1 0

Corporate Treasuries Accumulate Bitcoin Three Times Faster Than Mining Output

Corporate digital asset treasuries have increased their holdings of Bitcoin, accumulating a net 260,000 BTC in the past six months despite price volatility. During this period, miners produced approximately 82,000 BTC, indicating corporate buyers absorbed more than three times the new supply. The monthly net treasury inflow is around 43,000 BTC, valued at about $25 billion.

Treasury Balances Peak

- Company-held Bitcoin treasuries grew from 854,000 BTC to roughly 1.11 million BTC over six months.

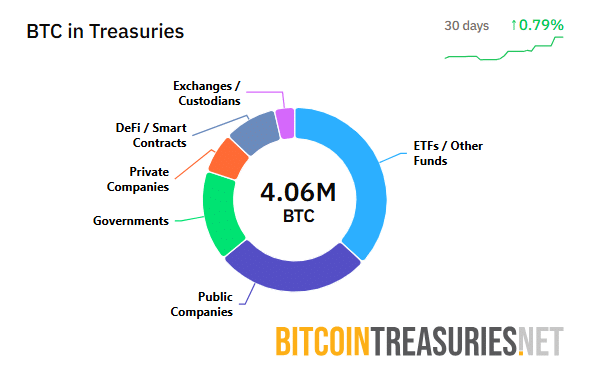

- A total of 4.06 million BTC is held by structured entities, with ETFs and funds holding 1.49 million BTC and public companies holding over 1.1 million BTC.

Top Bitcoin DATs

- Strategy controls the majority of corporate Bitcoin holdings with 687,410 BTC, accounting for about 60% of all Bitcoin held by companies.

- MARA Holdings is second with 53,250 BTC, primarily from mining activities.

- Twenty One Capital holds 43,514 BTC, starting accumulation after merging with Cantor Equity Partners.

- Metaplanet has 35,102 BTC, accumulated since 2024 as a hedge against inflation.

Bitcoin miners add about 450 BTC daily, while corporate treasuries absorb significantly more monthly, potentially reducing liquid circulation if the trend continues.