0 0

BULLISH 📈 : CPI Data Boosts Bitcoin Futures Activity and Risk Sentiment

Bitcoin faced another challenging week, maintaining a bearish trend. It is currently around the $69,000 mark, with analysts using on-chain data to predict future movements.

CPI Data and Bitcoin Futures

- The U.S. Consumer Price Index (CPI) showed a 2.4% inflation rate, exceeding expectations and boosting risk assets like Bitcoin.

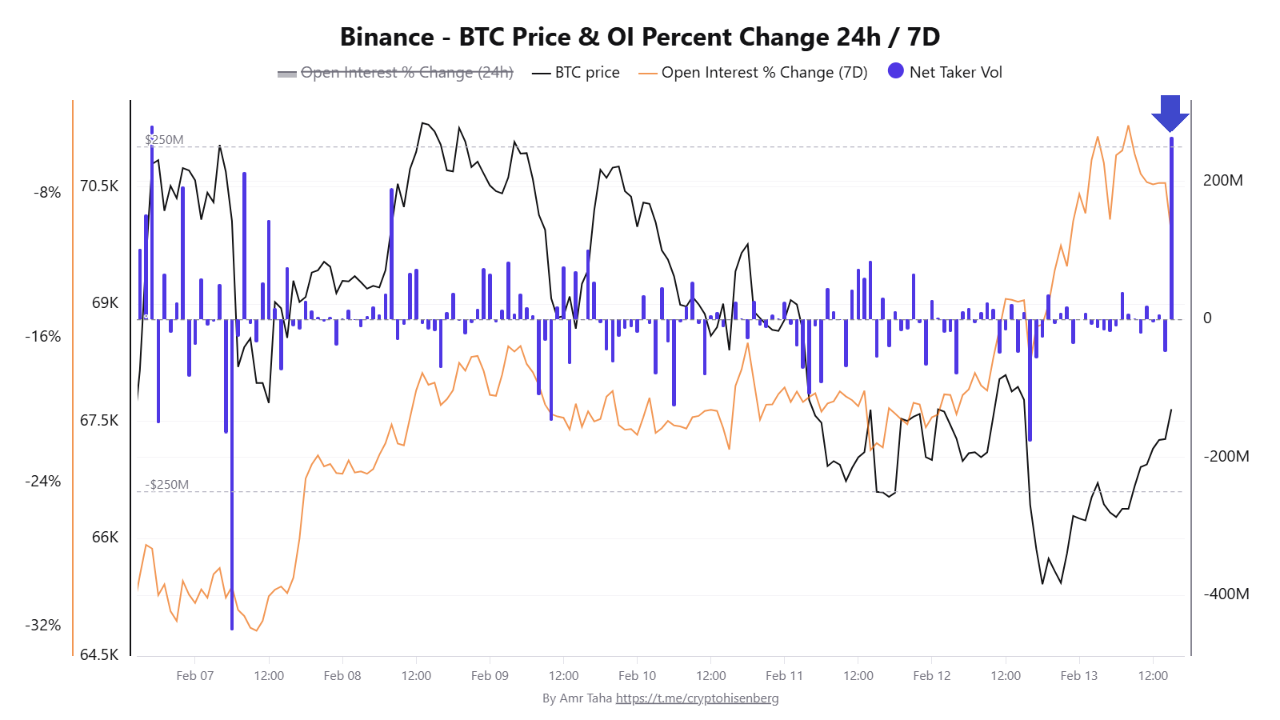

- Following the CPI release, Binance data indicated a sharp increase in Bitcoin futures activity, with Net Taker Volume reaching over $265 million in an hour.

- Open Interest percent change rose, showing traders are entering new leveraged positions, raising speculative interest but also liquidation risks.

Short-Term Stress vs. Long-Term Stability

- On-chain metrics indicate stress among short-term holders, with the STH-LTH MVRV indicator dropping to 0.72, suggesting average unrealized losses of about 44% for short-term holders.

- Realized cap for short-term holders fell to -$57 billion, indicating significant losses, whereas long-term holders show resilience with a positive realized cap of approximately $35 billion.

- Increased leveraged long positions and short-term holder losses suggest market instability and potential volatility.

Bitcoin currently trades at $68,929, up 5.06% in the past day.