8 2

Crypto for Advisors Explores Mechanics of On-Chain Yield Generation

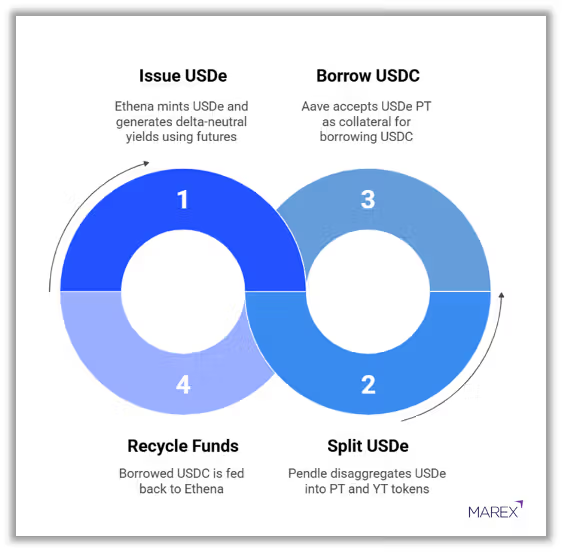

Decentralized finance (DeFi) leverages smart contracts to create yield-generating investment opportunities. A recent article by Elisabeth Phizackerley and Ilan Solot details the collaboration between three protocols: Ethena, Pendle, and Aave.

Key Points:

- Ethena issues USDe, a synthetic dollar, utilizing deposits for delta-neutral strategies on futures contracts, yielding approximately 9% for stakers.

- Pendle splits USDe into Principal Tokens (PTs) and Yield Tokens (YTs), allowing for distinct investment opportunities.

- Aave enables borrowing against PT deposits, facilitating a cycle where borrowed funds are reinvested back into Ethena.

- These protocols function seamlessly together due to their EVM compatibility, enhancing integration and capital efficiency.

- Hyperliquid is emerging as a potential fourth player, with its products already linked to Ethena and Pendle, which may broaden market liquidity and yield strategy development.

The interconnections among these protocols demonstrate how DeFi can rapidly scale, with Hyperliquid potentially expanding this model further.

Additional Insights:

- There are currently 92 cryptocurrency-related ETF applications pending with the U.S. SEC.

- Google Cloud is developing the Universal Ledger (GCUL), a Layer-1 blockchain for financial institutions.

- SEC Chair Paul Atkins proposed a "SuperApp Exchange" for trading tokenized stocks, bonds, and cryptocurrencies in one platform.