Canaan Faces Nasdaq Delisting Risk After Shares Fall Below $1

Canaan Inc. (NasdaqGM:CAN) faces a Nasdaq warning for its share price falling below $1. The company has 180 days, until July 13, 2026, to comply with Nasdaq's Listing Rule 5550(a)(2), requiring the stock to maintain a closing bid of at least $1 for 10 consecutive trading sessions.

- The company's shares have traded below $1 for 30 consecutive business days as of Jan. 14, 2026.

- If Canaan fails to meet the requirement by the deadline, it might receive an additional 180-day extension, subject to conditions and a fee.

- Possible measures to regain compliance include a reverse stock split.

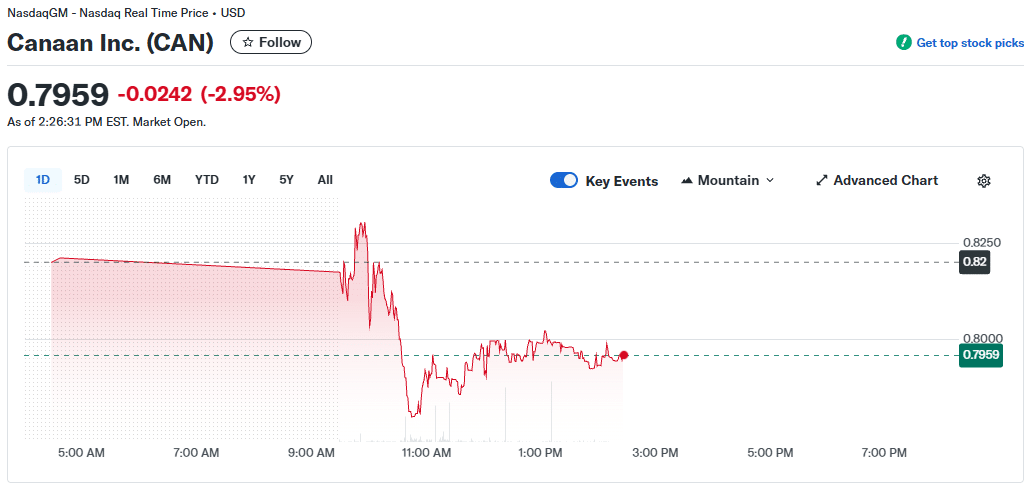

Canaan's stock continued trading below $1, closing at approximately $0.798 on Jan. 16, 2026. This follows a continuous decline triggered by market dynamics and demand for Bitcoin mining machines.

Despite analysts predicting a multi-dollar target for CAN, the minimum bid rule remains unaffected. Canaan's performance is closely linked to Bitcoin prices and general crypto market trends.

The company's future results depend on market demand, macroeconomic factors, and regulatory developments, influencing its strategy execution amidst the current listing deficiency.