CME Reports Record Volume and Open Interest in Crypto Futures

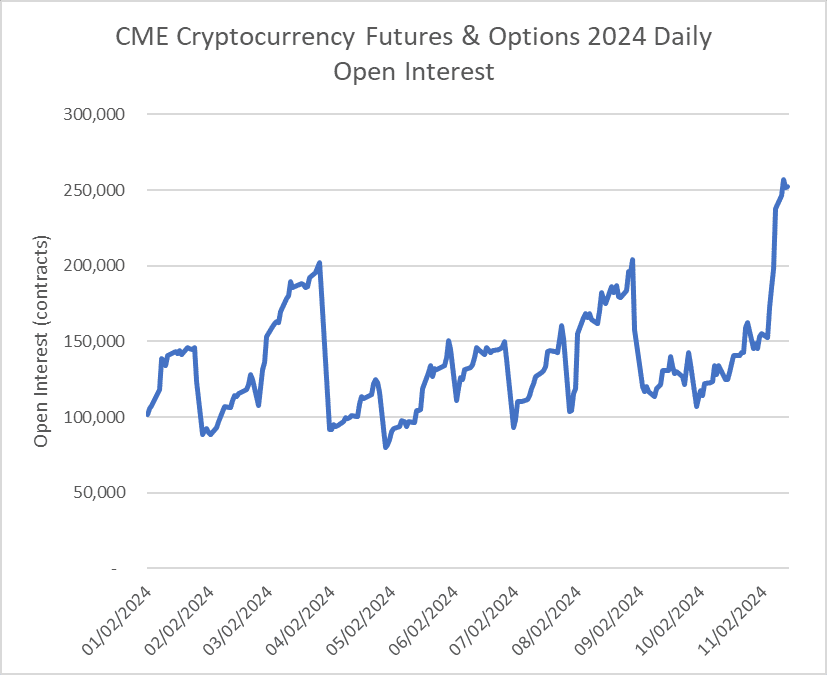

We’re halfway through the month, and CME’s crypto unit is experiencing its best month since launching bitcoin futures contracts in 2017.

CME’s head of crypto, Gio Vicioso, reported that the firm averages “a little bit over $10 billion a day across our futures suite.”

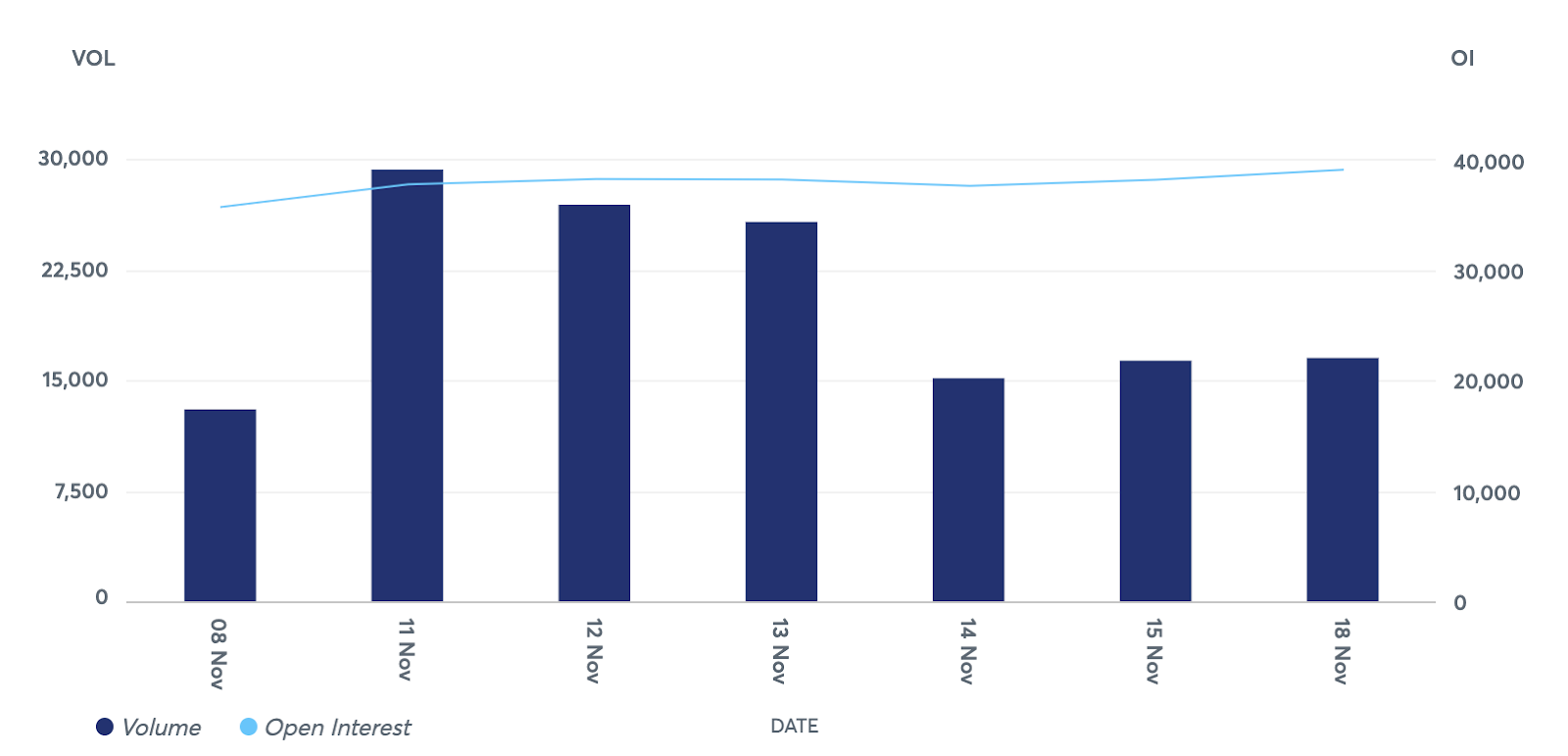

Comparing November this year to last, volume and contract terms have increased more than 5x. Open interest is also at a record high, averaging over 166,000 contracts, which is up 60% compared to October and over 3x compared to November 2023.

Due to the large size of bitcoin contracts, retail investors are increasingly turning to CME’s micro bitcoin contracts.

Micro contracts have averaged over $1 billion a day recently, compared to $200 to $300 million per day earlier this year. Micro bitcoin futures volume has grown from representing roughly 6% of total volumes to over 15% of large bitcoin contracts.

The participant makeup includes both retail and institutional buyers, with institutions possibly testing new strategies due to the manageable margin requirements.

Increased interest has led to greater volatility in ether and bitcoin. Vicioso views this as typical and noted that bitcoin's momentum appears likely to continue. Large Open Interest Holders—entities holding over 25 contracts—have reached around 600, setting a record for CME.

“Both our standard BTC and ETH contracts, as well as our micro BTC and ETH contracts, all achieved records in terms of the number of large open interest holders,” Vicioso stated.

Updated Nov. 19, 2024 at 2:36 pm ET: Corrected Open Interest to Large Open Interest Holders.