13 0

Cantor Equity Partners Shares Rise 55% on Proposed Bitcoin SPAC Merger

Shares of Cantor Equity Partners (CEP) increased by 55% on Tuesday and rose an additional 15% in pre-market trading, currently priced below $19.

The increase is linked to investor optimism regarding its merger with Twenty One Capital, a bitcoin-native investment vehicle supported by Tether, Bitfinex, and SoftBank.

Key details include:

- Twenty One Capital, led by Strike CEO Jack Mallers and Brandon Lutnick, aims to serve as a public proxy for bitcoin.

- The entity may hold over 42,000 BTC at launch, introducing metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR).

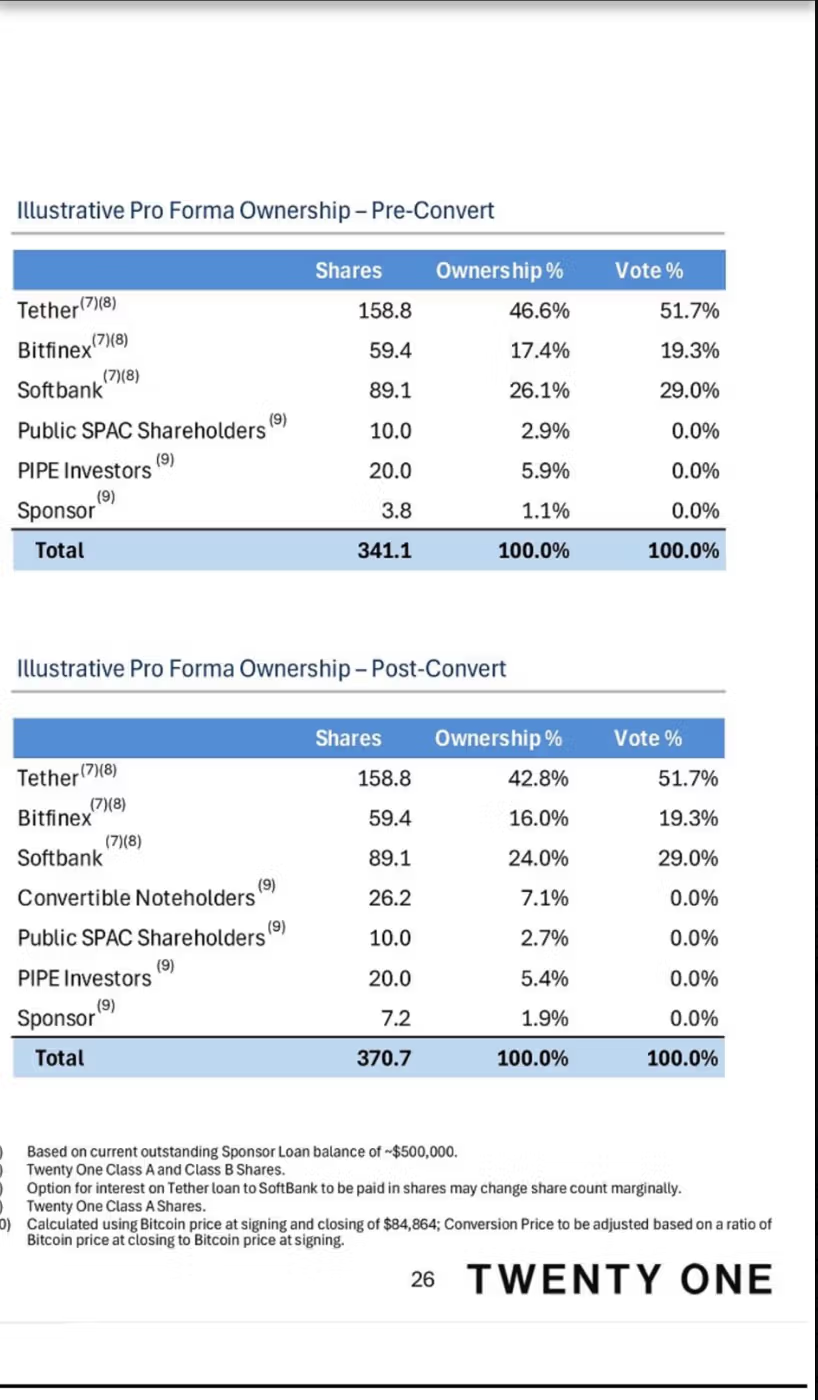

- Tether will control 42.8% of equity and 51.7% of voting power; Bitfinex and SoftBank will hold 16.0% and 24.0%, respectively.

- Public SPAC shareholders will have only 2.7% ownership post-merger.

- With BTC near $94,000, the firm has nearly $4 billion in BTC exposure.

- CEP is viewed as a high-leverage investment on institutional bitcoin adoption and is set to relist under ticker “XXI” after the merger.