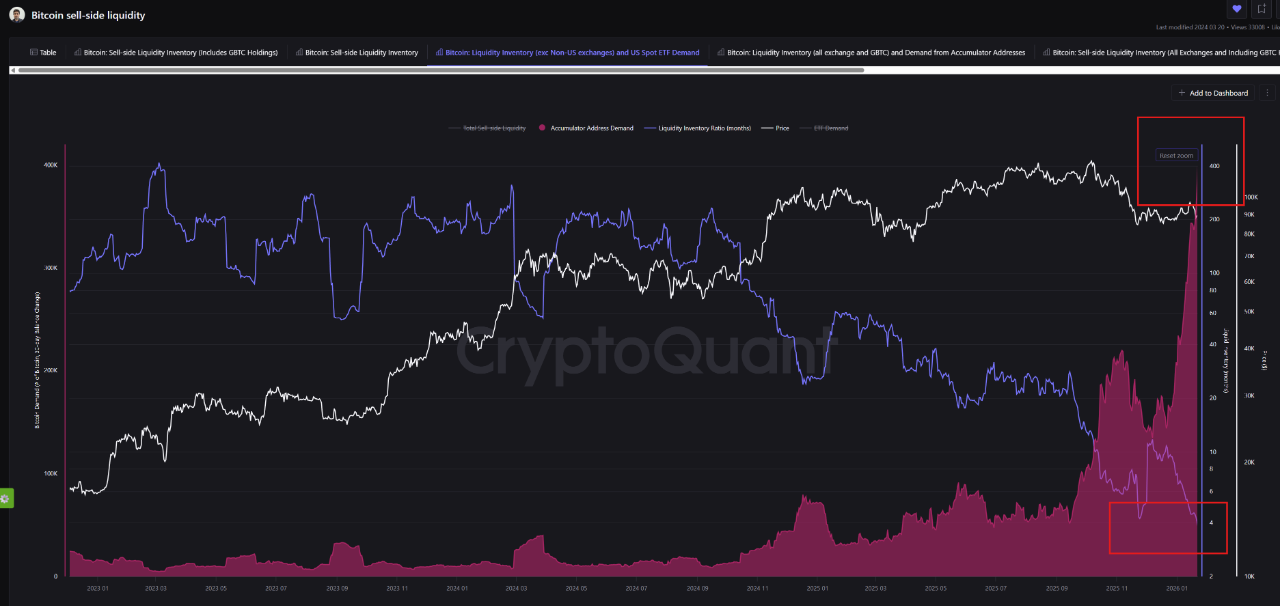

- On-chain analysis suggests a potential bullish trend for Bitcoin based on Accumulator Address Demand and Liquidity Inventory Ratio metrics.

- The Accumulator Address Demand metric indicates net buying pressure from addresses that consistently buy Bitcoin without significant selling, typically associated with whales.

- Large withdrawals from exchanges are usually executed by whales, suggesting increased buying pressure and heightened Accumulator Address Demand.

- The indicator has reached an all-time high, potentially signaling intense "fear of missing out" among whales.

- The Liquidity Inventory Ratio (Month) shows a sharp increase in demand compared to the supply available on exchanges, reaching a value of 3.8.

- This ratio suggests that US exchanges are experiencing exceptionally high demand relative to supply.

- A 3.8 reading implies a potential supply shock if current conditions persist, although it primarily indicates intensified whale demand.

Together, these metrics suggest a distinctly bullish outlook, as data indicates whales may be positioning for a renewed upward trend in Bitcoin price.

Bitcoin Price Overview

Currently, Bitcoin is valued at $88,520, marking a decline of over 1% in the past 24 hours.