BULLISH 📈 : Bitcoin Hyper raises $31M to enhance Bitcoin network with SVM

Key Highlights:

- Bitcoin's 2026 outlook targets $180K-$200K, contingent on sovereign adoption and maintaining the $70K support.

- A breakdown below $80K could signal a potential cycle reset for Bitcoin.

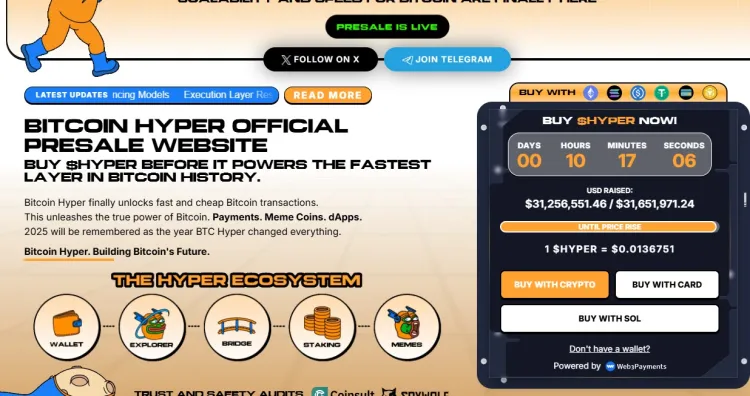

- Bitcoin Hyper is leveraging Layer 2 demand, raising over $31M to integrate Solana Virtual Machine (SVM), enhancing Bitcoin with high-speed smart contracts.

- Fragmented institutional liquidity creates a dual market: slow growth for BTC spot and high-velocity speculation in infrastructure layers.

As Bitcoin approaches mid-2025 to 2026, it faces a pivotal shift towards utility, demanding high-speed execution. The divergence between store-of-value assets and high-velocity infrastructure layers becomes evident.

Projections for 2026 depend on defending the 50-week moving average and realizing the 'U.S. Strategic Reserve' thesis. A break above $80K could lead to rapid price discovery due to the lack of historical resistance.

- Bull Case ($180k+): Sovereign wealth funds disclose BTC allocations, causing a buying frenzy.

- Base Case ($120k-$140k): Steady increase with periodic corrections driven by ETF rebalancing.

- Invalidation Scenario (<$85k): Sustained drop below $85K suggests a cycle top.

Watch for volume at $80K; a high-volume close confirms the bullish thesis. Meanwhile, Bitcoin Hyper targets high-velocity upside with its SVM integration, raising $31.2M during presale. It aims to offer sub-second transaction finality and robust smart contract capabilities.

Smart money is positioning itself with significant investments in Bitcoin Hyper, but risks remain due to its presale nature and regulatory changes. Investors seeking high-risk, high-reward opportunities may find the SVM-integration narrative compelling.

Disclaimer: This summary is informational and not financial advice. Cryptocurrencies are volatile and high-risk assets. Conduct your own research before investing.