Crypto Industry Anticipates Growth Driven by Regulatory Clarity and Innovation

The crypto industry is gearing up for 2025 with significant developments that may enhance the adoption of digital assets, particularly Bitcoin. Key factors influencing this trajectory include:

1. Regulatory Clarity

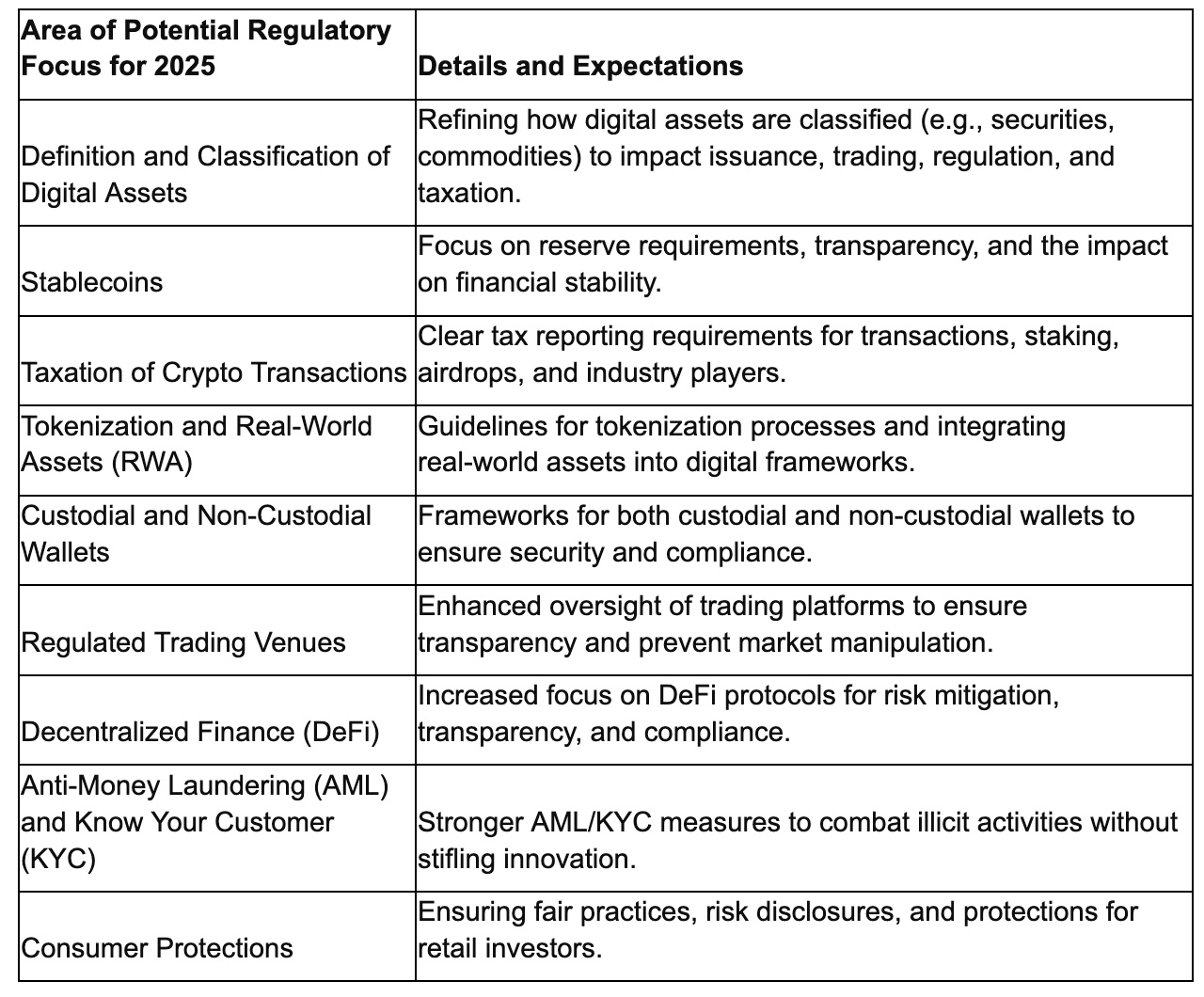

- Definition and classification of digital assets will be refined in the U.S., affecting issuance, trading, regulation, and taxation.

- Stablecoins will attract regulatory focus due to their potential impact on financial stability.

- Clearer tax reporting requirements for crypto transactions are expected.

- Topics such as tokenization, custodial wallets, DeFi, AML/KYC compliance, and consumer protections will be actively addressed.

2. Institutional Participation

- Crypto ETFs saw explosive growth in 2024, indicating strong investor interest.

- Continued inflows into BTC and ETH ETFs will validate crypto as an asset class.

- Potential introduction of crypto yield-generating ETFs could attract more investors.

3. Technological Innovation

- Advancements in Layer-2 blockchain scalability and AI integration will enhance transaction efficiency and user experience.

- AI agents on decentralized networks will facilitate tasks and optimize interactions, simplifying Web3 engagement.

The outlook for 2025 suggests a positive trend for crypto adoption, driven by regulatory clarity, institutional involvement, and technological advancements. The pace and form of mainstream acceptance remain key considerations for market participants.

Expert Insights

Impactful Developments: The political shift towards pro-crypto policies under President-elect Donald Trump is seen as a major catalyst for market dynamics.

Regulatory Landscape: A neutral regulatory stance from the SEC may encourage financial institutions to engage more deeply with crypto assets.

Integration Strategies: As crypto becomes foundational to various asset classes, financial professionals are urged to incorporate crypto into broader investment strategies.

Additional news includes:

- J.P. Morgan’s E-Trade contemplating the addition of crypto trading.

- The SEC lawsuit against Coinbase has been paused, moving to the second circuit.

- Czech National Bank exploring bitcoin for reserve diversification.