8 0

Corporate Bitcoin Treasuries Exceed 1 Million BTC Amid Growing Market Confidence

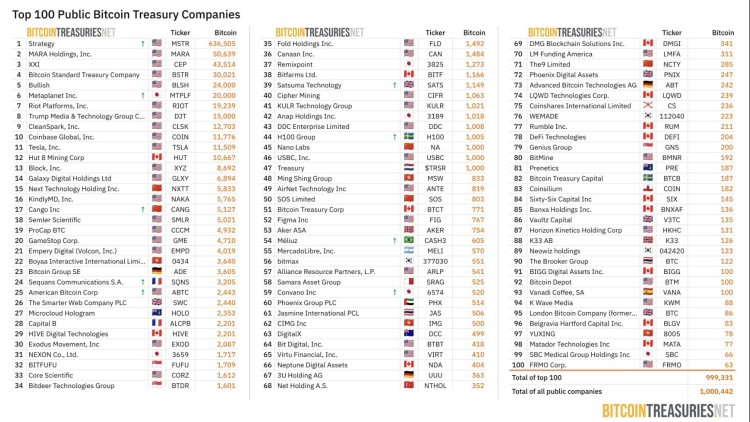

Public companies have reached a significant milestone by collectively owning over 1 million BTC, valued at more than $111 billion. Key holders include:

Mining firms are shifting towards accumulation rather than liquidation of BTC. Currently, exchanges and ETFs together hold approximately 1.62 million BTC.

The rise in institutional adoption is expanding opportunities for retail and institutional investors to gain exposure to BTC.

Key Projects to Watch

Three notable projects are positioned to benefit from the growing crypto investment landscape:

- Bitcoin Hyper ($HYPER): A Layer-2 solution for Bitcoin using the Solana Virtual Machine to enhance transaction speeds and reduce fees.

- Snorter Bot ($SNORT): A trading bot that automates crypto trades with an emphasis on meme coins, featuring a Telegram interface.

- Ethereum ($ETH): With substantial institutional backing, Ethereum’s treasury holdings exceed 3.2 million ETH, valued around $14 billion.

Despite market uncertainties, continued corporate adoption of BTC indicates potential for increased capital inflow into the crypto sector.