0 0

BULLISH 📈 : Raoul Pal predicts US liquidity resolution will boost crypto market

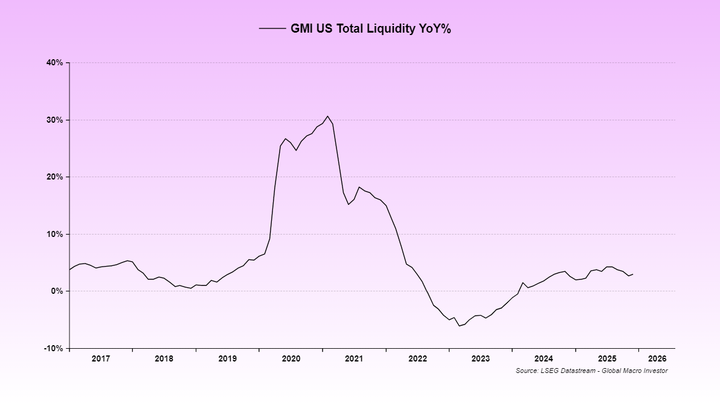

Raoul Pal argues that the current downturn in Bitcoin and high-beta risk assets is due to a temporary liquidity issue in the US, not a broken market cycle. He attributes this to Treasury cash management and government shutdown dynamics.

- Pal challenges the notion that Bitcoin and crypto cycles are over, suggesting it's a "narrative trap."

- He found that both Bitcoin and SaaS equities share similar downturn patterns, indicating an overlooked factor affecting both.

US Liquidity Drain

- US liquidity has been constrained by two government shutdowns and issues with financial infrastructure.

- The Federal Reserve's reverse repo facility drain concluded in 2024, impacting liquidity.

- Lack of liquidity is reflected in weak macroeconomic indicators like the ISM.

- US remains the main global liquidity supplier, heavily influencing Bitcoin and tech sectors.

- Bitcoin and SaaS equities, as long-duration assets, were hit hardest by liquidity withdrawal.

- Gold's rise absorbed liquidity that might have supported Bitcoin and SaaS stocks.

- The latest shutdown further exacerbated liquidity issues by increasing Treasury General Account balances.

Pal suggests the liquidity crunch is nearing resolution, predicting a potential "liquidity flood" from factors such as changes in regulations, partial TGA drawdowns, fiscal stimulus, and rate cuts.

- He disputes claims that Kevin Warsh would maintain a hawkish Fed policy, suggesting a focus on economic growth and avoiding actions that could destabilize lending.

- Pal admits GMI underestimated the impact of US liquidity, acknowledging unexpected events like the Reverse Repo drain, TGA rebuild, and gold rally.

He emphasizes patience, remaining optimistic about future market conditions if his anticipated policy and liquidity strategies materialize.

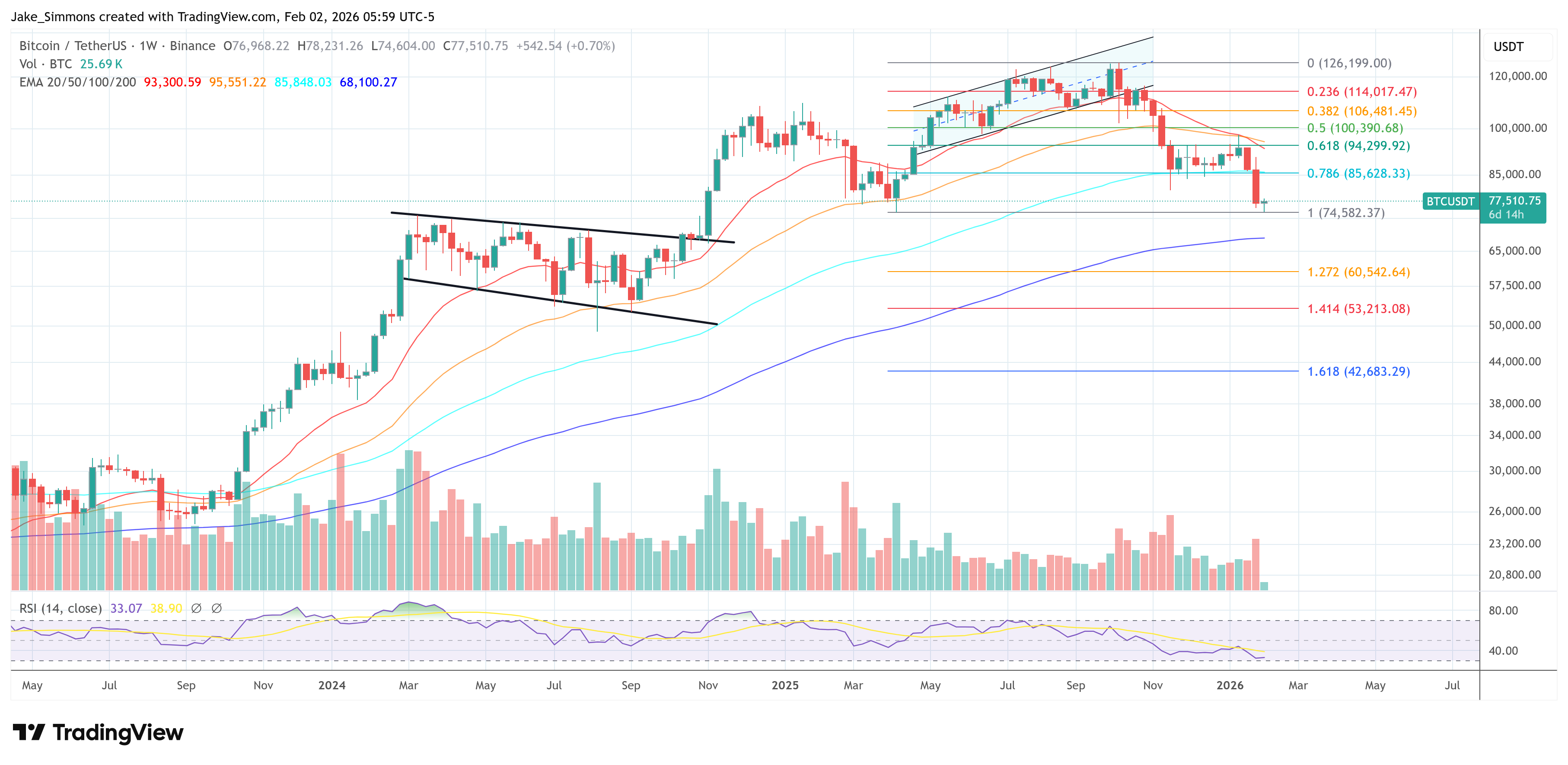

At press time, Bitcoin traded at $77,510.