7 0

BULLISH 📈 : Expert suggests Bitcoin could see explosive volatility like silver

Bitcoin's options pricing and low activity suggest potential for significant price movement, according to ProCap CIO Jeff Park. He notes:

- Low implied volatility and thin participation hinder upward momentum.

- The current implied volatility is ~38, with poor month-to-date volume.

Silver Market as a Reference

- Silver prices surged due to speculative bids and tight physical conditions.

- On Jan. 26, silver futures rose 14%, the largest one-day gain since 1985.

- SLV ETF trading volume reached $32 billion, significantly higher than its average.

Impact of "Paper" Exposure

- Park suggests that synthetic Bitcoin could drive price volatility, similar to silver.

- Silver's surge was driven by financial instruments rather than spot demand.

Park emphasizes the importance of volatility for Bitcoin's market dynamics, predicting eventual significant price movements.

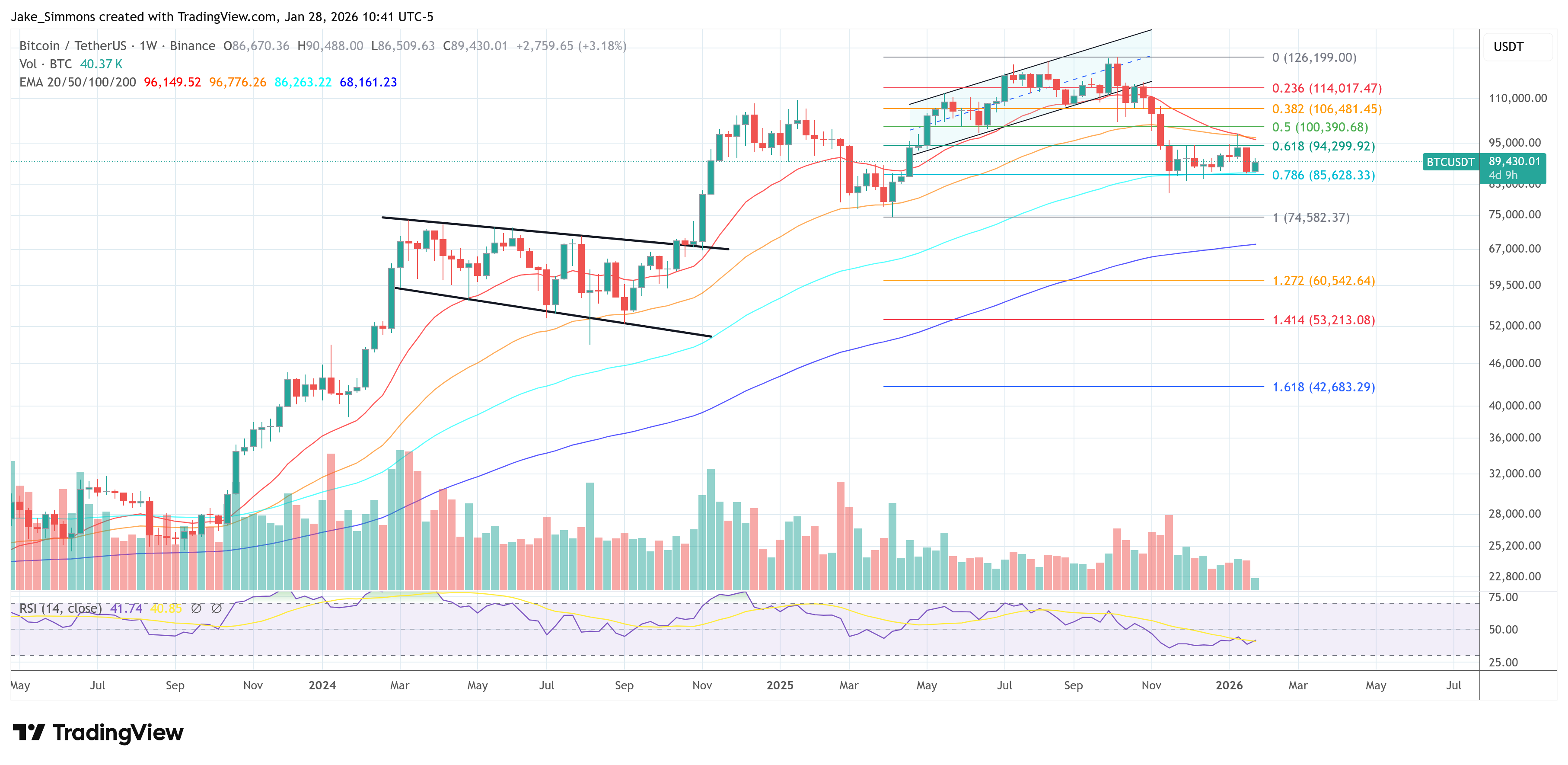

Bitcoin is currently trading at $89,430.