3 0

BULLISH 📈 : ING partners with Bitwise as Bitcoin Hyper raises $31.2M

Traditional finance and decentralized infrastructure are converging, as ING partners with Bitwise to deepen involvement in the crypto ecosystem. This move signals a shift in institutional capital's approach to digital assets.

- ING's partnership with Bitwise allows institutions to bypass technical challenges of direct ownership while benefiting from digital asset yield generation.

- This aligns with the 'Bitcoin as collateral' thesis and pushes competitors to reassess risk models.

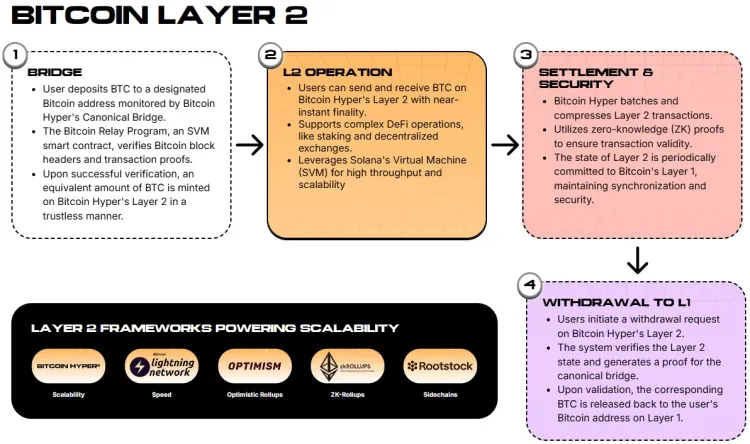

- The demand for utility has highlighted Bitcoin Layer 1's limitations, such as lack of smart contract capability and slow transactions.

- Layer 2 solutions, particularly Bitcoin Hyper, are gaining attention for addressing scalability issues.

Bitcoin Hyper's Technological Advancements

- Bitcoin Hyper integrates the Solana Virtual Machine (SVM) for fast transaction speeds and low costs while maintaining Bitcoin's security.

- This enables development of high-frequency trading platforms, gaming dApps, and complex DeFi protocols using Rust within the Bitcoin ecosystem.

- The Decentralized Canonical Bridge facilitates trustless transfers, solving previous fragmentation issues.

Investment and Market Activity

- Bitcoin Hyper has raised $31.2 million during its presale, indicating strong early support.

- The token is priced at $0.013675, offering a competitive entry point compared to established Layer 2s.

- Staking incentives with a short vesting period encourage long-term investment.

Investors should note that cryptocurrency markets are volatile and conduct their own due diligence before investing.