10 0

CME Group Expands Crypto Trading to 24/7 Starting Early 2026

The CME Group plans to offer 24/7 trading for cryptocurrency futures and options by early 2026, pending regulatory approval. This move responds to increasing client demand for continuous crypto trading, allowing participants to manage risks effectively.

- CME Group ranks among the top derivatives marketplaces globally, with a record $39 billion in crypto open interest as of September 18.

- The group first introduced Bitcoin contracts in December 2017, followed by Ethereum in February 2021, and later added Solana and XRP futures in 2025.

The overall crypto derivatives market extends beyond CME, with significant activities on centralized platforms and decentralized exchanges like Hyperliquid and Aster.

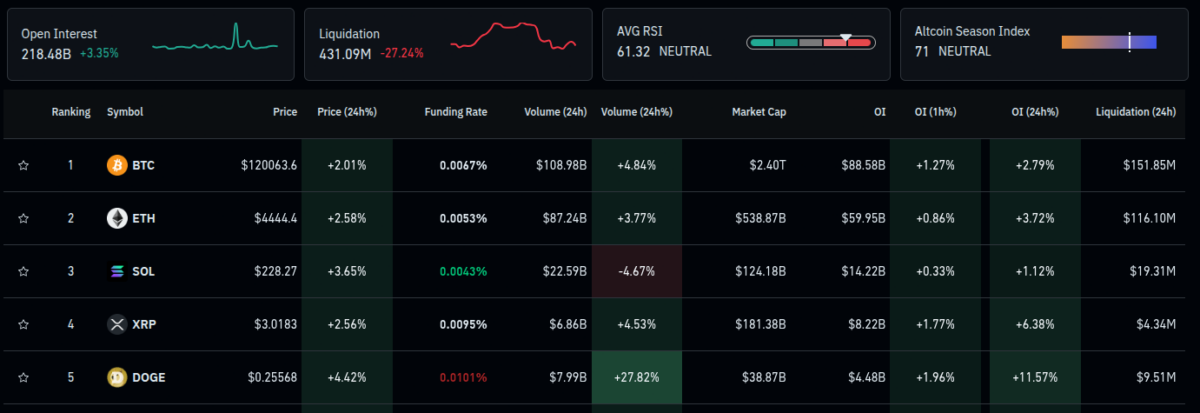

- Total open interest in the crypto derivatives market is $218.48 billion, up 3.35% in the last 24 hours.

- Top cryptocurrencies by open interest include BTC, ETH, SOL, XRP, and DOGE.

Other traditional financial institutions are also expanding into crypto markets. Nasdaq filed a proposal with the SEC to enable tokenized securities trading, aiming to leverage blockchain technology for improved settlement times and reduced market friction.