Coinbase’s Influence on Bitcoin Diminishes as Binance Gains Ground

Bitcoin (BTC) has demonstrated notable momentum in its current market cycle, with recent insights indicating that liquidity sources beyond Coinbase are influencing price trends. Analyst Mignolet from CryptoQuant provided an analysis detailing the roles of major exchanges like Coinbase and Binance in Bitcoin's ongoing bull cycle.

Shifting Liquidity Dynamics And Exchange Roles

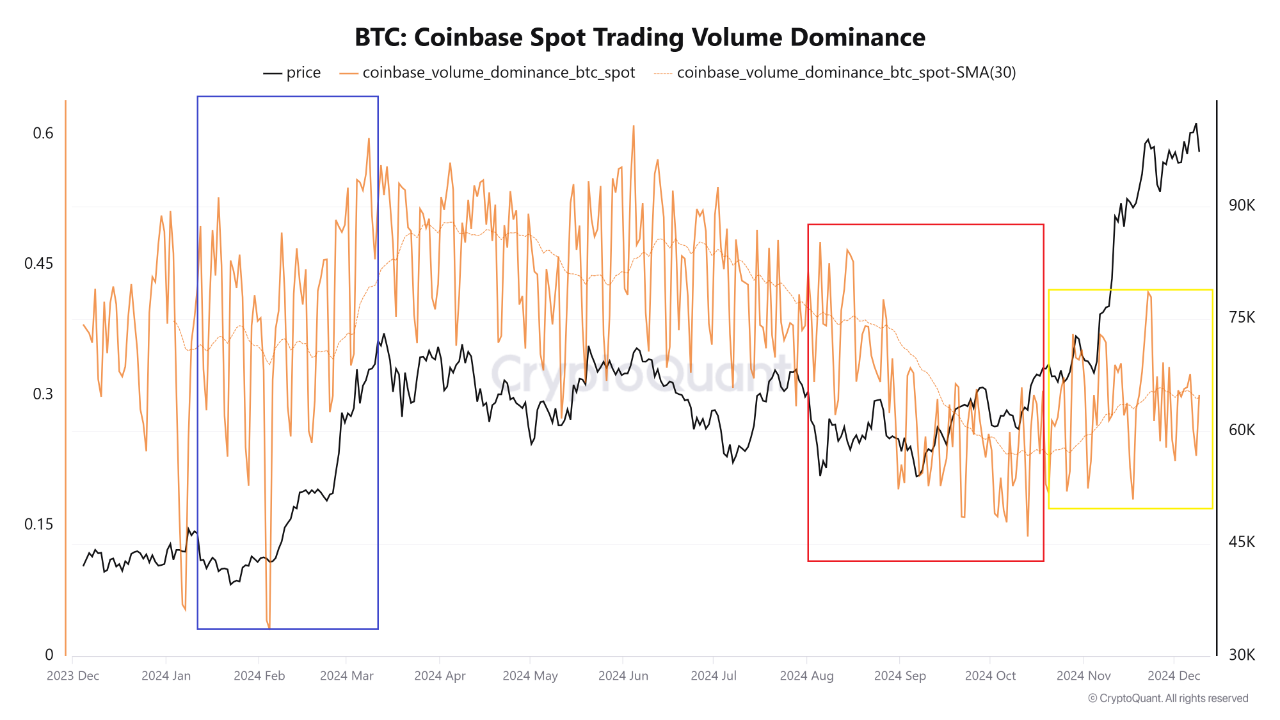

Mignolet's post on CryptoQuant titled “Coinbase Dominance Remains Low” assessed Coinbase's influence on Bitcoin price movements. While Coinbase was significant during the initial phases of this year's Bitcoin rally, its dominance has decreased, signaling a wider distribution of liquidity across the market. Binance has become a key player in maintaining bullish momentum.

Coinbase dominance remains low

“However, just before the rise in September-October, Coinbase dominance actually declined and has not significantly increased even now (red box).” – By @mignoletkr

More details

https://t.co/nmnPGuz3WK pic.twitter.com/mBSImH8MwD

— CryptoQuant.com (@cryptoquant_com) December 11, 2024

Mignolet noted that Coinbase's spot trading dominance has declined during the second phase of Bitcoin's rally. The approval of Bitcoin exchange-traded funds (ETFs) earlier this year led to increased trading activity on Coinbase, which contributed to rising Bitcoin prices. However, with the progress of the rally, Coinbase's influence has diminished.

Despite Coinbase's importance as a liquidity source, Binance has gained prominence in the current market phase. Mignolet emphasized that both platforms are crucial but highlighted Binance as a more critical liquidity source. This shift suggests a distribution of liquidity among a broader range of participants, contributing to a decentralized market structure and indicating increasing institutional and retail interest in Bitcoin.

Bitcoin Sees Sharp Rebound

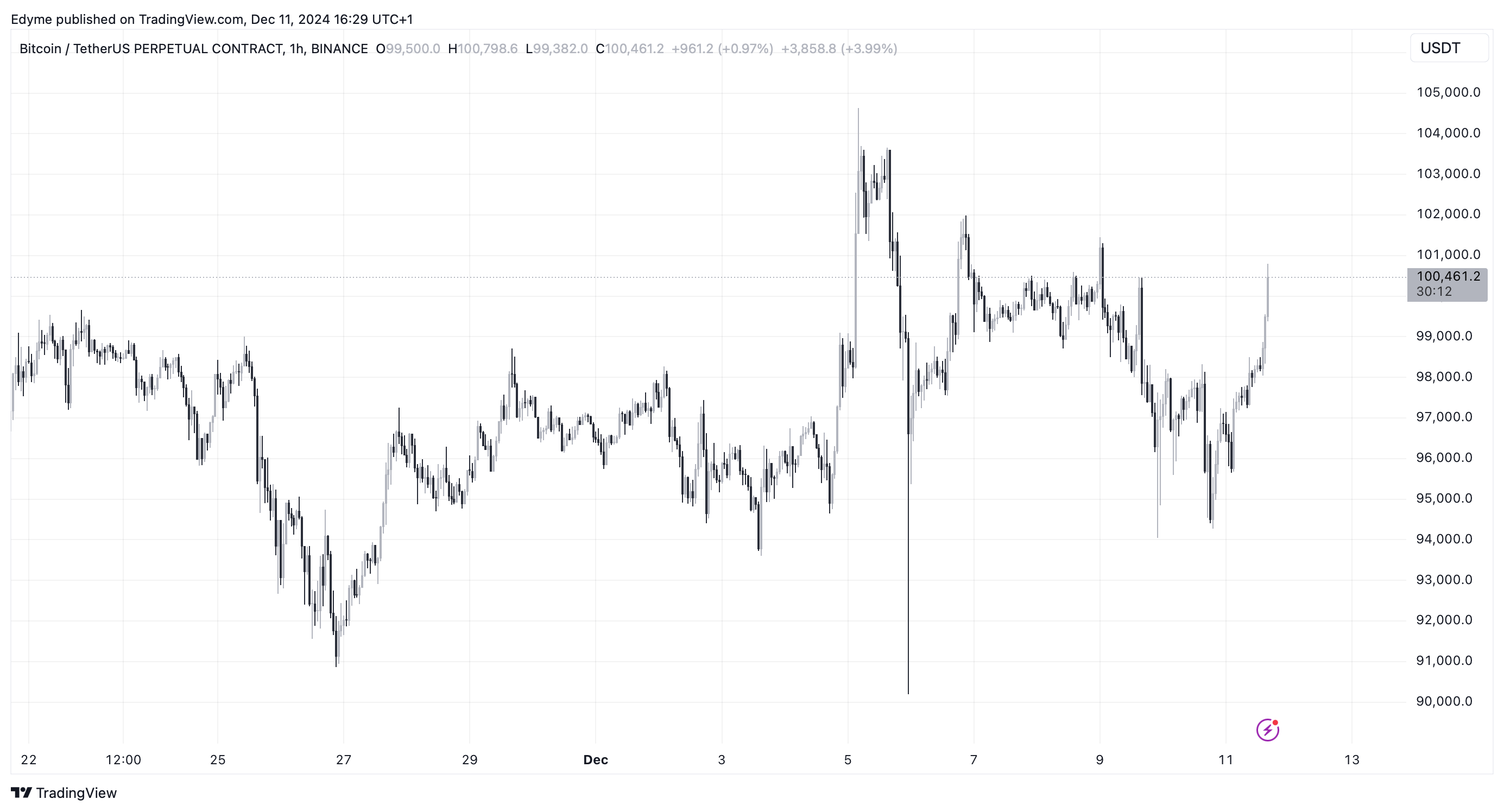

After experiencing a correction below the $95,000 mark, Bitcoin has rebounded sharply. As of the latest data, the asset has reclaimed the $100,000 price mark, currently trading at $100,625, reflecting a 4% increase.

This price increase positions Bitcoin just 3.6% below its all-time high of over $103,000 reached earlier this month.

Featured image created with DALL-E, Chart from TradingView