Cardano’s ADA Hits 90 Cents, Highest in 2.5 Years

Cardano's ADA experienced a significant increase, reaching 90 cents on Friday, its highest value in two and a half years. This rise coincides with Bitcoin nearing the $100,000 mark, having surpassed $99,000 earlier that day. The growing interest in Bitcoin has shifted focus to altcoins, enhancing overall market activity.

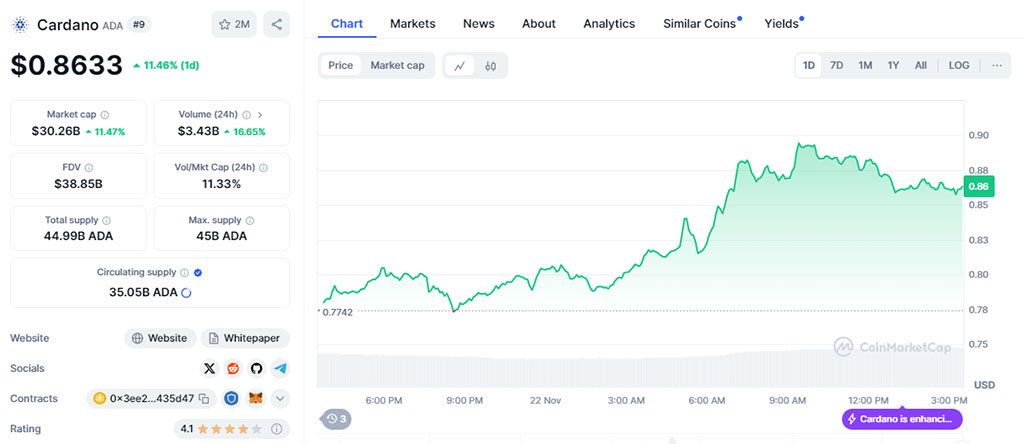

Source: CoinMarketCap

ADA's price rose by 11.46% in one day, marking its strongest level since May 2022. The token has appreciated 40% over the past week and shows a month-to-date growth of 141%, elevating its market capitalization to $30.26 billion, making it the ninth-largest digital asset globally.

Whales Accumulate $12B in ADA, Transactions Up 300%

A key factor behind ADA's surge is substantial buying activity by whales, defined as investors holding over $10 million in ADA. Tagus Capital reports that large holders control more than $12 billion in ADA, indicating confidence in Cardano's future. On-chain data reveals a 300% increase in large ADA transactions over the past two weeks, according to analytics firm IntoTheBlock.

This increase in activity suggests rising interest from institutional investors. Tagus Capital notes that part of this momentum is sentiment-driven, with Cardano's founder, Charles Hoskinson, hinting at potential collaborations with the Trump administration for crypto-friendly policies.

Cardano's technical performance supports a positive outlook. ADA recently broke through a key resistance level of $0.77, closing with a bullish hammer candle. Analysts believe that surpassing the recent daily high could lead to a 20% increase, targeting the $1 mark. Before this upward movement, ADA underwent a five-day consolidation phase, often seen as a bullish indicator, with market sentiment suggesting a continuation of this trend.

ADA Sees 5.76% Open Interest Spike

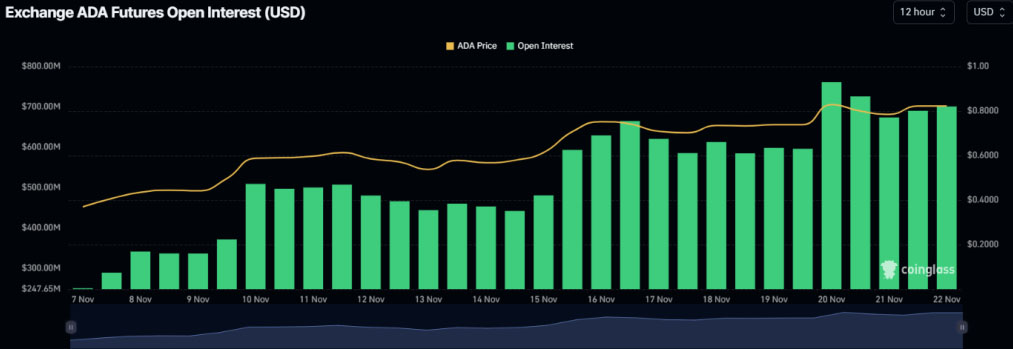

In addition to whale investments, ADA is gaining traction among traders. Recent data from on-chain analytics firm CoinGlass indicates that ADA’s open interest increased by 5.76% in the past 24 hours and by 3.15% in the last hour. This rise in open interest reflects strong trader engagement, contributing to the ongoing price rally. Collectively, these indicators suggest a favorable buying opportunity, with many anticipating continued growth.

Source: CoinGlass

Despite the price surge, trading volume has decreased by 30%, indicating a shift towards larger, strategic investments instead of high-frequency trading. This pattern of lower volume amidst rising prices often reflects strong underlying demand and potential for further appreciation.