9 0

Coinbase, Strategy Report Significant Q3 Profit Gains Amid Crypto Volatility

Key Highlights from Coinbase and Strategy's Q3 Financial Disclosure:

Coinbase (COIN)

- Exceeded profit expectations with a transaction revenue of $1.05 billion, up from $572.5 million the previous year.

- Reported a net income of $432.6 million ($1.50 per share), surpassing analysts' forecast of $1.06 per share.

- Completed acquisition of Deribit, controlling over 75% of the options market outside the US, which enables expansion within the US.

- Focused on stablecoin adoption to enhance payment acceleration.

Strategy (Formerly MicroStrategy)

- Posted a net profit of $2.78 billion ($8.42 per share) against a loss of $340.2 million ($1.72 per share) in the previous year.

- Holds 640,808 Bitcoin acquired at $47.44 billion, averaging $74,032 per BTC, with current trading around $107,400.

- Shares have decreased by 12% in 2025 despite Bitcoin prices rising by 14.5%.

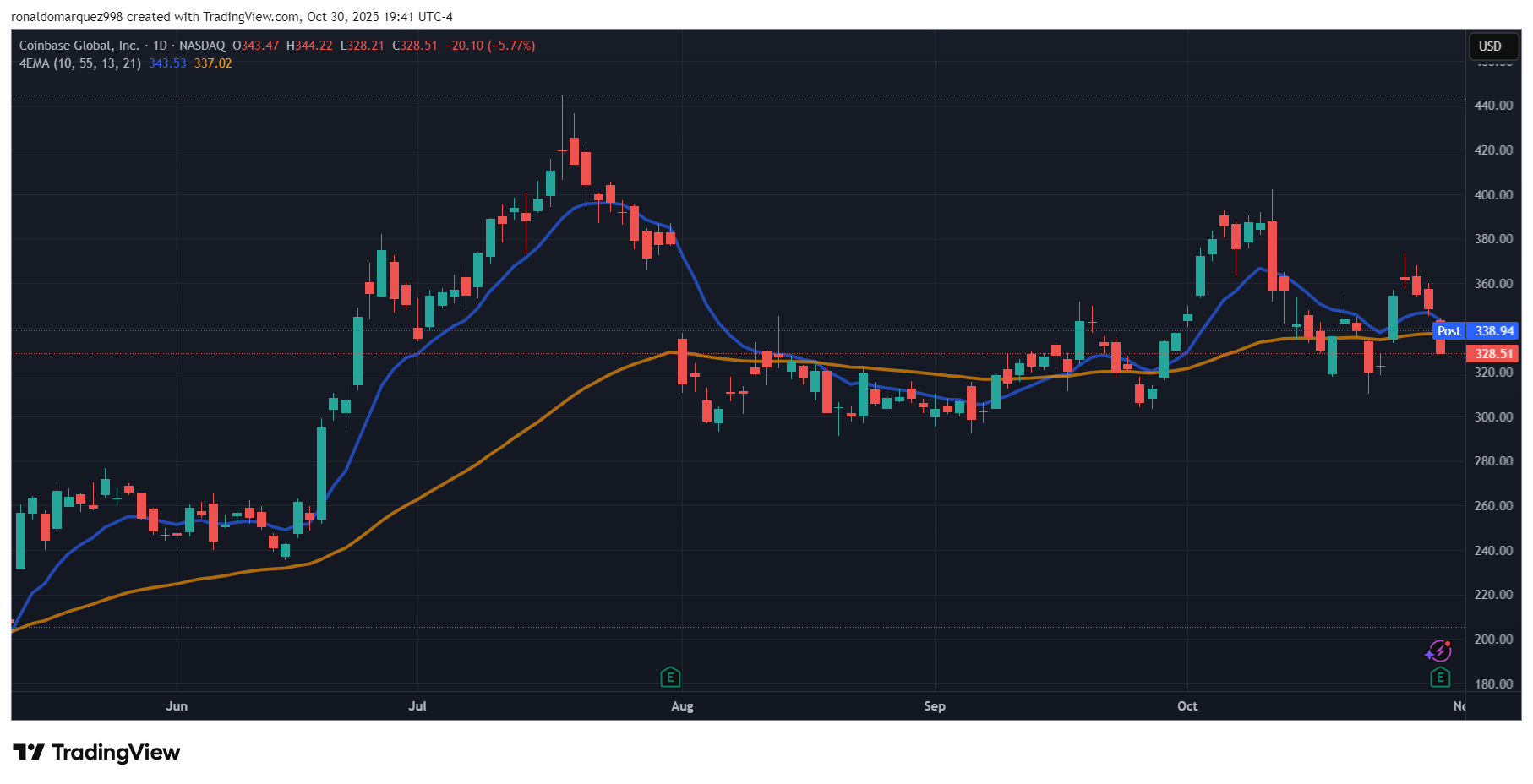

Both companies experienced stock price increases following their earnings reports: COIN surged 3% to $328, while Strategy gained nearly 4% reaching $254.