2 0

Corporate Bitcoin Holdings Increase to $85 Billion, More Than Double Last Year

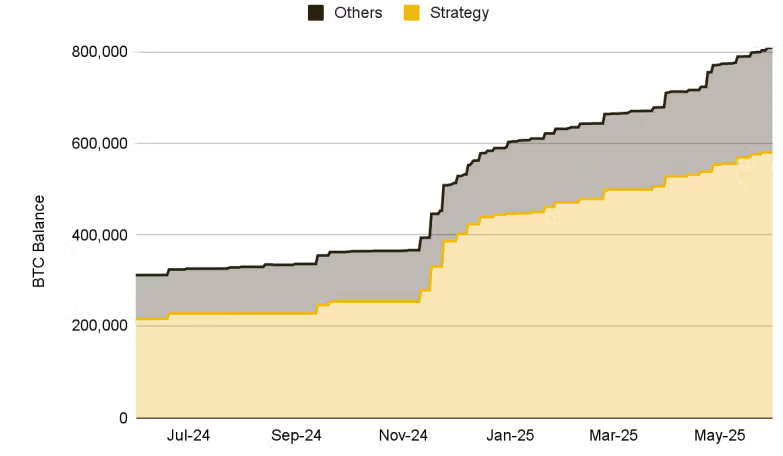

As of May, 116 public companies hold a total of 809,100 BTC, valued at approximately $85 billion. This marks an increase from 312,200 BTC held the previous year, according to Binance Research.

- Nearly 100,000 BTC was added since early April.

- The rise is attributed to increasing prices and favorable market conditions.

- Donald Trump's pro-crypto stance during his 2024 campaign may influence corporate treasury strategies.

- Trump has initiated plans for a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile.

- The SEC has dropped several lawsuits against major crypto firms.

- Fair-value accounting rules introduced by FASB allow companies to recognize gains on BTC holdings.

- New entrants like GameStop have begun accumulating BTC, though Strategy maintains over 70% of corporate holdings.

- Some companies are diversifying into other assets like ETH and SOL.

- Tokenized real-world assets (RWAs) surged by over 260%, rising from $8.6 billion to $23 billion this year.