19 4

Coinbase Partners with US Banks for Stablecoin Integration, $PEPENODE Gains Attention

- Coinbase is integrating stablecoin and custody services with major US banks, potentially increasing institutional investment in crypto by making token transfers more akin to traditional banking.

- This development could speed up liquidity flow into exchanges and on-chain markets as banks offer crypto custody and facilitate stablecoin transactions.

- The historical pattern shows speculative capital tends to move towards high-volatility assets like memecoins and gamified yield experiments as infrastructure becomes more established.

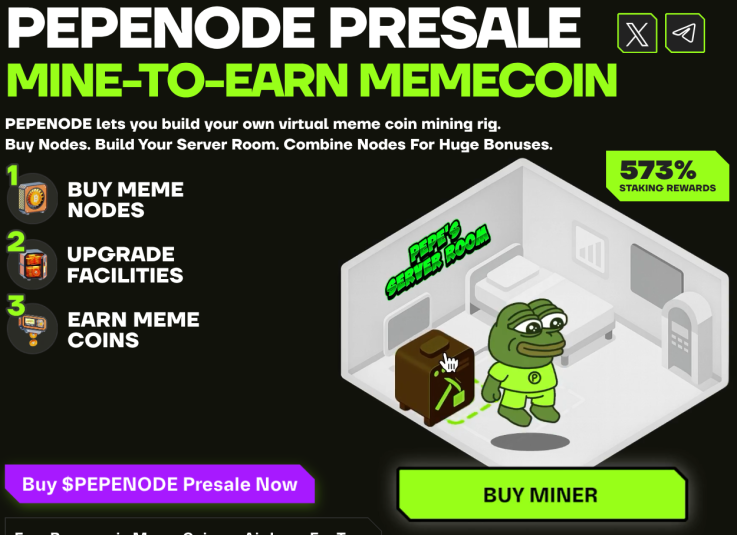

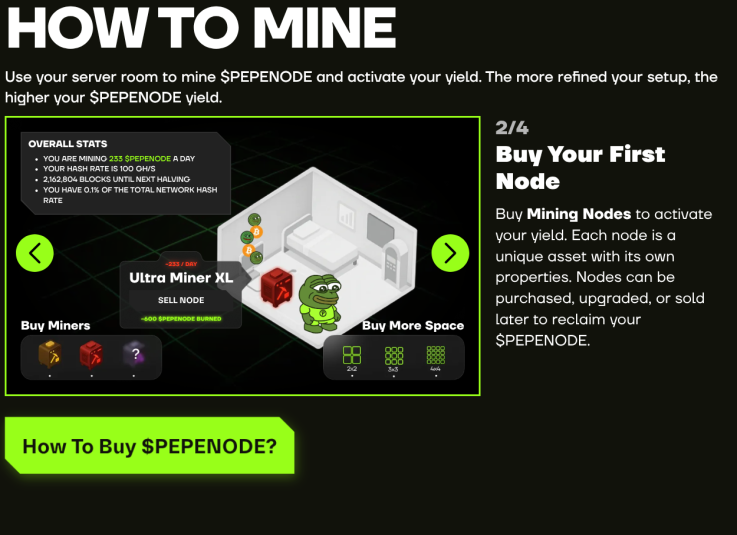

- PEPENODE's mine-to-earn model exemplifies a shift towards interactive, gamified approaches for generating on-chain yield, eliminating the need for hardware in virtual mining.

- PEPENODE operates on Ethereum, allowing users to earn rewards without physical mining equipment. The system offers tiered node rewards and a game-like interface.

- PEPENODE has raised over $2.2M from its presale, with significant investments indicating interest in its mine-to-earn concept.

- The project leverages Ethereum smart contracts for staking, rewards distribution, and governance, presenting a user-friendly overlay for interacting with on-chain logic.

- Institutional adoption of stablecoin rails may push retail and speculative capital further into high-risk ventures like memecoins and new DeFi models.